When Can I Apply for a Remortgage After Chapter 7 Bankruptcy or With Bad Credit

Navigating the mortgage process in Utah can be challenging if you’ve faced financial setbacks. In this guide, we explain when you can apply for a remortgage after Chapter 7, how to qualify with less-than-perfect credit, and the tools you need, like a mortgage calculator and debt-to-income ratio, to plan your path to homeownership.

Will I Get Approved for a Mortgage Loan with Bad Credit?

If you’re asking, “Will I get approved for a mortgage loan with bad credit?”, your approval hinges on four key factors: your credit score, down payment size, debt-to-income ratio, and loan type. Conventional loans generally require a 620+ score, but FHA loans may accept a 580+ score. A lower credit score often means higher rates, so review a current mortgage rate calculator and compare with a mortgage calculator debt-to-income ratio tool to see where you stand.

Mortgage Calculator Debt-to-Income Ratio

Using a mortgage calculator, the debt-to-income ratio early helps you model monthly obligations—including credit cards, auto loans, and taxes—against your gross income. Aim for a DTI under 43%, though some programs allow up to 50%. For an external perspective on DTI best practices, see the CFPB’s guidelines here.

Mortgage vs Rent: Should You Wait?

Comparing mortgage vs rent helps determine if buying now makes sense. Include principal, interest, mortgage insurance, taxes, and maintenance. Use our mortgage vs rent calculator to see how Utah rates have trended over the past year.

Mortgage Loan Requirements & Types

Understanding mortgage loan requirements and mortgage loan types ensures you target the right program:

Conventional: 620+ score, 3–20% down payment.

FHA: 580+ score, 3.5% down payment, flexible DTI.

VA: No down payment for veterans and active duty.

USDA: No down payment, rural properties only.

Each has distinct steps and requirements.

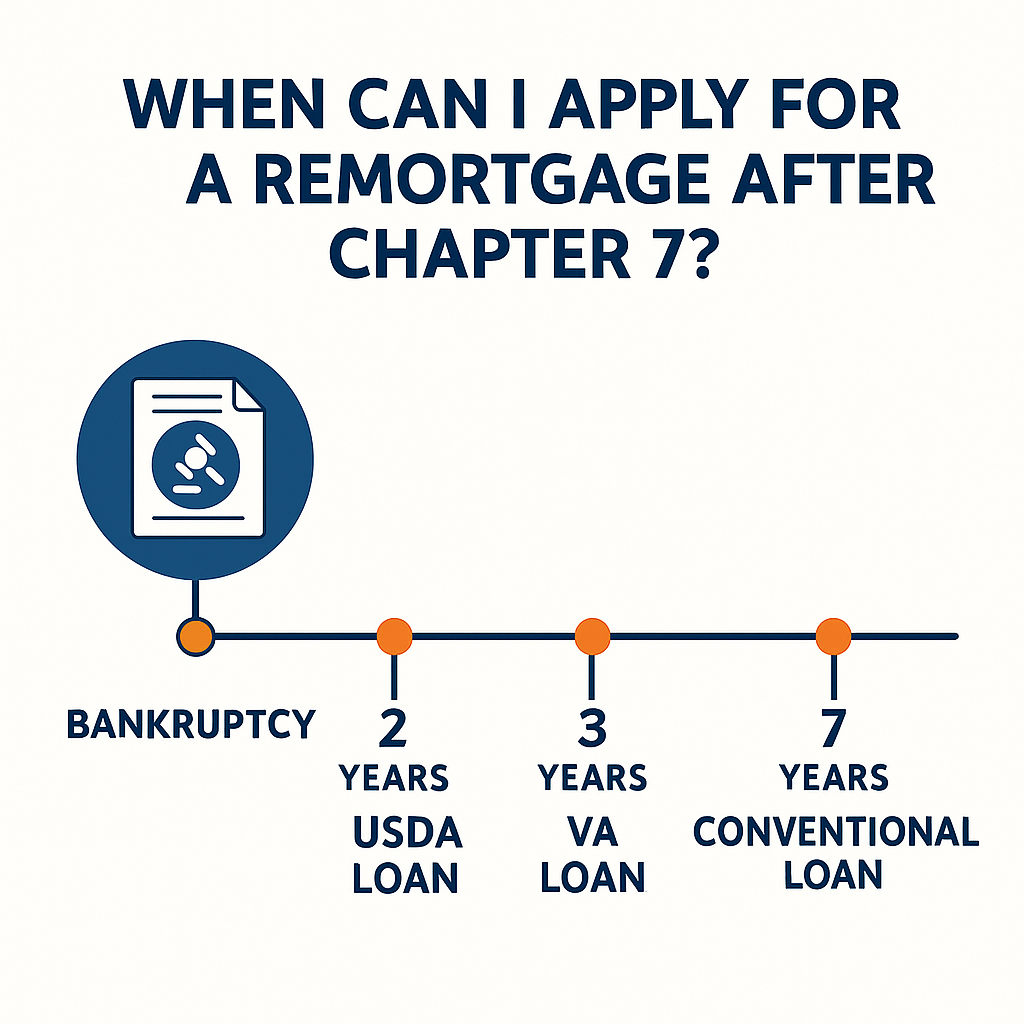

When Can I Apply for a Remortgage After Chapter 7?

For a conventional loan, you must wait four years after your Chapter 7 discharge. FHA and VA programs often reduce this to two years if you’ve reestablished steady on-time payments. If you’re considering a refinance on an existing Utah property, most lenders ask for at least 12 months of on-time payments and 20% equity before you can apply for a remortgage.

Mortgage Interest Deduction & Forecasts

Don’t forget the tax benefit: the mortgage interest deduction can lower your effective rate. Keep an eye on market sentiment by checking a mortgage rate forecast from trusted sources and comparing it with the mortgage rate trends on our site.

Will I Get Approved for a Mortgage Loan if I Owe?

If you still owe on credit accounts, approval is possible if your DTI remains under lender limits. Prioritize paying down small balances, then run scenarios using a Free Mortgage Calculator to see how paying off $500 vs. $1,000 affects your monthly payment.

Mortgage Relief & Local Utah Programs

Utah’s state-sponsored mortgage relief grants and down-payment assistance programs can bridge funding gaps. First-time buyers or those recovering from bankruptcy should ask their mortgage loan officer about these options.

Next Steps: Ready to move forward?

Apply now, and use our suite of tools: mortgage calculator, debt-to-income ratio, mortgage vs rent, and live mortgage rates this week to lock in a plan that fits your budget and timeline.