If you’re a Utah homeowner, you may be wondering whether it’s time to look into mortgage refinancing. Whether you want to lower your monthly payment, shorten your loan term, or tap into equity through a cash out refinance, refinancing can be a powerful tool to strengthen your financial future. But with so many options, from refinance home loan offers to VA refinance rates, it’s important to understand the details before making a decision.

This guide will walk you through the essentials of refinancing in Utah — including the latest refinance rates, how to use a refinance calculator, and how to find the best refinance companies for your situation.

Why Consider Mortgage Refinancing?

Refinancing means replacing your existing mortgage with a new loan. Many Utah homeowners choose a home refinance to take advantage of current refinance rates that may be lower than their original loan. Others want to access cash for big expenses through a cash out refinance or switch to a shorter term with refinance rates 30 year fixed or 15-year options.

Key benefits of a refinance home loan include:

- Lowering your interest rate and monthly payment.

- Paying off your home faster.

- Accessing home equity for projects or debt consolidation.

- Switching from an adjustable-rate mortgage to a fixed-rate loan.

Understanding Mortgage Refinancing Rates in Utah

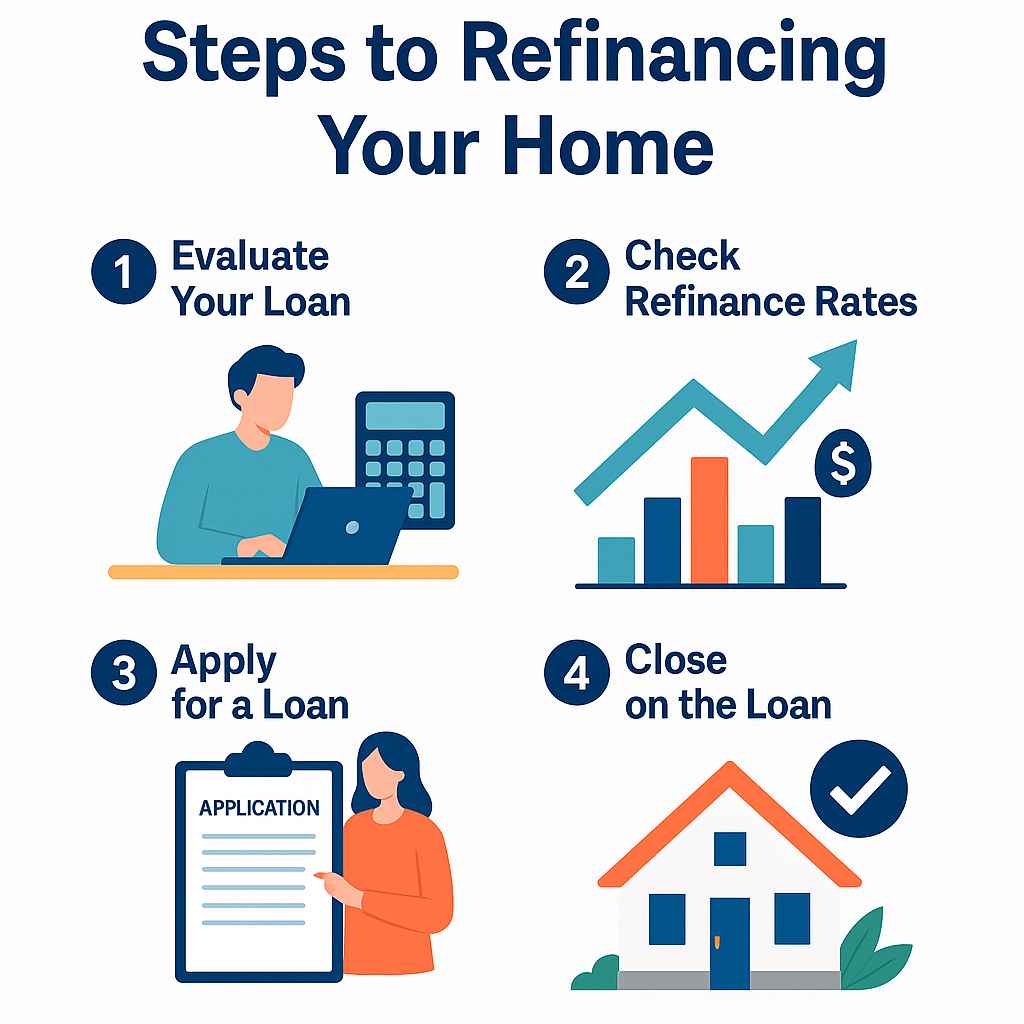

Rates play the biggest role in whether refinancing makes sense. Many homeowners search for terms like refinance mortgage rates, home refinance rates, or simply refinance rates today to get an idea of what’s available.

Keep in mind that refinance rates vary depending on:

- Your credit score.

- Loan-to-value ratio.

- Loan type (conventional, FHA, VA).

- Market conditions.

Using online resources, you can compare current refinance rates and even estimate costs with a refinance calculator or a home refinance calculator.

👉 Learn more about Utah refinance options here: Utah Refinance Loans.

Mortgage Refinancing Calculators to Estimate Savings

Tools like a refinance mortgage calculator or a cash out refinance calculator help homeowners see whether refinancing is worth it. For example, if you’re debating between a 15-year and a refinance rates 30 year fixed loan, these calculators can show the difference in interest paid over time.

If you want to pull equity, a cash out refinance calculator shows how much you could receive while still keeping a manageable monthly payment.

👉 Calculate your mortgage here: Mortgage Calculator

Cash Out Refinance Options

A cash out refinance lets you borrow more than you owe on your home and pocket the difference in cash. Many Utah homeowners consider this option for home improvements, education expenses, or consolidating high-interest debt.

Some lenders also offer cash out refinance rates that vary from traditional refinancing. Be sure to compare home loan refinance offers from different providers to find the best deal.

For veterans, a VA cash out refinance is another option. This program often comes with competitive VA refinance rates and flexible terms designed specifically for service members and their families.

Choosing the Best Mortgage Refinancing Companies in Utah

With so many lenders advertising best refinance home loan products, it can be hard to know where to start. Many borrowers search for the best refinance companies or best home refinance companies to see reviews and rankings.

When choosing a lender, consider:

- Customer service and responsiveness.

- Closing costs and fees.

- Range of products (fixed vs. ARM, cash-out vs. rate-and-term).

- Transparency with rates and terms.

Finding the best refinance rates often means shopping around. Even small changes in refinance mortgage rates can lead to big savings over the life of your loan.

Common Refinance Scenarios

Utah homeowners use refinancing in a variety of ways:

- Refinance house to lower monthly costs after income changes.

- Refinance my home to switch from FHA to conventional once equity reaches 20%.

- Use a home refinance calculator to see if shortening the term makes sense.

- Seek home loan refinance offers when consolidating high-interest debt.

Is Now the Right Time to Refinance?

Given recent shifts in interest rates, many homeowners are revisiting their mortgages. Searching terms like refinance rates today or current refinance rates shows just how quickly the market can move.

For some, locking in the best refinance rates now could mean saving thousands over time. For others, a cash out refinance or VA refinance rates might make more sense.

Final Thoughts

If you live in Utah and are thinking about refinancing, it pays to research your options carefully. From comparing refinance mortgage rates and using a refinance calculator to exploring the best refinance companies, the right information can help you make the smartest financial choice.

Whether your goal is to refinance my home for lower payments, explore cash out refinance rates, or use a VA cash out refinance, the key is to match your needs with the right product. With the right approach, mortgage refinancing can be a smart strategy to secure your financial future in Utah.