Welcome to our comprehensive guide on understanding the mortgage market. In a world

where financial decisions can feel overwhelming, we’re here to help you make sense of the key

factors that impact one of the biggest purchases of your life. This article will walk you through the essential components of securing a home loan, from deciphering interest rates to finding

the right mortgage professional. We’ll use all of the keywords you have listed, from mortgage

rates to the all-important mortgage calculator, to give you a detailed look at what you need to

know.

Understanding Mortgage Rates and What They Mean for You

When you begin your home-buying journey, the term you’ll encounter most frequently is

mortgage rates. These rates, often expressed as a percentage, determine the cost of borrowing

money to buy a home. They are a critical factor in calculating your monthly payments and the

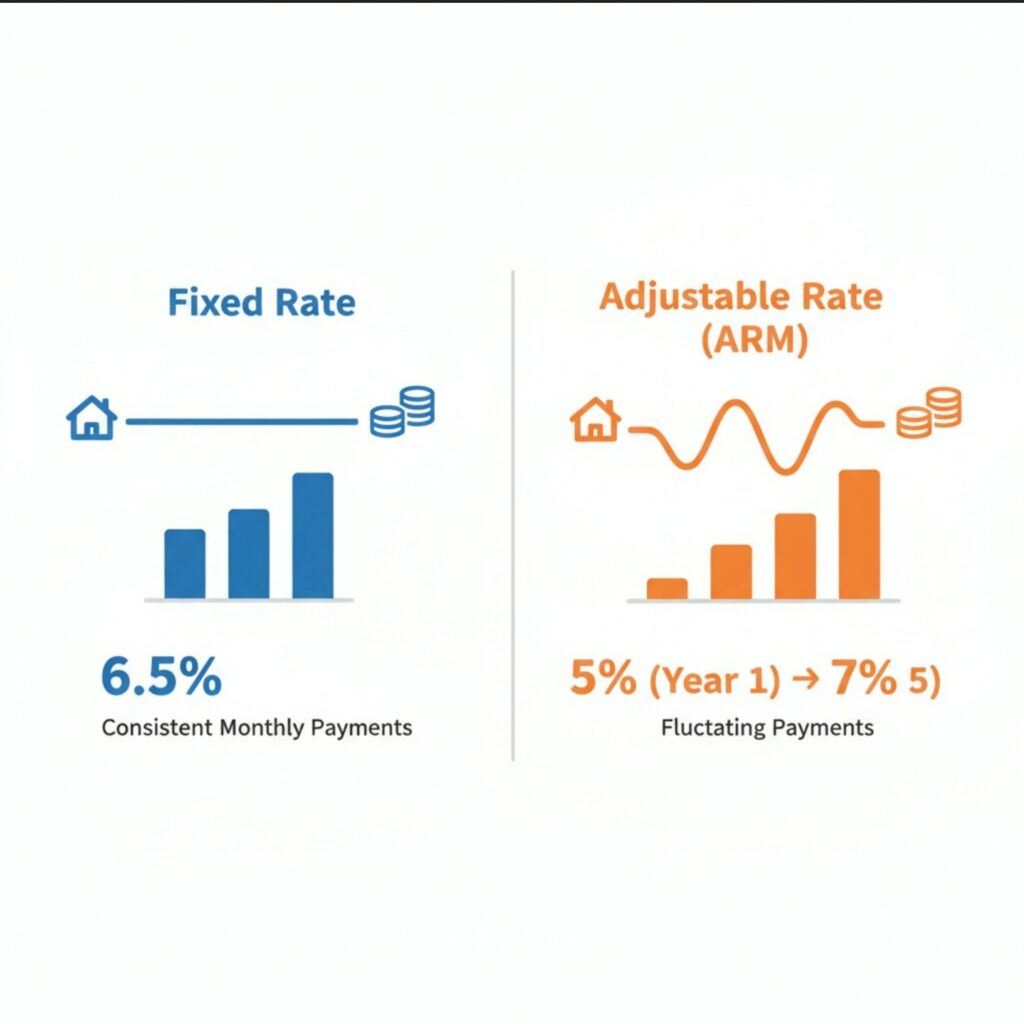

total amount you’ll pay over the life of the loan. Understanding the difference between fixed

and variable rates is crucial. A fixed-rate mortgage offers a consistent interest rate for the

entire loan term, while a variable-rate mortgage, or an adjustable-rate mortgage (ARM), can

change over time. Many people are interested in a 30-year mortgage rate because it offers a

long repayment period and lower monthly payments, which can make homeownership more

accessible.

*Mortgage Rate Comparison Chart: A visual comparison chart showing the stability of a fixed

mortgage rate versus the fluctuating nature of an adjustable mortgage rate (ARM), with lines

representing consistent and variable interest percentages.*

To truly grasp the impact of these numbers, you need to look at the current mortgage interest

rates. Staying informed about these figures is essential for timing your home purchase and

securing the best deal. The market is dynamic, with rates fluctuating based on a variety of

economic indicators. This is why tools like a mortgage estimator are so useful. They provide a

quick and easy way to get a general idea of your potential loan costs. You can also explore

keywords such as current fixed mortgage rates or current mortgage loan interest to narrow

your search to specific loan types and market conditions. By keeping a close eye on these rates,

you can position yourself to make a financially sound decision.

The Power of the Mortgage Calculator in Your Home Search

Hands Using Mortgage Calculator: Close-up of hands typing numbers into a mortgage

calculator on a digital tablet, demonstrating the process of estimating home loan payments.*

Once you have a handle on the rates, the next step is to put that knowledge into action with a

mortgage calculator. This tool is your best friend during the early stages of home searching. By

entering your desired loan amount, interest rate, and term, the calculator can estimate your

monthly payments. You can use a standard home loan calculator or a more specific one like a

va home loan calculator if you are a veteran. Many of these calculators, often simply called mtg

calculator, also allow you to factor in property taxes, insurance, and other costs to give you a

more accurate picture of your total monthly housing expenses. Don’t forget to use keywords like va home loan mortgage calcul or a generic mortgage mortgage calculator in your searches

to find a variety of tools. The more you use these tools, the more confident you’ll become in

your ability to budget for your new home.

Finding the Right Professional: Mortgage Lenders and Brokers

With a solid grasp of rates and a powerful calculator in hand, it’s time to connect with

professionals. The first step is often a mortgage pre approval. This process involves a lender

reviewing your financial information to determine how much you can borrow. It gives you a

clear budget and shows sellers that you are a serious buyer. For this step, you will be working

with a mortgage lender or a mortgage broker. A lender, such as a bank or credit union,

provides the funds directly, while a broker acts as an intermediary, connecting you with

different lenders to find the best rates. When searching for these professionals, keywords like

mortgage broker near me or mortgage loan lenders can help you find local experts who can

provide personalized guidance.

Meeting with a Mortgage Professional: A homeowner candidate discussing mortgage options

and the pre-approval process with a friendly and professional mortgage broker or lender in an

office setting.

Many people also search for mortgage broker to find a professional who can help them

navigate the complex world of loans. Brokers often have access to a wider range of loan

products and may be able to secure a better rate than you could on your own. It’s also

important to check the latest mortgage rates and the current housing loan interest rate to

ensure you are getting the best offer possible. Don’t just rely on one source for information;

compare a few different lenders and brokers to find the right fit for your needs.

In-Depth Analysis of Key Mortgage Terms

To help you feel even more confident, let’s break down some of the specific terms and concepts:

• Mortgage pre approval: This is a crucial step that gives you a realistic budget and shows

sellers you are a serious buyer. Getting pre-approved helps you avoid the

disappointment of falling in love with a home you can’t afford.

• Mortgage rates today: This specific search term reflects the need for real-time

information in a fast-moving market. Rates can change from day to day, and staying on

top of them is key. Home loan mortgage rates: A broad term that can lead to a lot of general information, but it’s a good starting point for understanding the landscape.

• Interest rates now: This query shows a user’s desire for immediate information and

highlights the urgency of the home-buying process.

• Mortgage loan lenders: A search for specific companies or institutions that provide

home loans.

• Current housing loan interest rate: This phrase points to a user’s need for a macro view

of the market, beyond just a single loan type.

By familiarizing yourself with these terms and using them to guide your research, you will be

well on your way to a successful home-buying experience.

We hope this blog post helps you on your journey. Remember, while the process can seem

daunting, taking it one step at a time and utilizing the right tools and professionals will make all

the difference.