Buying a home in today’s climate can be extremely overwhelming, not to mention the added pressure of applying for a mortgage. But with the right tools and guidance, the process can become much easier. This guide will walk you through each step of the application process, from pre-approval to closing, while showing you how to use tools like a mortgage calculator and how to stay ahead of changing mortgage rates.

Step 1: Understand Your Finances Before You Apply

Before you start the application, take a hard look at your current financial health:

- What’s your credit score?

- How much do you have saved for a down payment?

- What is your debt-to-income ratio?

These are the first things a mortgage lender will check. Getting these numbers in order early can improve your chances of getting approved and securing better home loan interest rates.

Tip: Try using a mortgage affordability calculator to estimate what you can realistically afford.

Step 2: Get Pre-Approved for a Mortgage

A mortgage pre-approval shows sellers you’re serious. It also gives you a clear price range to shop in.

During pre-approval, your lender will evaluate your credit, income, and assets. You’ll receive a letter that outlines how much they’re willing to lend and at what rate.

You can also get pre-qualified online using a lender’s website — it’s faster, but not as reliable as full pre-approval.

Step 3: Use a Mortgage Calculator to Plan Monthly Payments

Using a mortgage calculator helps you see what your monthly payments might look like based on:

- Loan amount

- Term (15 or 30 years)

- Mortgage rates

- Down payment

Some calculators even factor in property taxes, insurance, and PMI to give a fuller picture.

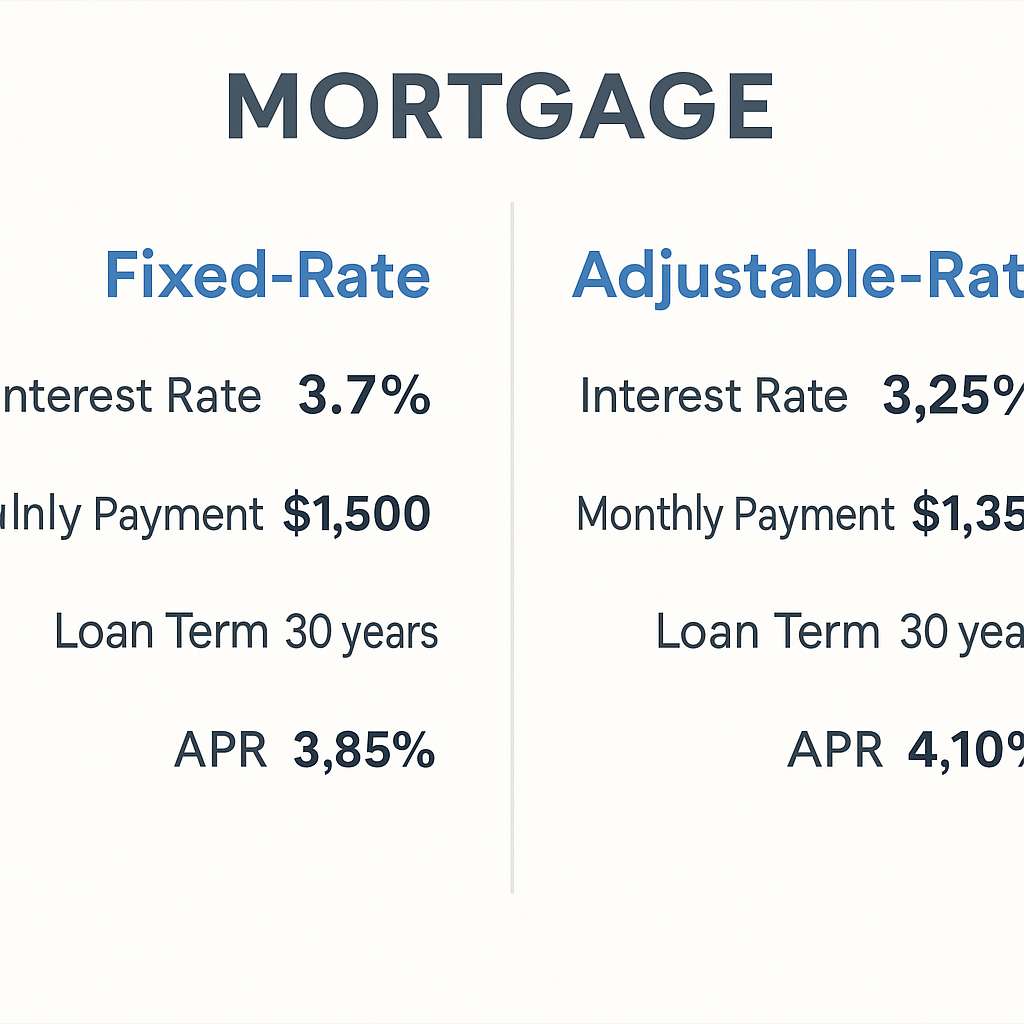

Step 4: Compare Lenders and Mortgage Rates

Don’t just go with your bank. Compare multiple mortgage lenders to get the best deal. Even a 0.25% difference in mortgage loan rates can save you thousands over the life of the loan.

Use these tools:

- Bankrate

- NerdWallet

- Better.com

- Zillow’s mortgage comparison tools

Make sure you understand the APR (which includes fees), not just the interest rate.

Step 5: Submit Your Full Mortgage Application

Once you’ve chosen a lender, it’s time to officially apply for a mortgage. Be prepared to upload:

- W-2s and tax returns (2 years)

- Recent pay stubs

- Bank statements

- Photo ID

- Proof of assets and debts

The lender will do a hard credit pull and begin underwriting your application.

Step 6: Get Through Underwriting and Close

If everything checks out, your lender will send a loan estimate and eventually a closing disclosure.

Final steps:

- Schedule a home appraisal

- Finalize paperwork

- Pay closing costs (typically 2-5% of the home price)

Once approved, you’ll sign your mortgage documents, get your keys, and officially become a homeowner!