Are you considering mortgage refinancing in Utah this year? With interest rates shifting and housing values stabilizing, 2025 could be the perfect time to refinance your home loan. Whether you’re looking to reduce your monthly payment, access equity, or shorten your loan term, understanding current refinance rates is essential.

Refinance my home to save on interest? Yes, please. From analyzing 15 year fixed refinance rates to locking in the best home refinance rates, this guide will help Utah homeowners make confident, informed decisions. The key is not just finding a lower rate but choosing the loan structure that best supports your long-term financial goals.

Refinance home loan: Why 2025 Might Be the Right Time

The decision to refinance home loan terms typically revolves around saving money, lowering monthly payments, or adjusting the loan duration. Homeowners across Utah are taking advantage of the stability in current refinance rates to improve their financial outlook.

Options like the 30 year mortgage refinance rates or 15 year mortgage refinance rates each serve different goals. If you’re staying long-term, 30 year mortgage refinance rates may offer manageable monthly payments. But if you want to pay off your loan faster, lower refinance interest rates on a 15-year term might be a better fit.

Some Utah residents are also considering cash-out refinances, using the equity in their homes for debt consolidation, home renovations, or investment opportunities. As equity builds, refinancing becomes not just a financial move but a wealth-building strategy.

Refinance rates today: What Utah Borrowers Should Expect

Keeping track of refinance rates today gives borrowers the leverage to lock in better terms. Current refinance mortgage rates vary daily based on market conditions, and Utah is seeing a competitive spread across local lenders and credit unions.

You should also compare refinance interest rates today for both 15 and 30-year options. Make sure to request a Loan Estimate from at least three lenders and review not just the rate, but the full APR, fees, and loan structure.

Many borrowers are surprised to learn that their existing lender isn’t always the best option. Exploring credit unions, regional banks, and online lenders can reveal more attractive refinance mortgage rates with lower closing costs and faster approval times.

Home refinance rates vs. refinance mortgage rates: Is There a Difference?

In general, home refinance rates and refinance mortgage rates today are used interchangeably. However, the term mortgage loan refinance often includes more detailed considerations like your credit score, loan-to-value ratio, and debt-to-income ratio.

As of this month, home refinance rates 30 year fixed are trending lower in Utah than the national average. This gives local borrowers a real opportunity to benefit from the lowest refinance rates in years.

If you’re refinancing a government-backed loan, like an FHA or VA loan, make sure to ask about streamline refinance options, which require less paperwork and may offer quicker processing than a standard mortgage loan refinance.

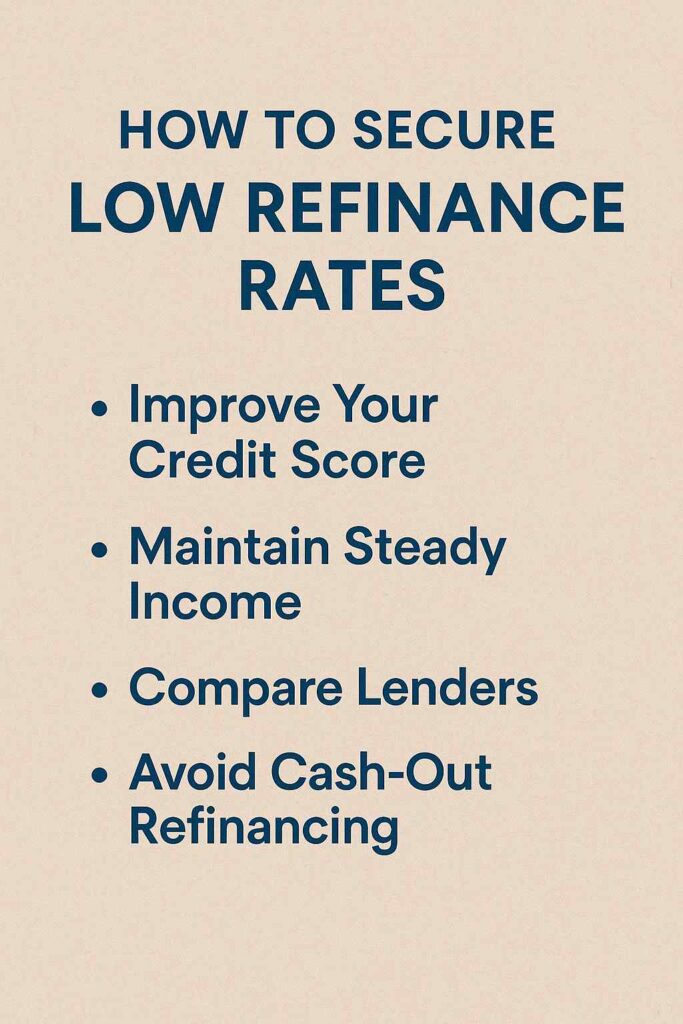

Best home refinance rates: How to Secure Them

To get the best home refinance rates, consider the following:

• Boost your credit score before applying

• Avoid cash-out refinancing unless necessary

• Maintain consistent income and employment history

• Consider locking in when refinance rates today 30 year fixed drop below your current rate

Even small reductions in refinance interest rates can lead to significant long-term savings.

Another tip: some Utah lenders offer lower refinance rates for borrowers who set up automatic payments from a checking account or who agree to keep multiple accounts with the institution.

Refinance my home: Should I Do It in 2025?

If you’re wondering whether to refinance my home in Utah, start by calculating your break-even point. This is the time it takes for the monthly savings to offset the refinancing costs. If you plan to stay in your home longer than that, refinancing could be a smart move.

With the availability of both current home refinance rates and custom loan options from Utah lenders, there’s never been a better time to explore your refinancing choices.

Also consider your life stage. If retirement is in your near future, shortening your term using today’s refinance interest rates could help you enter retirement debt-free.

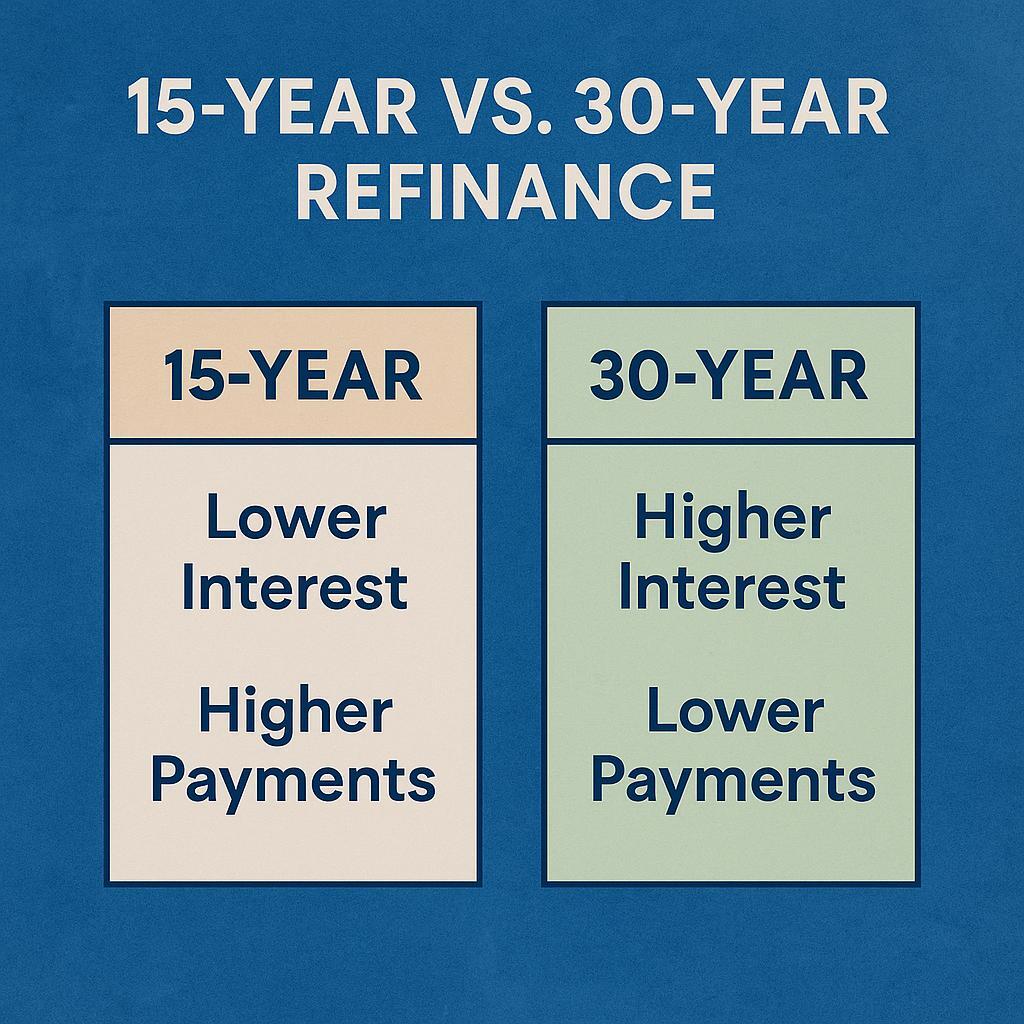

Current refinance rates 30 year fixed vs. 15 year fixed refinance rates

A side-by-side comparison:

• 30 year mortgage refinance rates: Lower monthly payments, higher total interest paid

• 15 year fixed refinance rates: Higher monthly payments, but lower total interest and faster equity growth

Choosing the right term depends on your financial goals, risk tolerance, and how long you plan to stay in your home.

For homeowners planning to sell or relocate within the next 5–7 years, it may not be worth it to pay higher monthly payments for a 15-year loan. Instead, consider hybrid ARM options with an initial fixed term and lower introductory refinance rates.

Lowest refinance rates in Utah: What Impacts Your Rate?

Your interest rate is affected by several factors:

• Credit score

• Debt-to-income ratio

• Loan-to-value ratio

• Type of property (primary home vs. rental)

If your financial profile is strong, lenders may offer some of the lowest refinance rates available, particularly on mortgage refinance rates today for qualified borrowers.

To improve your loan profile before applying, pay down high-interest debt, avoid opening new credit accounts, and provide clear, organized documentation of your income and assets.

Refinance your Home: Key Takeaways Before You Apply

Before you refinance, make sure to:

• Review your credit and debt levels

• Research refinance rates

• Gather financial documents: W-2s, tax returns, pay stubs

• Shop for multiple quotes from Utah lenders

Whether you’re interested in a simple rate-and-term refinance or exploring cash-out options, understanding refinance rates today and current mortgage refinance rates 30 year fixed is the first step toward saving money and building wealth through your home.