Utah Mortgage Refinance Rates

If you’re a homeowner in Utah, keeping track of Utah mortgage refinance rates can be the key to saving money and reaching your financial goals. Whether you want to lower your monthly payment, shorten your loan term, or access your home’s equity, refinancing gives you options. The right strategy begins with comparing refinance mortgage lenders Utah and identifying which programs fit your needs.

Current Refinance Rates in Salt Lake City

For homeowners in Salt Lake City, it’s common to search for current refinance rates in Salt Lake City before making a decision. Rates shift often, which is why checking multiple lenders is essential. Requesting a mortgage refinance quote Utah will give you personalized numbers based on your credit, home value, and goals. Beyond interest rates, also look at Utah refinance interest rates trends, closing costs, and customer service quality.

Best Refinance Companies in Utah

When choosing the best refinance companies in Utah, it’s important to look beyond just low advertised rates. Local Utah mortgage refinance companies can offer added value through their knowledge of the housing market and regional programs. As you go through the refinance application Utah process, pay close attention to responsiveness, transparency, and communication. Today, many lenders also provide an online mortgage refinance Utah option, making it easier than ever to apply and upload documents from home.

Refinance Goals and Debt Consolidation

Refinancing is not one-size-fits-all. Some homeowners choose a mortgage refinance for debt consolidation in Utah to simplify payments, while others focus on lowering monthly costs. A cash-out refinance Utah can help fund major expenses like home improvements or education, while others prefer to refinance to pay off debt Utah for financial peace of mind. Each path has different benefits, so it’s important to match your goals with the right loan.

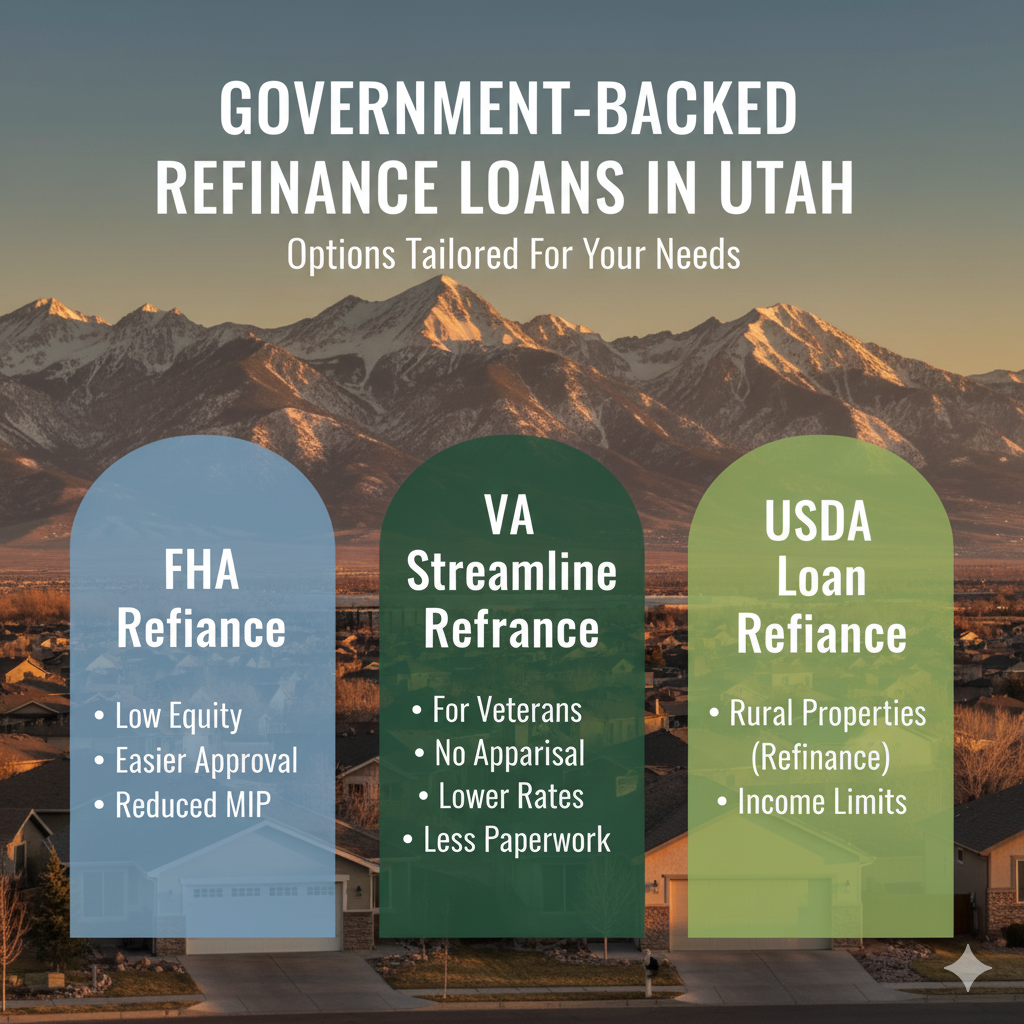

FHA, VA, and USDA Refinance Options in Utah

Utah homeowners have access to several government-backed programs designed to make refinancing more accessible. An FHA refinance Utah may be a good option for those with limited equity, while a VA streamline refinance Utah allows veterans and service members to secure lower rates with less paperwork. For borrowers in rural areas, a USDA loan refinance Utah supports affordable homeownership through flexible terms. Partnering with experienced refinance mortgage lenders Utah can help you determine which program best fits your financial situation.

Fixed-Term Refinance Options

Choosing the right loan term is one of the most important decisions in the refinance process. The stability of a 30-year fixed refinance rate Utah loan appeals to those who want long-term predictability, while 15-year fixed refinance rates Utah loans allow homeowners to pay off their mortgage faster and save on interest. Specialized options are also available, such as mortgage refinance rates for retirees Utah or mortgage refinance rates for investment property Utah, depending on your stage in life and goals.

Special Refinance Situations in Utah

Not every homeowner has perfect credit. Programs for refinancing a mortgage with bad credit Utah are available for borrowers who may not qualify for traditional products. For veterans and military families, it’s worthwhile to explore mortgage refinance rates for veterans in Utah to maximize the benefits of VA-backed loans. These specialized options open the door for more borrowers to take advantage of refinancing opportunities.

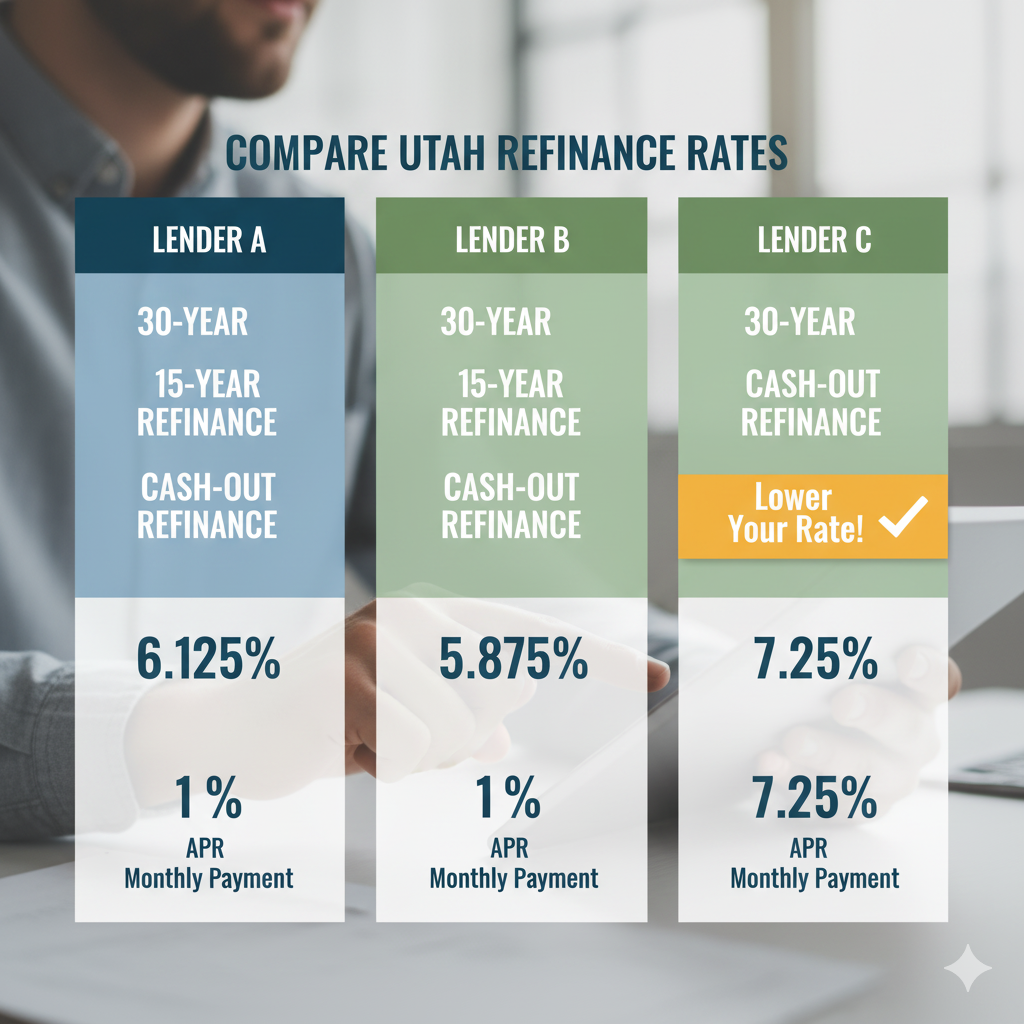

Understanding Closing Costs and Comparing Rates

Before moving forward, make sure to understand mortgage refinance closing costs Utah. These fees can influence whether refinancing is worth it in the short term. Comparing lenders side by side is critical—take time to compare Utah refinance rates and request quotes from multiple companies. Whether you’re aiming to lower payments, build equity faster, or reduce overall interest, shopping around ensures you get the best fit for your financial needs.