Unlock Your Future: A Veteran’s Roadmap to First-Time Homeownership in Utah

VA Loan Calculator Guide for Utah First-Time Home Buyers

Published by Kassidy Jo Samuels

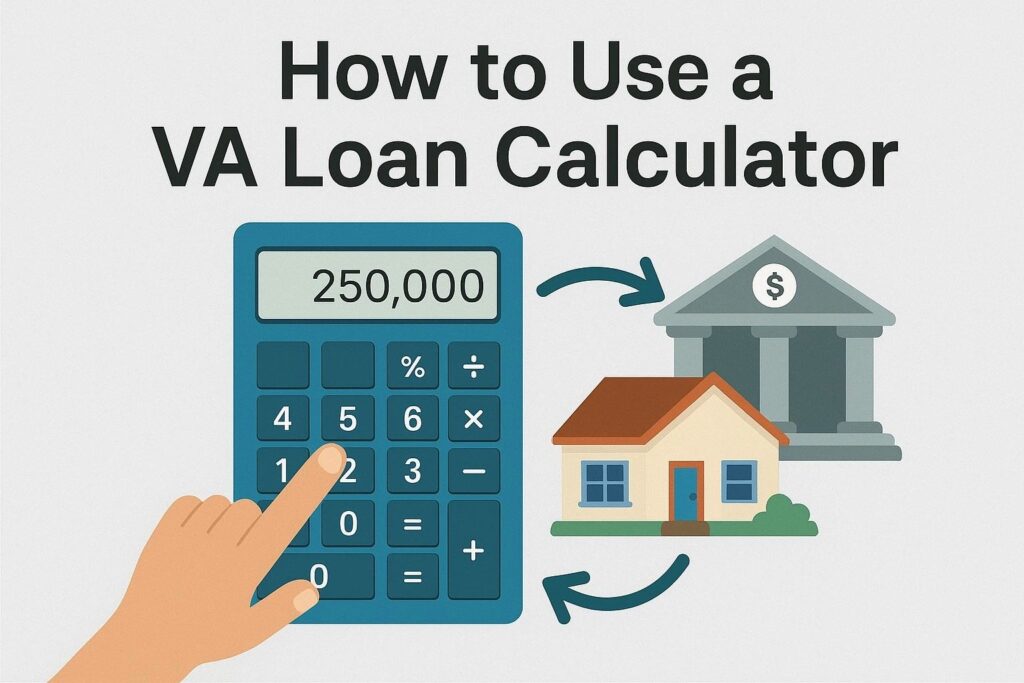

Using a VA Loan Calculator to Estimate Costs

Buying your first home can feel overwhelming, especially if you’re transitioning out of the military and beginning to explore your VA loan benefits. However, whether you’re a veteran or an active-duty service member, taking advantage of the VA home loan program can significantly ease the path to affordable homeownership.

To get started, it’s essential to understand how to estimate your mortgage accurately using a VA loan calculator. Equally important is knowing how to navigate the mortgage pre-approval process with confidence.

In this guide, we’ll walk you through the most important tools—such as a home loan calculator, VA mortgage calculator, and equity home loan calculator—so you can make well-informed decisions about your future in Utah’s competitive housing market

Mortgage Pre-Approval and Loan Calculators

Understanding Mortgage Calculators

If you’re beginning your home buying journey, then a home loan calculator is one of the best places to start. Not only does it provide a quick snapshot of your potential monthly payments, but it also helps estimate how much house you can realistically afford based on key factors like your income, down payment, and loan terms.

For veterans, however, a VA home loan calculator offers an even more accurate estimate. Specifically, it takes into account important VA-specific benefits by factoring in:

VA funding fees

$0 down payment options

Competitive interest rates

The best tools allow you to input principal, interest, property taxes, and insurance—giving you a clear monthly payment estimate to compare offers.

Using VA Loan Payment Calculator Tools

The VA loan program offers significant benefits:

No down payment

No private mortgage insurance

Lower interest rates

Use these tools to your advantage:

VA loan payment calculator: Breaks down monthly costs

Veteran home loan calculator: Compares loan amounts and repayment terms

Equity home loan calculator: Estimates the value of equity over time

Understanding Current Home Loan Interest Rates

Utah’s housing market is competitive, and interest rates fluctuate based on market conditions, your credit, and loan type. Check:

Average home loan interest rates and,

Current Utah rates before locking in

Start by getting pre-approved—a conditional offer from a lender after reviewing your finances. This boosts your credibility with sellers.

Some lenders even offer “pre-pre-approvals” for early-stage planning.

Exploring Veterans United, Rocket, and USAA Home Loans

When comparing lenders, consider:

Veterans United – Veteran-focused service, top-rated resources

Rocket Home Loans – Fast digital pre-approvals

USAA – Especially competitive for military families with strong credit

Use their platforms to:

Compare home loan mortgage rates

Use online calculators

Gather rate estimates

A First-Time Buyer in Utah? Here’s What to Do Next

If you’re applying for a first-time home loan as a veteran:

Compare VA loans with conventional options

Use calculators to evaluate both affordability and long-term savings

Understand that “home loan” and “mortgage loan” are often interchangeable

✔️ Checklist:

- Start with mortgage pre-approval

- Use VA calculators to check payment estimates

- Compare lenders’ interest rates

- Review multiple offers before choosing

Final Thoughts on Home Loan Mortgage Rates and Tools

With so many tools at your disposal—from the home loan calculator to the VA mortgage payment calculator—there’s no reason to go into the home buying process unprepared.

Whether you’re checking USAA home loan rates, comparing loan types, or simply exploring your eligibility, you have the tools and benefits to make smart, informed decisions.