Rates, Loans, and Smart Steps!

Buying your first home is an exciting milestone, but it can also be overwhelming. As a first time home buyer, you may have many questions about mortgage rates, loans, and the steps involved in the home buying process. This guide will help you navigate the journey of becoming a homeowner in Utah.

Understanding Mortgage Rates in Utah for First Time Home Buyers

Mortgage rates play a crucial role in determining your monthly payments and the overall cost of your home. As a first time home buyer, it’s essential to understand how mortgage rates work and how to find the best rates in Utah. Comparing mortgage rates from different lenders can help you save money in the long run.

Loan Options for First Time Home Buyers

There are several loan options available for first time home buyers in Utah. These include FHA loans, USDA loans, VA loans, and conventional loans. Each loan type has its own eligibility requirements, benefits, and drawbacks. It’s important to research and choose the loan that best fits your financial situation and home buying goals.

Down Payment Assistance for First Time Home Buyers

One of the biggest challenges for first time home buyers is saving for a down payment. Fortunately, there are down payment assistance programs available in Utah that can help you cover this cost. These programs offer grants, loans, and other financial assistance to eligible buyers.

Affordable Housing Loans for First Time Home Buyers

Affordable housing loans are designed to help low- and moderate-income families achieve homeownership. As a first time home buyer, you may qualify for these loans, which often come with lower interest rates and more flexible terms. Researching affordable housing loan options can help you find a home that fits your budget.

Minimum Down Payment Requirements for First Time Home Buyers

The minimum down payment required for a home purchase varies depending on the loan type and lender. For first time home buyers, some loans offer low down payment options, such as 3% or even 0% down. Understanding the minimum down payment requirements can help you plan your finances and determine how much you need to save.

How Much Mortgage Can a First Time Home Buyer Afford?

Determining how much mortgage you can afford is a crucial step in the home buying process. As a first time home buyer, you’ll need to consider your income, expenses, and other financial obligations. Using a mortgage calculator can help you estimate your monthly payments and find a home within your budget.

Getting Preapproved for a Mortgage as a First Time Home Buyer

Getting preapproved for a mortgage is an important step for first time home buyers. Preapproval shows sellers that you are a serious buyer and gives you a clear idea of how much you can borrow. The preapproval process involves submitting financial documents and undergoing a credit check.

Mortgage Eligibility for First Time Home Buyers

To qualify for a mortgage, first time home buyers need to meet certain eligibility criteria. Lenders will consider factors such as your credit score, income, employment history, and debt-to-income ratio. Improving your credit score and reducing your debt can increase your chances of getting approved for a mortgage.

Credit Score Requirements for First Time Home Buyers

Your credit score is a key factor in determining your mortgage eligibility and interest rate. First time home buyers with higher credit scores are more likely to qualify for better loan terms. It’s important to check your credit report, address any errors, and take steps to improve your credit score before applying for a mortgage.

How Long Does Mortgage Approval Take for First Time Home Buyers?

The mortgage approval process can take anywhere from a few weeks to a few months. As a first time home buyer, it’s important to be prepared for this timeline and stay in communication with your lender. Providing all required documents promptly and responding to any requests can help expedite the process.

Understanding Closing Costs for First Time Home Buyers

Closing costs are the fees and expenses associated with finalizing your home purchase. These costs can include appraisal fees, title insurance, and attorney fees. First time home buyers should budget for closing costs, which typically range from 2% to 5% of the home’s purchase price.

Loan Estimate for First Time Home Buyers

A loan estimate is a document that provides an overview of the loan terms, interest rate, monthly payments, and closing costs. First time home buyers will receive a loan estimate after applying for a mortgage. Reviewing the loan estimate carefully can help you understand the total cost of your loan and make informed decisions.

Mortgage Insurance for First Time Home Buyers

Mortgage insurance is required for certain types of loans, especially those with low down payments. First time home buyers should be aware of the cost of mortgage insurance and how it affects their monthly payments. Some loans allow you to cancel mortgage insurance once you reach a certain level of equity in your home.

Escrow in Mortgage for First Time Home Buyers

Escrow is an account used to hold funds for property taxes and homeowners insurance. As a first time home buyer, you’ll make monthly escrow payments along with your mortgage payment. Understanding how escrow works can help you manage your finances and ensure that your property taxes and insurance are paid on time.

Loan Amortization Schedule for First Time Home Buyers

A loan amortization schedule shows the breakdown of each mortgage payment, including the principal and interest. First time home buyers can use this schedule to see how their loan balance decreases over time. Understanding loan amortization can help you plan for the future and make extra payments to pay off your mortgage faster.

Mortgage Glossary for First Time Home Buyers

The mortgage process involves many terms and concepts that may be unfamiliar to first time home buyers. A mortgage glossary can help you understand key terms such as APR, PMI, and DTI. Familiarizing yourself with these terms can make the home buying process less confusing and more manageable.

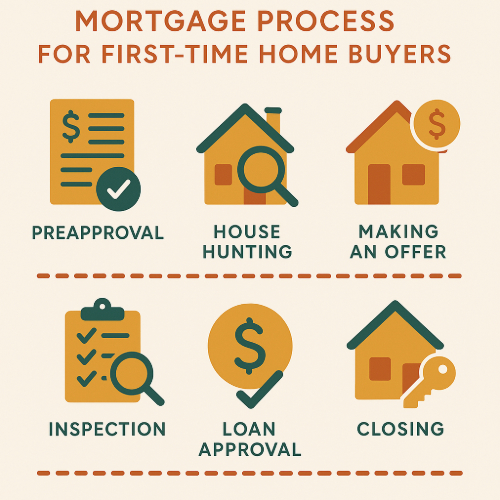

The Mortgage Process Step by Step for First Time Home Buyers

The mortgage process can be complex, but breaking it down into steps can make it more manageable for first time home buyers. This section will guide you through the process, from getting preapproved to closing on your home. Understanding each step can help you stay organized and confident throughout your home buying journey.

Working with a Mortgage Broker in Salt Lake City for First Time Home Buyers

A mortgage broker can help first time home buyers find the best loan options and navigate the mortgage process. Working with a local mortgage broker in Salt Lake City can provide personalized assistance and access to a wide range of lenders.