If you’re looking to buy a home in Utah, understanding the difference between mortgage prequalification and preapproval is crucial. With the real estate market being more competitive than ever, especially in rapidly growing areas like Salt Lake City and Provo, potential homebuyers need every advantage. In this guide, we’ll break down what prequalification and preapproval mean, how they affect your buying power, and why they’re essential steps in the Utah home loan process.

What is Mortgage Prequalification?

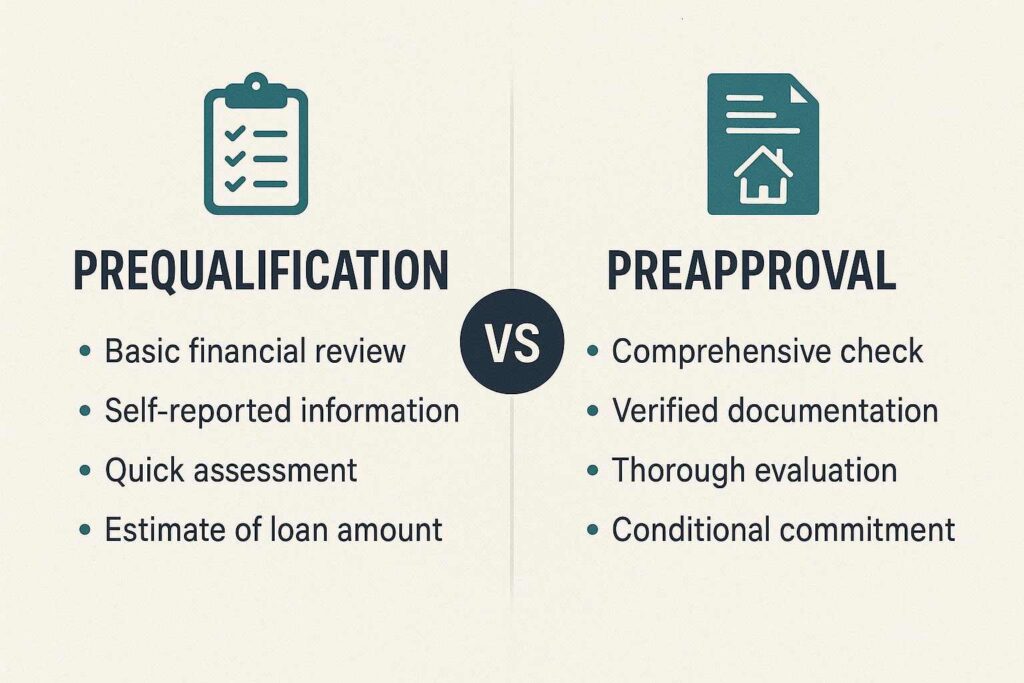

Mortgage prequalification: This is typically the first step in the homebuying journey. It’s a basic assessment of your creditworthiness based on the financial information you provide to a lender. This can often be done online or over the phone and does not require a credit check, which makes it a convenient way to gauge how much you might be able to borrow.

For buyers in Utah, mortgage prequalification offers an initial idea of loan amounts and interest rates. It can also help you compare mortgage lenders near me and explore different mortgage loan options, such as conventional loans, FHA loan requirements, or even HELOC rates.

What is Mortgage Preapproval?

Unlike prequalification, mortgage preapproval is a more in-depth process. It requires submission of financial documents, such as tax returns, pay stubs, and bank statements, and it includes a hard credit check. Getting preapproved means the lender has conditionally committed to offering you a loan, pending an appraisal and final underwriting.

In Utah’s fast-paced market, having a mortgage preapproval letter can make your offer more competitive. It tells sellers you’re serious and financially ready to close the deal. If you’re using tools like a mortgage calculator Utah, you’ll get a more accurate picture when you’re preapproved.

Prequalification vs. Preapproval: Key Differences

Here’s a quick breakdown of how these two terms differ:

| Feature | Prequalification | Preapproval |

| Credit Check | No | Yes |

| Documentation | Minimal | Required |

| Time | Quick (minutes) | Longer (days) |

| Accuracy | Estimate | Verified |

| Buyer Credibility | Low | High |

Understand these differences when applying for specialized loans, whether you’re checking mortgage rates today or heloc interest rates today.

Why This Matters in Utah

Utah’s real estate market is booming. Whether you’re in Salt Lake City, Ogden, or St. George, having a mortgage preapproval gives you an edge. Many sellers won’t even consider an offer unless the buyer is preapproved.

Use a mortgage payment calculator to estimate your monthly obligations, preapproval gives you a full financial picture.

Steps to Get Prequalified and Preapproved in Utah

- Use a mortgage calculator Utah to determine how much house you can afford.

- Compare mortgage rates daily to lock in the best interest.

- Check with local lenders—search for terms like mortgage lenders near me.

- Apply for prequalification with basic info.

- Gather documents like W-2s, tax returns, and bank statements.

- Submit a full preapproval application to a lender offering competitive mortgage rates today.

Also, don’t overlook digital lenders who offer easy mortgage calculators and tools to get preapproved online within hours.

Common Mistakes to Avoid

- Assuming prequalification equals preapproval

- Overlooking the impact of credit score

- Not comparing mortgage interest rates today

- Failing to estimate taxes and insurance using a home affordability calculator

- Forgetting to factor in HELOC calculators or refinance mortgage calculators

Mistakes like these can cost you time, money, and even your dream home.

Mortgage Calculators and Loan Requirements

If you’re considering a VA home loan, check VA home loan rates today and learn about VA loan requirements. For those exploring refinancing options, use a refinance mortgage calculator to compare scenarios.

First-time buyers might want to start with a first-time home buyer calculator or research fha loan requirements what they qualify for. Use a mortgage estimator calculator to get a ballpark monthly payment based on your desired home price and loan type.

If you’re also considering a home equity line of credit, comparing heloc calculators and heloc interest rates today will be essential.

Final Thoughts

Whether you’re just exploring the market or ready to make an offer, knowing the difference between mortgage prequalification and preapproval can be the key to landing your new home in Utah. By understanding your finances, comparing mortgage rates daily, and leveraging tools like mortgage calculators, you’ll be better positioned to secure the best deal possible.

Don’t wait until you’ve found your dream home—start the process today. Get prequalified or preapproved so you can move confidently and quickly when the time is right.