Everything You Need to Know About Tiny Home Loans in 2025

Are you ready to downsize, live more sustainably, or simplify your budget?

A tiny house mortgage can help. Lenders now offer several loan products for this growing market. Whether you plan to buy a finished home or order a custom build, you must understand each financing path.

Understanding Your Tiny House Financing Options

Tiny homes rarely fit the rules for a standard mortgage, so you need alternatives.

First, check banks, credit unions, and online lenders that market “tiny house loans.”

Next, compare personal loans; they fund quickly, yet their rates run higher.

Finally, look into tiny-house credit-union programs. These often feature lower fees and flexible terms.

One increasingly common route is to go through tiny house credit union mortgage programs, which may offer better terms, lower closing costs, and more flexibility than traditional banks. If your home is built on a permanent foundation, you may be able to apply for a fixed-rate mortgage, while those with mobile or on-wheels homes may need to consider a chattel loan for manufactured home.

Fixed-Rate vs. Chattel Loans

If your home sits on a permanent foundation, you can request a fixed-rate mortgage. Homes on wheels usually require a chattel loan, which treats the structure as personal property rather than real estate.

A chattel loan is a type of loan used to finance the purchase of movable personal property, often referred to as chattel, such as manufactured homes, vehicles, or equipment. It differs from a traditional mortgage, which is used for real estate, as chattel loans specifically target assets that are not permanently attached to land.

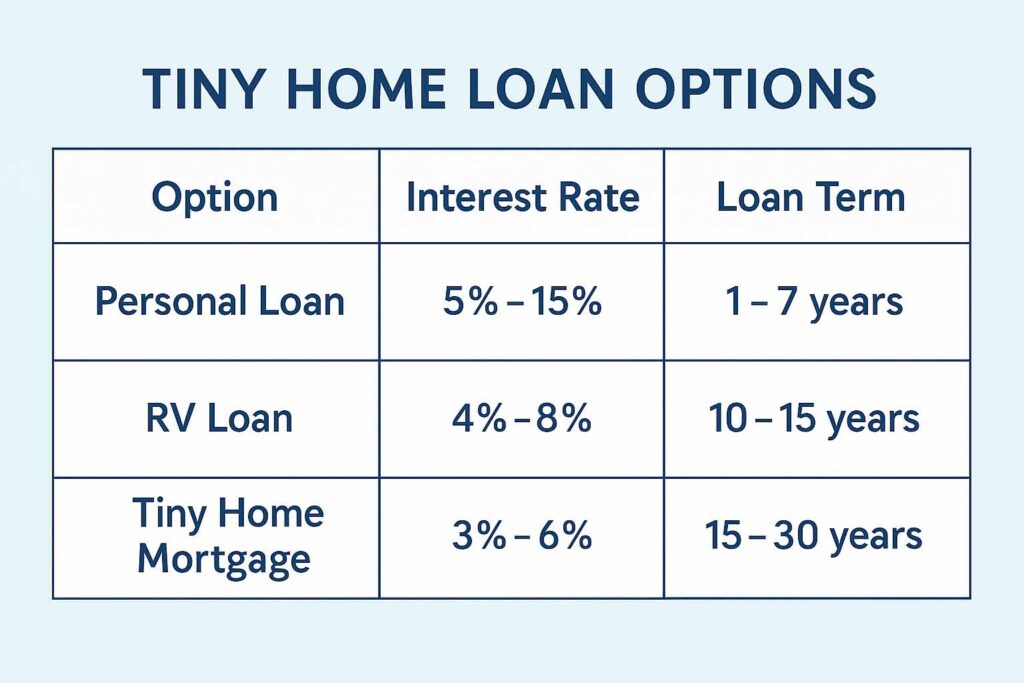

| OPTION | INTEREST RATE | LOAN TERM |

| Personal Loan | 5 – 15% | 1 – 7 years |

| RV Loan | 4 – 8% | 10 – 15 years |

| Tiny Home Mortgage | 3 – 6% | 15 – 30 years |

As you can see, there are a number of financing options depending on how long of long term you are interested in, each with different common interest rates. Check with a local credit union or bank for accurate mortgage rate information.

The smaller the house, the larger the life.” – Unknown

Are You Eligible for a FHA Manufactured Home Loan for your Tiny Home Mortgage?

Many first-time buyers are surprised to learn that government-backed programs such as the FHA manufactured home loan or VA manufactured home loan can apply to tiny or manufactured homes, especially if they meet certain size and foundation requirements. You’ll need to meet credit and loan requirements, and the home often must be permanently affixed to owned land.

If you qualify for a USDA manufactured home loan, you could benefit from zero down payment and low-interest terms, especially in rural areas. These programs are ideal for people who want to keep monthly payments manageable.

Planning Your Down Payment for a Tiny Home Mortgage

Most lenders want a 3 – 20% down payment. Your credit score drives that figure. Therefore, raise your score before you apply, and the lender may lower both the down payment and the mortgage-insurance premium. Use an online calculator to test payment scenarios, including taxes and escrow.

Use a mortgage calculator to estimate your monthly payments based on your interest rate, loan type, and loan estimate. Don’t forget to factor in property taxes, mortgage insurance, and escrow account costs. Check out our article on Mortgage Pre-Approval.

Modular Home vs. Tiny Home: A Quick Comparison

If you’re not 100% set on a tiny home, you might want to compare it to a modular home mortgage or manufactured home financing.

Modular homes are built in sections at a factory and later assembled on-site. They give you more space and, often, a smoother underwriting path. Rates can run a bit lower than tiny-home loans, yet zoning laws for modular builds stay strict. Consequently, verify local codes before you decide.

Interest rates and modular home loan rates are often slightly better than those for tiny homes. That said, modular home lenders still may require stricter building codes and zoning compliance.

The Role of Your Real Estate Agent and Lender

A knowledgeable real estate agent familiar with alternative housing is a must. They can help you find properties zoned for tiny homes and even connect you to manufactured home lenders or best manufactured home lenders who offer competitive rates.

Working with a mortgage broker or mortgage lender who understands tiny homes will make a big difference in navigating approval hurdles. Ask your broker to break down terms between an adjustable-rate mortgage and fixed-rate mortgage so you can decide what works best for your long-term goals.

Final Thoughts: Is a Tiny Home Right for You?

The home buying process for a tiny house may involve a few more hoops than a traditional purchase—but the rewards are worth it. Lower debt-to-income ratio requirements, smaller closing costs, and reduced monthly obligations make it an appealing choice for many modern buyers.

Whether you’re a minimalist, a first-time buyer, or simply ready for a change, a tiny house mortgage could be the start of your next great adventure.

External Links for More Information about Tiny Home Mortgages and Tiny House Mortgages

Tiny home financing and loan options – Rocket Mortgage

Tiny home lender – LightStream by Truist

What to Know About Buying a Tiny House – NerdWallet

Author: Cole Preece

Originally Published: July 13th, 2025

About the Author

Cole Preece is an MBA and MSIS student at the University of Utah graduating in December 2025. Cole is a Utah local who enjoys exploring the mountains, forests, and beaches in the Rocky Mountains and Pacific Northwest.

Get in touch with Cole on LinkedIn at www.LinkedIn.com/in/colepreece