If you’re thinking about buying a home or refinancing in the Beehive State, understanding mortgage rates in Utah is one of the most important steps in the process. Whether you’re looking for the best mortgage rates in Utah, exploring programs for first-time buyers, or comparing terms like the 30 year fixed mortgage rates versus the 15 year mortgage rates, knowing your options can save you thousands over the life of a loan.

Today’s Mortgage Market in Utah

When people search for mortgage rates today Utah or even drill down to mortgage rates today 15 year fixed, they’re looking for accurate, up-to-date numbers. Mortgage interest rates fluctuate daily based on national economic conditions and local lending practices. That’s why it’s important to not just search for mortgage interest rates today, but also to understand what factors determine them.

In Salt Lake City, for instance, Salt Lake City mortgage rates tend to mirror statewide averages but can vary depending on the lender. Local factors, such as demand in urban markets, may lead some Utah county mortgage lenders to offer slightly different rates.

Loan Options: Finding the Right Fit

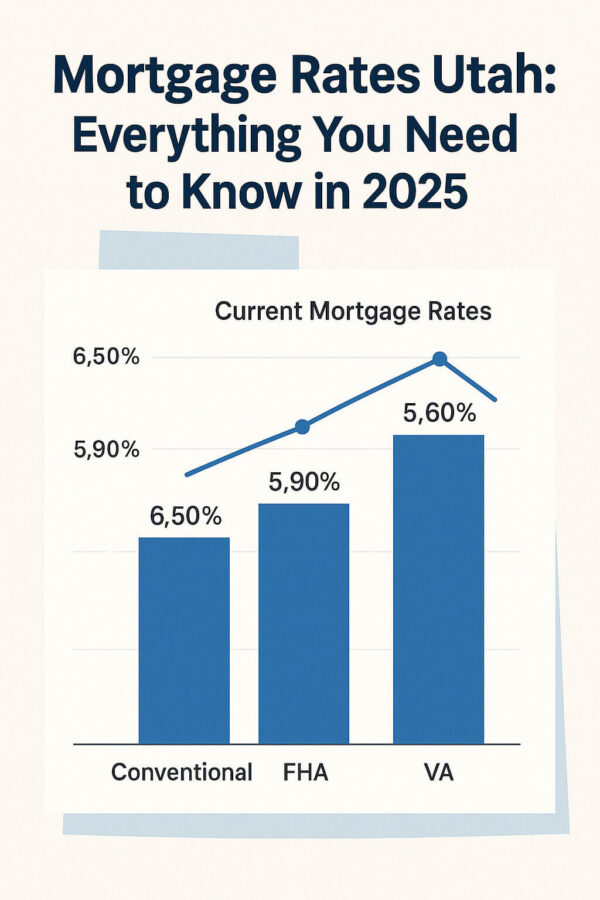

Not all mortgages are created equal. The type of loan you choose will affect your rate in Utah:

- Conventional mortgage rates: Best for borrowers with strong credit and stable income.

- FHA mortgage rates: Attractive to first-time homebuyers who may not have a large down payment.

- VA mortgage rates: Designed for veterans and active-duty service members, often with no down payment.

- USDA loan rates Utah: Great for rural buyers who meet eligibility requirements.

- VA home loan mortgage rates: Provide some of the lowest financing options available to those who qualify.

Home loan mortgage interest rates and home loan mortgage rates vary by product, so comparing is key.

Fixed Rate Options: 30-Year vs. 15-Year

Two of the most common loan types are the 30 year fixed mortgage rates Utah and the 15 year mortgage rates.

- A 30-year fixed offers predictability and lower monthly payments, making it ideal for those who want long-term stability.

- A 15-year fixed typically has a lower interest rate, meaning you’ll pay off your home faster and save on interest, but your monthly payments will be higher.

When researching, be sure to compare mortgage rates today 15 year fixed against 30-year options to see which fits your budget and goals.

Tools That Make It Easier

Homebuyers want more than just numbers—they want to know what those numbers mean for their monthly budget. That’s why using tools like a mortgage calculator Utah is so valuable.

- A mortgage calculator with extra payments helps you see how adding even a small amount each month can shave years off your loan.

- A Utah refinance mortgage calculator shows how refinancing into a lower rate might reduce your monthly bill or shorten your loan term.

- A home mortgage estimator or monthly mortgage estimator can give you a quick snapshot of what to expect before you talk to lenders.

These tools are crucial when deciding whether to refinance, buy new, or switch loan terms.

Choosing the Right Lender

With so many options, who offers the best mortgage lenders Utah? The answer often depends on your specific needs. Local credit unions, regional banks, and national institutions all compete for borrowers, but each offers slightly different rates, fees, and customer service experiences.

If you’re a new buyer, exploring first-time home buyer mortgage Utah programs can provide benefits like lower down payments or special grants. Many lenders also simplify the process by allowing you to get pre-approved mortgage Utah online, giving you a clearer picture of what you can afford.

Final Thoughts: Making an Informed Decision

At the end of the day, comparing mortgage rates Utah across loan types, terms, and lenders is the smartest way to save money. Remember:

- Check mortgage interest rates today regularly—they change quickly.

- Compare FHA mortgage rates Utah, VA mortgage rates Utah, and USDA loan rates Utah to conventional loans to find the best fit.

- Use calculators like a mortgage calculator or monthly mortgage estimator to plan your budget.

- Don’t forget about lender choice—working with the best mortgage lenders Utah can make a big difference in closing costs and service.

Buying a home is one of the biggest financial decisions you’ll make. By understanding terms like 30 year fixed mortgage rates Utah, exploring tools like the Utah refinance mortgage calculator, and knowing where to find the best mortgage rates in Utah, you’ll be well prepared to secure a loan that fits your life and goals.