If you own a home in Utah, chances are you’ve been keeping a close eye on interest rates. Whether you’re looking to refinance your mortgage, shorten your loan term, or lower monthly payments, understanding today’s Utah mortgage interest rates can make a big difference in your financial future. In 2025, homeowners have more tools than ever to shop around and make informed decisions, but the amount of information can feel overwhelming. That’s why it’s essential to break down the numbers, compare options, and know when refinancing makes sense.

In this article, we’ll look at how to compare current mortgage interest rates, review the

different refinance loan types, explore rate predictions, and provide guidance on how to decide if refinancing this year is right for you.

A Snapshot of Today’s Utah Mortgage Market

Rates are constantly shifting, and mortgage refinance rates today are influenced by everything from inflation to Federal Reserve policy. Utah, like the rest of the country, has seen fluctuations that leave many homeowners asking whether they should lock in or wait.

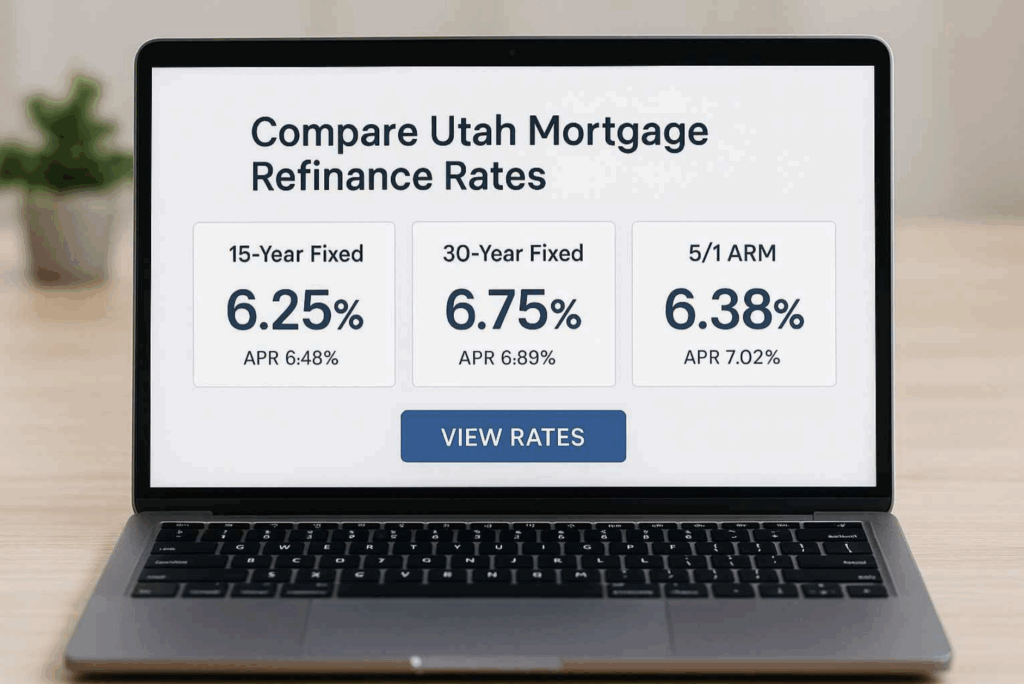

Here’s a quick breakdown of current mortgage rates in Utah as of early 2025:

• 30 year mortgage rates Utah remain a popular choice for those wanting stable, predictable monthly payments.

• 15 year mortgage rates Utah often come in lower, appealing to homeowners eager to pay off their loan faster.

• Specialized products such as FHA refinance rates, jumbo loan refinance rates, and VA loan refinance rates offer tailored opportunities depending on your eligibility.

Why Comparison Matters

With so many options, it’s not enough to glance at a single lender’s advertised rate. Doing a mortgage refinance rate comparison ensures you’re not leaving money on the table. Even a fraction of a percentage point difference in your interest rate can save you thousands of dollars over the life of your loan.

That’s why it’s smart to look beyond “average” numbers. While the average refinance rate Utah gives a general sense of where the market stands, the best deal for you depends on your credit score, home equity, and loan type. Some borrowers qualify for the lowest refinance mortgage rates while others may see higher offers based on risk factors.

If you’re shopping online, consider looking for the lowest refinance rates Utah online. Many digital lenders advertise competitive promotions, but be sure to verify fees and closing costs before deciding.

Different Types of Refinance Options in Utah

Not all refinance loans are created equal. Here’s a breakdown of the most common types available in 2025:

• Utah FHA refinance rates: These government-backed loans are designed for homeowners with lower credit scores or smaller down payments. They often come with more lenient approval standards.

• Utah jumbo loan rates: If your loan balance exceeds conventional limits, you’ll need a jumbo loan. Jumbo loan refinance rates tend to be higher, but shopping around can help secure competitive offers.

• Utah VA refinance rates: For eligible veterans and service members, VA loan refinance rates provide some of the most flexible and cost-effective options available.

When comparing, focus not just on the headline number but on the entire package of terms and conditions.

Fixed vs. Variable: Which Is Right for You?

Another major decision is whether to choose a fixed or adjustable loan. Fixed vs variable refinance rates Utah is an ongoing debate. Fixed-rate loans give you stability with the same payment for the entire term, while variable (or adjustable) rates may start lower but can rise over time.

For many Utah homeowners in 2025, fixed rates are attractive because they remove uncertainty during a time of fluctuating markets. However, if you expect to sell or refinance again within a few years, a variable rate might save money in the short run.

Timing the Market: Is Now the Right Time?

One of the most common questions homeowners ask is: is now a good time to refinance in Utah? The answer depends on your personal situation.

If you bought your home when rates were much higher, refinancing into the best refinance mortgage rates Utah could reduce your monthly payment significantly. On the other hand, if you already have one of the lowest rates available, it might not make sense to refinance unless you’re shortening your loan term or tapping into equity.

Looking ahead, mortgage refinance predictions 2025 suggest rates may stay relatively steady, but modest shifts are always possible. Analysts expect refinance mortgage rate trends Utah to mirror national economic conditions, with rates influenced by inflation and housing demand.

How to Compare Refinance Rates in Utah

So, what’s the best strategy? Here are practical steps on how to compare refinance rates in Utah:

1. Check daily updates: Websites that publish today’s Utah mortgage interest rates give you a real-time sense of where things stand.

2. Get multiple quotes: Don’t stop at one lender—request estimates from at least three to five lenders for a proper mortgage refinance rate comparison.

3. Understand the fees: The lowest refinance mortgage rates may come with higher closing costs, which can eat into your savings.

4. Use calculators: A refinance calculator helps you see if your savings outweigh the costs.

5. Look at the big picture: Sometimes locking in stability, even at a slightly higher rate, is better than chasing the absolute lowest number.

Final Thoughts

In 2025, refinancing your home loan is still one of the most powerful tools for reducing debt, lowering payments, or paying off your mortgage sooner. The key is knowing how to navigate the market, compare your options, and decide whether now is the right time for you.By paying attention to Utah mortgage refinance rates, staying updated on refinance mortgage rate trends Utah, and carefully weighing the pros and cons of different products, you’ll be in a strong position to make the best choice.

Remember, the right refinance doesn’t just save you money—it gives you peace of mind knowing your mortgage works for you, not the other way around.