Buying a home is exciting, but the process can feel overwhelming. One of the best steps you can take before house hunting is to learn how to get preapproved for a mortgage. A preapproval shows sellers you’re serious, gives you a budget, and helps avoid surprises later. In this guide, we’ll walk through every detail of mortgage pre approval requirements, from credit scores to loan types, so you’re ready to shop with confidence.

Mortgage Pre Approval vs Prequalification

Many first-time buyers confuse mortgage pre approval vs prequalification, but they are not the same. Prequalification is an informal estimate based on your self-reported finances, while preapproval is a verified commitment from a lender. With a pre approval letter what it means you have had your credit and documents reviewed, making you a stronger candidate in the eyes of sellers and real estate agents.

Mortgage Pre Approval Credit Score and Income Requirements

Your mortgage pre approval credit score is one of the biggest factors lenders consider. For most conventional loans, the minimum credit score for mortgage pre approval is 620. In fact, a mortgage pre approval credit score 620 is often seen as the baseline for qualification. Government-backed programs can be more flexible, with FHA allowing scores as low as 580.

Beyond credit, lenders also look closely at mortgage pre approval income requirements. Stable, documentable income reassures lenders you can make monthly payments. Equally important is your DTI ratio for mortgage approval—the percentage of your income that goes toward debts. Most lenders prefer a DTI of 43% or less. Finally, you’ll need to demonstrate the minimum down payment for mortgage pre approval, which can range from 0% on VA and USDA loans to 3–5% on conventional mortgages.

Documents Needed for Mortgage Pre Approval

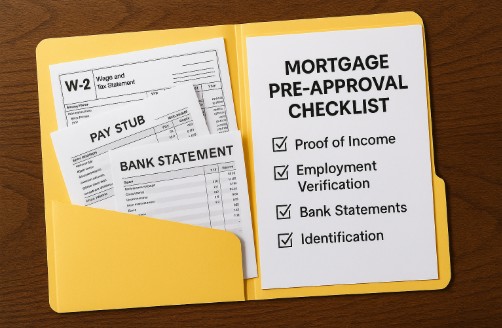

Lenders verify your finances using a set of required documents. Common documents needed for mortgage pre approval include:

- Recent pay stubs and W-2s.

- Two years of tax returns.

- Bank and investment account statements.

- Proof of assets and ID.

Keeping everything organized in a mortgage pre approval checklist ensures a smooth process. Submitting complete paperwork upfront is the fastest way to get approved.

Special Borrower Situations

Not every borrower has a standard employment or income profile. Lenders also review unique cases such as:

- Mortgage pre approval for self employed: You’ll likely need two years of tax returns, profit-and-loss statements, and possibly a CPA letter.

- Mortgage pre approval for 1099 income: Independent contractors must show consistent earnings through 1099 forms and bank deposits.

- Mortgage pre approval with student loans: Even deferred student loans are typically included in your DTI calculation.

- Mortgage pre approval with co signer: Adding a co-signer can help if your credit or income alone doesn’t meet the requirements.

Loan Program Requirements

Each mortgage program comes with its own standards:

- FHA loan pre approval requirements: Minimum 580 score with 3.5% down.

- VA loan pre approval requirements: Available to eligible veterans/service members, often requiring no down payment.

- USDA loan pre approval requirements: Designed for rural properties, usually with zero down and income limits.

- Conventional loan pre approval requirements: Generally stricter, with a minimum score of 620 and flexible down payment options.

For those buying their first home, a first time home buyer mortgage pre approval can open doors to special programs, lower down payments, and potential assistance options.

How Long Does Mortgage Preapproval Take?

Many buyers want to know how long does mortgage pre approval take. The answer depends on how quickly you provide your documents and how complex your finances are. Some lenders even offer mortgage pre approval same day if everything is ready. Typically, expect one to three business days.

It’s also important to know how long is a mortgage pre approval good for. Most preapproval letters remain valid for 60 to 90 days, after which you may need to update your file. If you prefer convenience, you can often apply for a mortgage online pre approval, uploading documents securely and tracking your progress digitally.

Why Mortgage Preapproval Matters

Getting preapproved is about more than paperwork—it’s about strategy. By meeting the mortgage pre approval requirements early, you’ll know your true buying power, identify issues before they become obstacles, and strengthen your negotiating position. Whether you’re working on a first time home buyer mortgage pre approval or exploring options as a self-employed borrower, a strong preapproval letter helps you shop smarter and act faster in today’s competitive market.

Conclusion

Understanding how to get preapproved for a mortgage is the foundation of successful home buying. From organizing documents needed for mortgage pre approval into a mortgage pre approval checklist, to meeting the right mortgage pre approval credit score, income requirements, and DTI ratio for mortgage approval, preparation is everything.

Whether you’re applying under FHA loan pre approval requirements, VA loan pre approval requirements, USDA loan pre approval requirements, or conventional loan pre approval requirements, the process is easier when you know what to expect. Add in scenarios like mortgage pre approval for self employed, mortgage pre approval for 1099 income, mortgage pre approval with student loans, or mortgage pre approval with co signer, and you’ll see that every borrower has a path forward.

With the right preparation and guidance, you can move from preapproval to closing with confidence—and your pre approval letter will be the key that unlocks your dream home.