Buying a home isn’t just a financial decision—it’s a life milestone, a dream finally within reach. But to make that dream a smart reality, understanding mortgage rates is absolutely crucial. Whether you’re hunting for the most accurate calculator, comparing today’s mortgage rates, or exploring powerful tools like home equity loans and HELOCs, the right insights can help you save thousands and move forward with confidence. In this guide, we’ll walk Utah homebuyers through everything—from current 30-year mortgage rates to practical affordability calculators—so you can take the next step toward homeownership with clarity and peace of mind.

Mortgage Rates in Utah

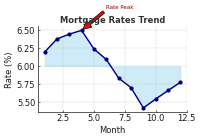

When it comes to home financing, the first step is reviewing current mortgage rates. National averages are important, but Utah mortgage rates can vary depending on local lenders and market trends. If you’re researching average rates, remember that lenders look at factors like credit score, income, and down payment before offering a rate.

Checking mortgage interest rates today allows you to see if locking in your loan now makes sense. Many Utah buyers also search for by loan type, whether it’s conventional, FHA, or VA. Comparing lenders daily is the best way to ensure you’re getting the most competitive rate.

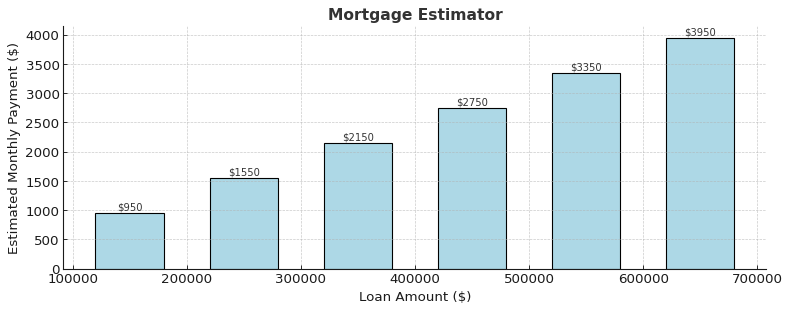

Mortgage Estimator

Most homebuyers in Utah consider a 30 year mortgage rate because of its lower monthly payment. However, some buyers choose a 15-year loan for faster payoff and reduced interest costs. Using a mortgage estimator helps you compare how loan length, interest rates, and down payments affect your overall costs.

With an estimator, you can see the breakdown of principal vs. interest, plus how much extra you’ll save by paying more each month. This makes it easier to choose between short- and long-term mortgage strategies.

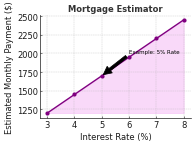

Why Mortgage Calculators Matter

A reliable mortgage calculator is the single best way to plan your purchase. By inputting your loan amount, interest rate, and down payment, you can instantly see what your monthly payment will be. A mortgage payment calculatoror monthly mortgage payment calculator is perfect for budgeting, while a simple mortgage calculator is ideal for quick estimates.

Other helpful tools include:

- Amortization calculator – shows how payments are applied to principal vs. interest over time.

- House payment calculator – factors in insurance and property taxes for a realistic monthly cost.

- Mortgage affordability calculator – helps determine how much house you can afford based on income and debt.

Home Equity Loan and HELOC Options

If you already own a home in Utah, tapping into equity can help fund renovations, consolidate debt, or cover large expenses. A home equity loan provides a lump sum at a fixed rate, while a home equity line of credit (HELOC)works more like a credit card, giving you flexibility to borrow as needed.

Tools such as a home equity loan calculator or a home equity calculator show how much equity you can borrow against. Shoppers also compare home equity loan rates, home equity line of credit rates, and even home equity loan interest rates before deciding which option fits best.

If you’re exploring revolving credit, look at HELOC rates and current HELOC rates in Utah. These rates often adjust with market conditions, so understanding the terms is critical before signing.

Refinancing Considerations

Beyond new purchases, many Utah homeowners look at refinancing when mortgage rates today drop. A refinance can lower your monthly payment or shorten your loan term. Using a mortgage estimator alongside a mortgage calculator makes it easier to decide whether refinancing saves enough to cover closing costs.

Putting It All Together

When you combine the insights from mortgage calculators with knowledge of mortgage rates, you get a complete picture of your home financing options. Start by checking current mortgage interest rates in Utah. Then, use tools like the mortgage affordability calculator and amortization calculator to see how payments fit into your budget. Finally, explore products like home equity loans and HELOCs for future financial flexibility.

Conclusion

Buying or refinancing a home in Utah doesn’t have to feel overwhelming. With the right information and the right calculators—whether it’s a mortgage payment calculator, house payment calculator, or home equity line of credit rates tool—you can make informed decisions that protect your financial future.

Whether you’re searching for mortgage rates, comparing a 30 year mortgage rate, or evaluating HELOC rates, the key is preparation. By understanding the full picture, you can confidently choose the loan that works best for your needs today and for years to come.