Buying your first home is exciting — but it can also feel overwhelming. Whether you’re wondering how much house you can afford or what your monthly payments will look like, using a home loan mortgage calculator is one of the smartest tools available. This guide will walk first-time buyers through how these calculators work and how they help you understand mortgage rates today, estimate payments, and even prepare for a possible refinance later down the line.

[Image: mortgage-payment-breakdown-graphic.jpg | Alt: Chart showing annual mortgage amortization schedule by year, with principal, interest, and total payments]

Source: https://www.freepik.com/premium-psd/mortgage-calculator-planner-app-ui-kit_20915062.htm

Understanding Your Mortgage Payment Estimate

One of the first steps to responsible homeownership is knowing what your monthly costs will look like. A mortgage payment estimate includes several factors: the total loan amount, the interest rate, the length of the mortgage (often 15 or 30 years), and any property taxes or insurance.

Using a tool like a mtg calc helps first-time homebuyers see the full picture. Many first time home buyer programs recommend calculating your loan-to-value ratio and your debt-to-income ratio to better plan your finances. This ensures you’re not taking on more debt than you can comfortably manage.

Online calculators typically request inputs like:

- Home price

- Down payment

- Credit score

- Current interest rates

- Term length (15-year or 30-year)

As you input values, the calculator will give you a monthly mortgage payment, including principal and interest. Some calculators even break down escrow, taxes, and PMI (private mortgage insurance), offering a more comprehensive view.

Why You Should Compare Mortgage Rates Today

It’s essential to compare mortgage rates today before locking in a loan. Rates can fluctuate daily based on economic conditions, inflation, and lender competition. Many calculators let you plug in different home loan mortgage rates to compare outcomes. This helps you decide whether it’s better to go with a fixed mortgage or explore an adjustable-rate mortgage (ARM).

Sites like LendingTree and Bankrate allow you to compare rates from multiple mortgage lenders at once. Even a 0.5% difference in interest can mean thousands of dollars over the life of a loan. That’s why first time homebuyer mortgage tips often emphasize shopping around.

To find the best deal:

- Use online tools to compare lenders

- Ask about discount points

- Factor in closing costs

- Consider government-backed loans like FHA, VA, or USDA

Being proactive in rate comparison not only saves money but also makes you a more informed borrower. It’s about more than just getting approved — it’s about getting the best possible deal for your situation.

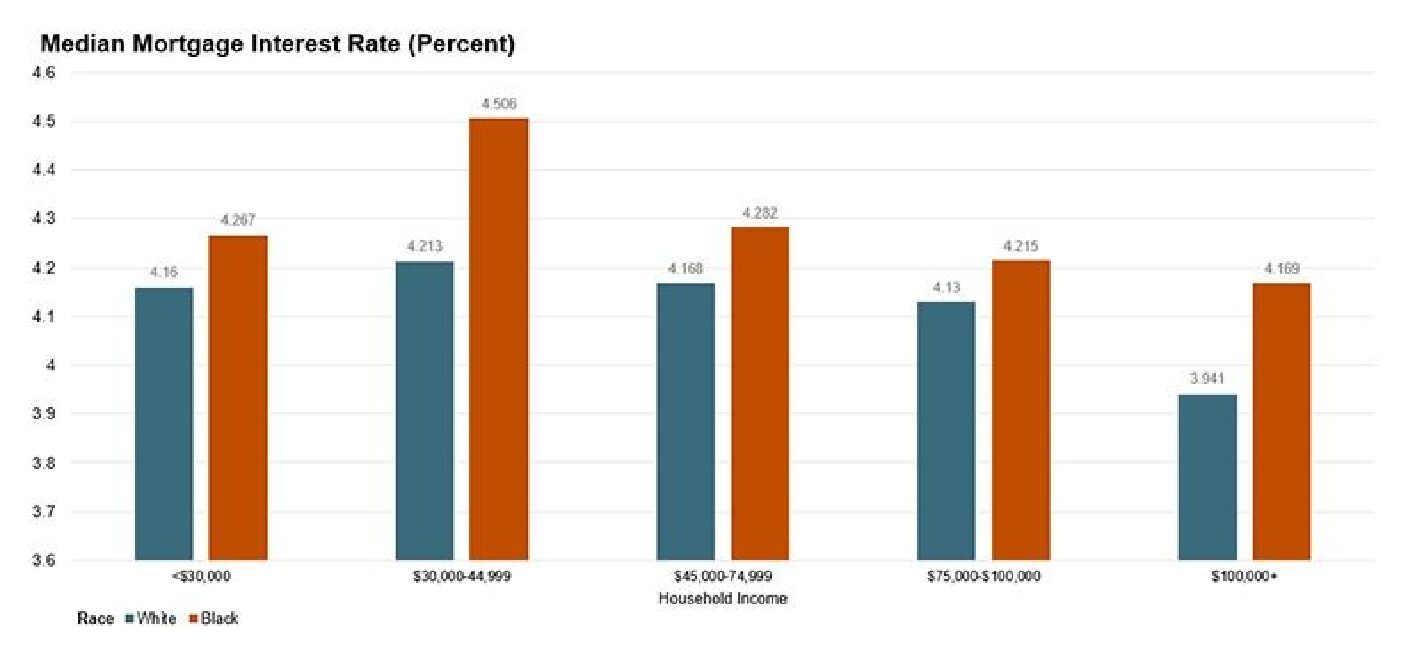

[Image: harvard_jchs_black_homeowner_interest_rates_disparity_hanifa_2021_fig_1_sm.png | Alt: Graph comparing median mortgage interest rates by race and income group]

Source: https://www.jchs.harvard.edu/blog/high-income-black-homeowners-receive-higher-interest-rates-low-income-white-homeowners

Using the Calculator for Refinance and Amortization Schedules

Even after you purchase your home, tools like a home loan mortgage calculator remain useful — especially if you’re planning to refinance. Refinancing allows you to replace your current loan with one that has better terms, like a lower interest rate or a shorter loan term.

When you refinance, a new amortization schedule is created, outlining how much of your monthly payment goes toward principal vs. interest over time. Using a calculator to run a refinance scenario helps you:

- Decide if refinancing makes financial sense

- Estimate new monthly payments

- Calculate long-term savings

For example, switching from a 30-year to a 15-year mortgage will increase monthly payments but significantly reduce total interest paid. You might also use a calculator to compare home equity loan or HELOC options for renovations or debt consolidation.

[Image: home-loan-comparison-15-vs-30.jpg | Alt: Bar chart comparing interest paid on 15-year and 30-year mortgage terms]

Source: https://www.ramseysolutions.com/real-estate/why-daves-against-30-year-mortgages

First-Time Homebuyer Tips: Maximizing Calculator Use

If you’re a first-time homebuyer, the key to using a home loan mortgage calculator effectively is consistency. Run multiple scenarios: adjust the down payment, raise or lower your credit score, and play with different loan terms. Doing this will give you a strong sense of your financial flexibility.

Don’t forget to check your state’s first-time home buyer grants, changing loan limits, and average home prices in your area. This contextual knowledge, paired with smart calculator use, will help you move forward with confidence.

It’s also wise to keep a close eye on your debt-to-income ratio, especially if you’re planning on taking out other loans like car payments or student loans. The lower this ratio, the better your terms will be.

Empowering Yourself with the Right Tools

For anyone navigating the homebuying journey, especially first-timers, tools like a home loan mortgage calculator are essential. Not only do they help you predict monthly payments and compare loan options, but they also prepare you for long-term decisions like refinancing.

Whether you’re figuring out how much house you can afford or weighing different home loan options, being informed and using the right tools gives you a huge advantage. With interest rates always fluctuating and housing markets shifting, staying proactive is your best bet.

Remember: the better your credit score, the better your terms — so work on maintaining strong financial habits even after your loan closes.

By putting in the research now and using calculators smartly, you’ll not only make your home purchase smoother but also set yourself up for long-term financial success.