Buying your first home is a major milestone — and it comes with a lot of questions. What’s a

mortgage preapproval? How do you apply for a mortgage? Which types of home loans are

right for you in Utah?

If you’re a first-time homebuyer Utah, this guide will walk you through the entire mortgage

application process step by step, using real advice, practical tips, and helpful comparisons.

From choosing a mortgage lender to learning the pros and cons of an FHA loan Utah vs.

conventional options, we’ve got you covered.

Understanding the Basics of Home Loans

A home loan is a loan you take out to purchase a home, and it typically lasts for 15 to 30 years.

There are different types of first-time home buyer loans designed to help people purchase their

first homes without needing a massive upfront payment.

Common loan types:

• FHA loan Utah: Backed by the government, ideal for those with lower credit scores.

Offers a low down payment mortgage (as low as 3.5%).

• VA home loans: Available to veterans and active-duty service members. Typically

require no down payment or private mortgage insurance.

• USDA loans: Designed for rural homebuyers. They often include zero down payment

options.

Prequalify vs. Preapproval: What’s the Difference?

Before shopping for homes, you’ll want to either prequalify for mortgage or obtain a mortgage

pre-approval.

• Prequalify for mortgage: An informal estimate based on financial self-reporting. Helps

you understand how much home you can afford.

• Mortgage preapproval or mortgage pre approval: A more detailed process involving

income verification, a credit check, and a conditional commitment from a lender. You’ll

receive a letter that makes your offer more credible to sellers.

How to Get Approved for a Mortgage

To get approved for a mortgage, your lender will review:

- Credit score

- Income and employment history

- Debt-to-income ratio

- Cash savings for down payment and closing costs

- Supporting documentation (W-2s, bank statements, tax returns)

Understanding the mortgage process step by step gives you confidence and avoids surprises.

Work closely with your mortgage lender to ensure every form is filled out correctly and

submitted on time

Comparing Utah Mortgage Rates

Utah mortgage rates fluctuate daily. It’s important to monitor current mortgage rates and

compare them to national averages.

You may see differences in:

• Mortgage interest rates for first-time buyers

• Loan terms (15-year vs. 30-year)

• Fixed vs. variable rates

Using an online tool to compare mortgage rates across lenders can save you thousands of

dollars over the life of your loan.

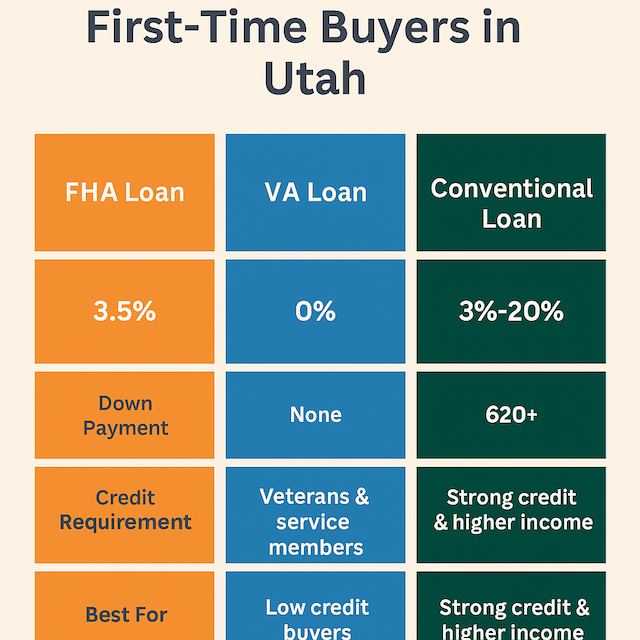

Conventional vs. FHA Mortgage

The conventional vs FHA mortgage debate is common for first-time buyers.

Loan Type Minimum Down Payment Credit Requirement Ideal For

FHA Loan 3.5% 580+ Lower credit, smaller savings

Conventional 3-20% 620+ Better credit, stable income

FHA loans offer more flexibility. Conventional loans may result in lower monthly payments if

you qualify.

Finding the Right Mortgage Lender in Utah

Your lender is your guide throughout the process. Look for best mortgage companies and best

mortgage lenders in Utah who:

- Explain your options clearly

- Offer low fees and transparent terms

- Are responsive and experienced

Ask whether they offer Utah home loan programs, including grants or down payment

assistance designed for first-time homebuyer Utah applicants.

Tips for First-Time Buyers

Here are essential mortgage tips for new buyers: - Don’t make large purchases before closing

- Maintain steady employment and income

- Use tools to understand how much mortgage can I afford

- Work with professionals who explain things in simple terms

Applying for a mortgage can be stressful, but having a good support team makes it easier.

Conclusion

As a first-time homebuyer Utah, you have access to a range of home loans and supportive

programs. Whether you’re exploring first-time home buyer loans, comparing Utah mortgage

rates, or trying to get approved for a mortgage, being informed is your greatest asset.