Navigating 30-Year Fixed-Rate Refinancing in Utah: Your Complete Guide

For many Utah homeowners, their home is not just a place to live; it’s a significant financial asset. As market conditions evolve, understanding your mortgage options becomes paramount. Among the various choices, the 30-year fixed-rate mortgage stands out as a popular and stable option, especially when considering refinancing. This guide will delve into the intricacies of 30-year fixed-rate refinancing in Utah, exploring everything from current refinance rates 30 year fixed to the potential impact on your monthly budget and long-term financial goals. Haven’t bought your forever home yet? Check out our tips and tricks to buying in Utah.

Understanding the Appeal of a 30-Year Fixed Mortgage

A 30-year fixed mortgage offers remarkable predictability, a quality highly valued by homeowners. Unlike adjustable-rate options, this loan type is characterized by a consistent interest rate throughout the entire loan term. This stability ensures that the principal and interest portion of your mortgage payment 30 years remains unchanged, providing a predictable housing cost for three decades. When you decide to refinance into a 30-year fixed loan, you are essentially replacing your existing mortgage with a new one that locks in these stable rates refinance 30 year fixed, offering a sense of financial security. Want to learn more about your current mortgage? Check out our helpful piece on understanding your mortgage .

Why Consider Refinancing Your Mortgage?

The decision to refinance into a new 30 year mortgage is often driven by several strategic financial motivations. Understanding these can help you determine if it’s the right move for your current situation:

- Lowering Your Monthly Payments: This is perhaps the most compelling reason homeowners explore refinance rates 30 year fixed. If today’s refinance mortgage rates 30 year fixed are significantly lower than what you’re currently paying, even a modest reduction can lead to substantial long-term savings and a more manageable mortgage payment 30 years. Many individuals actively seek the lowest 30 year refinance rates or the best 30 year refinance rates to optimize their monthly budget.

- Accessing Home Equity (Cash-Out Refinance): A cash out refinance rates 30 year fixed allows you to leverage your home’s accumulated equity. This popular option provides a lump sum of cash, ideal for funding major expenses such as home renovations, educational pursuits, or consolidating high-interest debt. When considering this, it’s crucial to thoroughly evaluate the 30 year cash out refinance rates and compare them against other financing avenues.

- Changing Loan Terms: Life circumstances change, and so might your financial capacity. If you’re currently managing a more aggressive 15-year loan and find its higher mortgage payment challenging, refinancing from 15 to 30 year loan can dramatically reduce your monthly obligations, thereby improving your cash flow. Conversely, if your goal is to pay off your home faster and you can comfortably afford higher payments, refinancing from 30 year to 15 year mortgage can save you significant interest over the loan’s lifetime.

- Switching Loan Types: For those with an adjustable-rate mortgage (ARM) who desire greater stability, a 30-year conventional mortgage refinance rates option provides the security of a predictable fixed rate, shielding you from future market fluctuations.

Factors Influencing Your 30-Year Refinance Rate

While general trends like the average 30 year refinance rate are widely reported, your specific refinance rates 30 year fixed in Utah will be a personalized reflection of several individual and broader market factors:

- Credit Score: Your creditworthiness is a primary determinant. A robust credit profile, typically a FICO score of 740 or higher, will generally qualify you for the most favorable and lowest 30 year mortgage refinance rates.

- Loan-to-Value (LTV) Ratio: This ratio compares your loan amount to your home’s appraised value. A lower LTV, indicating substantial equity in your home, usually translates into more competitive rates refinance 30 year fixed.

- Debt-to-Income (DTI) Ratio: Lenders meticulously assess your ability to comfortably manage monthly payments by comparing your total monthly debt obligations against your gross monthly income.

- Discount Points: You may have the option to pay “points” (prepaid interest) at closing, which are essentially prepaid interest. In exchange for this upfront cost, you can secure a lower interest rate over the life of the loan.

- Market Conditions: Broader economic indicators, including inflation rates and the monetary policies set by the Federal Reserve, exert a direct influence on mortgage rates today refinance 30 year fixed across the market.

Understanding Your 30-Year Mortgage Payments: A Look at the Numbers

One of the most practical considerations for any homeowner contemplating a refinance is the actual mortgage payment 30 years. While an online mortgage 30 years calculator is an invaluable tool for precise figures, let’s explore some typical scenarios to give you an idea of potential monthly principal and interest payments (note: these figures are illustrative and do not include property taxes or home insurance, which vary by location in Utah):

- For a $100 000 mortgage payment 30 years, at an example 6.5% interest rate, your principal and interest payment would be approximately $632.

- A $250 000 mortgage payment 30 years at the same 6.5% rate would be around $1,580.

- If you have a $300 000 mortgage payment 30 years, expect to pay roughly $1,896.

- For a $350 000 mortgage payment 30 years, the payment could be approximately $2,219.

- And for a $400 000 mortgage payment 30 years, it would be in the vicinity of $2,528.

- Even for a $500 000 mortgage 30 years, the monthly principal and interest could be around $3,160.

These examples powerfully demonstrate how significantly the total loan amount impacts your monthly mortgage payment 30 years, even with consistent interest rates.

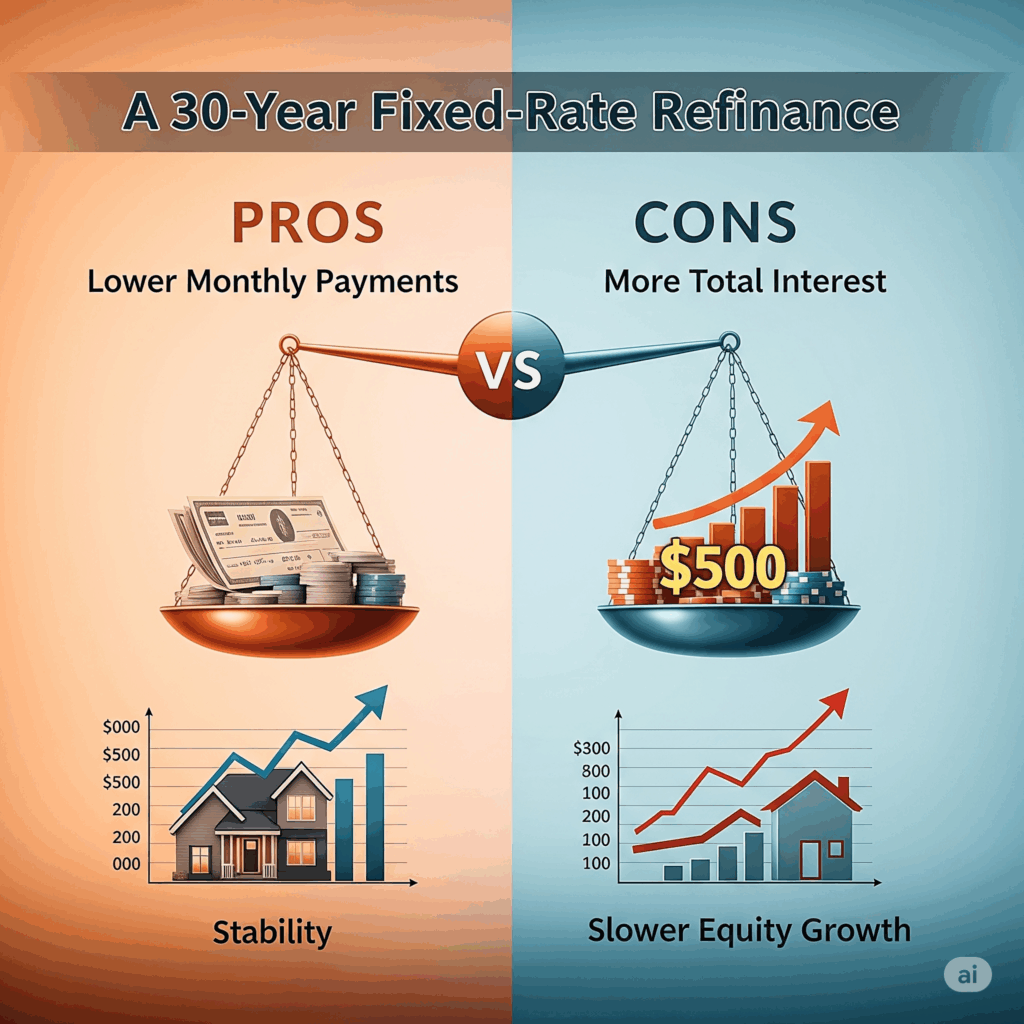

The Pros and Cons of a 30-Year Fixed Refinance

Choosing a 30-year fixed loan for your refinancing comes with a distinct set of advantages and disadvantages, which are crucial to weigh against your personal financial goals:

Pros:

- Lower Monthly Payments: Spreading the loan over 30 years typically results in the lowest possible monthly principal and interest payment, significantly improving your monthly cash flow.

- Payment Stability: The fixed interest rate provides unparalleled budget predictability, effectively shielding you from future rate hikes and market volatility.

- Financial Flexibility: Lower payments can free up valuable funds that can be strategically redirected towards other investments, bolster your savings, or accelerate the repayment of other higher-interest debts.

- Wider Lender Choice: Due to its widespread popularity, you’ll generally find a broad array of competitive 30 year mortgage quote options from numerous lenders, offering ample choice.

Cons:

- More Total Interest Paid: Over a lengthy 30-year term, you will inevitably pay a significantly larger sum in total interest compared to a shorter-term loan, such as a 15-year fixed mortgage.

- Slower Equity Build-Up: The extended amortization schedule means that a smaller proportion of your early payments is allocated towards reducing the principal, which can slow down the pace at which you build home equity.

- Slightly Higher Interest Rates: In some market conditions, the 30 year refinance rates offered might be marginally higher than the interest rates available for 15-year terms on the same day.

Specialized 30-Year Refinance Scenarios and Lender Considerations

Beyond the standard conventional mortgage refinance rates, several specialized scenarios might apply when considering a 30-year fixed loan:

- 30 year second home mortgage rates: If you own a vacation home or an investment property in Utah, refinancing it can carry different rate implications compared to a primary residence, often due to perceived higher risk.

- Lender-Specific Rates: As you explore the lowest 30 year mortgage rates refinance, you’ll likely encounter specific offers from various financial institutions. For instance, some individuals actively seek USAA 30 year mortgage rates, Navy Federal 30 year mortgage rates, or Alliant Credit Union 30 year mortgage rates. It’s always prudent to compare offers from a diverse range of lenders to ensure you secure the best 30 year refinance rates tailored to your unique financial situation.

Getting Your Personalized 30-Year Mortgage Quote in Utah

The most effective way to determine if a 30-year fixed-rate refinance aligns with your financial aspirations is to obtain a personalized 30 year mortgage quote. It’s important not to rely solely on broadly advertised mortgage rates today refinance 30 year fixed, as these are often presented for ideal borrower profiles. A local Utah mortgage professional possesses the expertise to help you understand all the intricate factors at play, including closing costs and fees, and can expertly guide you through every step of the process. They can thoroughly explain how various scenarios, such as refinancing from 15 year to 30 year or vice-versa, will specifically impact your financial future.

Ultimately, whether your primary goal is to find the lowest 30 year refinance rates to significantly reduce your monthly expenses, or you’re contemplating a cash out refinance rates 30 year fixed to strategically unlock your home’s equity, making a well-informed decision is paramount. By understanding the profound nuances of the 30-year fixed loan, diligently comparing rates refinance 30 year fixed, and carefully considering your long-term financial objectives, you can confidently navigate the dynamic Utah mortgage market. We encourage you to reach out to a local expert today to get a tailored 30 year mortgage quote and thoroughly explore all your available options.