📈 Why Mortgage Rates Matter More Than Ever in 2025

If you’re looking to buy a home in Utah, mortgage rates could make or break your deal in 2025. After a rollercoaster ride of rate hikes and inflation battles, many buyers are asking: What are mortgage rates today? And more importantly, where are they headed?

🔍 Utah Mortgage Rates Today (30-Year Fixed & More)

As of this week, mortgage rates today 30-year fixed in Utah are hovering between 6.25% and 6.65%, depending on your lender and credit profile. While these rates are lower than the 2023 peaks, they’re still higher than the sub-4% era many remember. Here’s a snapshot:

- Best mortgage rates today: Typically found with local credit unions or online lenders

- Mortgage rates for first-time buyers: Often include special incentives

- Best mortgage rates near me: Vary widely — comparison shopping is key

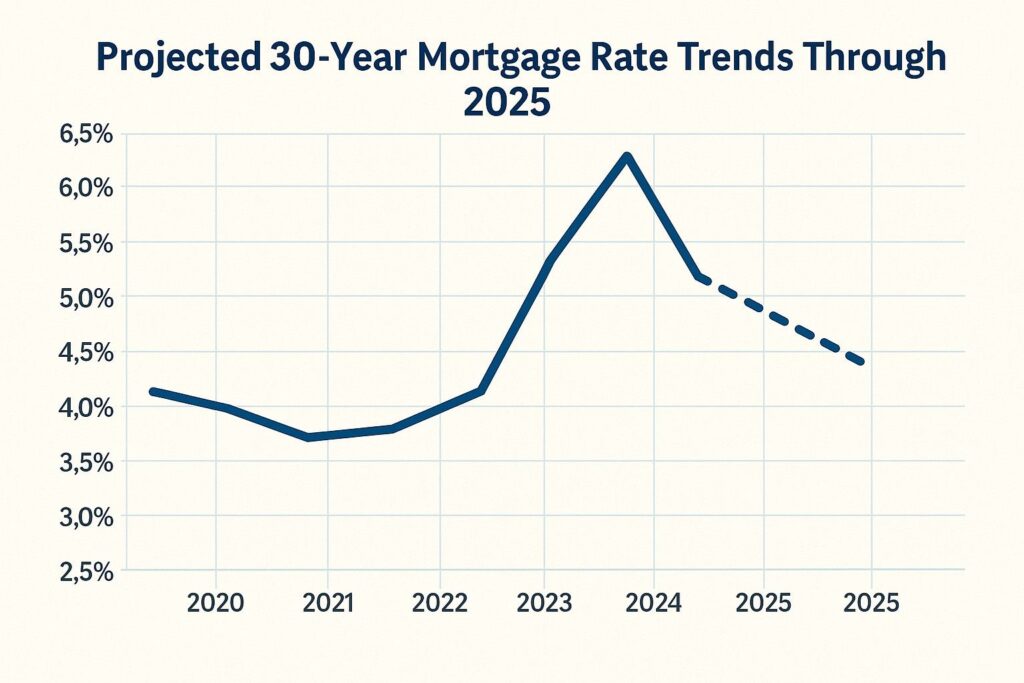

🔮 Mortgage Rate Predictions for 2025

What do experts say about mortgage rates 2025? Forecasts suggest a slow decline, potentially reaching the mid-5% range by Q4 2025. While not a return to pandemic-era lows, this could save buyers tens of thousands over the life of a loan.

Here’s what may influence future rates:

- Federal Reserve decisions

- Inflation trends and economic growth

- Utah’s booming housing demand in areas like Salt Lake City and St. George

If you’re waiting for the “perfect” rate, you may miss out on the perfect home.

📊 Should You Lock in a Rate Now or Wait?

Many Utah buyers are torn: lock now or hold out? The truth is, timing mortgage rates perfectly is nearly impossible. Instead, consider:

- Getting pre-approved now to hold today’s rates

- Looking into adjustable-rate mortgage rates (ARM) if you plan to refinance later

- Asking lenders about rate float-down options in case rates drop before you close

🧠 Understanding the Loan Landscape in Utah

Beyond rates, remember that your credit score, loan type, and down payment all impact your final APR. Common mortgage products include:

- 30-year fixed

- 15-year fixed

- FHA loans for first-time buyers

- Jumbo loans for high-value homes

Don’t forget to factor in mortgage insurance and closing costs when comparing offers.

📍 Where to Find the Best Mortgage Rates in Utah

You don’t have to settle for national chains. Many of the best mortgage lenders in Utah are local. Try searching for:

- “best mortgage rates near me”

- “Utah credit union mortgage offers”

- “local mortgage broker Salt Lake City”

Tools like Zillow, Bankrate, or NerdWallet can also help you compare offers in real-time.

✅ Tips to Get a Better Rate

Want to save thousands on your mortgage? Follow these quick tips:

- Improve your credit score

- Put down at least 20%

- Compare 3+ lenders before choosing one

- Consider buying mortgage points

- Stay informed with the latest mortgage rate trends

📢 Final Thoughts: Utah Buyers Should Act with Confidence

The mortgage landscape is changing, but that doesn’t mean you should wait forever. With strong Utah housing market trends and expected mortgage rate drops, now may be the time to act.

👉 Get pre-approved, compare rates, and be ready to strike when the right home — and rate — align.