Today’s Mortgage Rates Guide

Navigating the world of home loans can feel overwhelming. Whether you are buying your

first home or refinancing, understanding today’s mortgage rates and the different loan

options available is essential. In this guide, we’ll help you compare current mortgage

interest rates, explore loan types like FHA loans, VA home loans, and first-time

homebuyer loans, and use calculators to find the right mortgage for you.

Compare Current Mortgage Interest Rates

Today’s mortgage rates change daily based on market conditions, your credit score, and the

type of loan you choose. Use our Mortgage Rate Comparison Tool to see current

mortgage rates & options from the best mortgage lenders in Utah. This will help you

decide whether a home equity loan vs. mortgage refinance makes the most sense for your

goals.

If you prefer a broader overview of national trends, check out Bankrate’s mortgage rates

today for external reference.

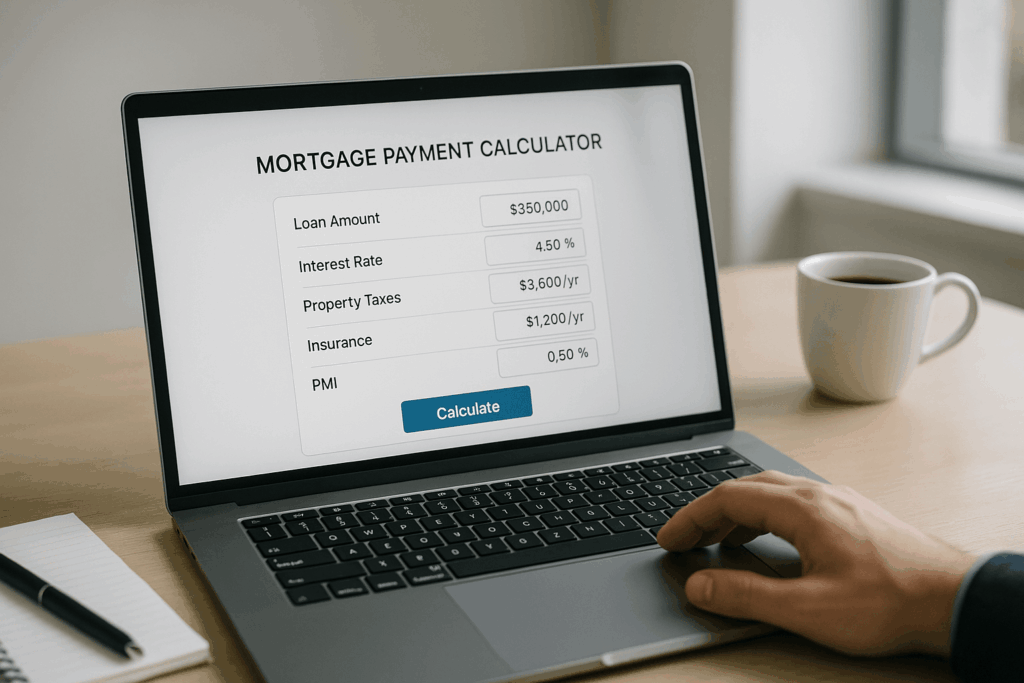

Estimate Your Monthly Payment

Using a mortgage payment calculator with taxes and insurance helps you understand the

true cost of your home. Try our Monthly Mortgage Payment Calculator to include property

taxes, homeowners’ insurance, and PMI. For even more accuracy, start with a house

payment estimate to see how different down payments and interest rates affect your budget.

Before you finalize your budget, don’t forget to review if you qualify for the mortgage

interest deduction to lower your tax bill.

Mortgage-payment calculator displayed on a laptop beside a coffee mug and notepad.

Created by ChatGPT using OpenAI’s DALL·E image model (29 June 2025).

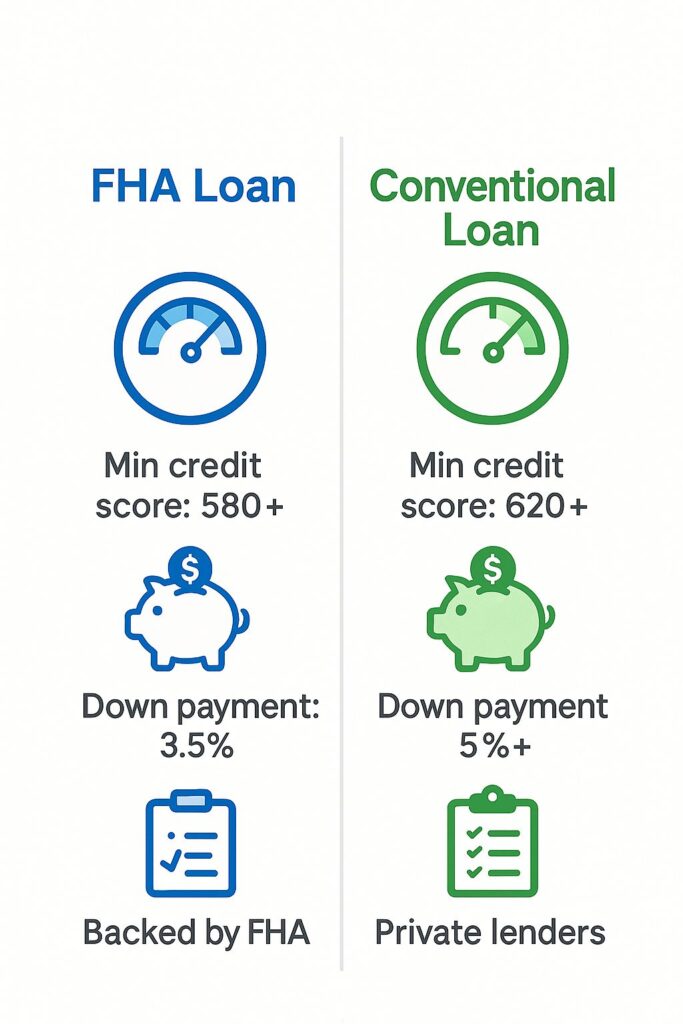

Popular Loan Options

FHA loans are ideal for buyers with lower credit scores and smaller down payments. VA

home loans offer excellent benefits to veterans and active service members, such as no down

payment and competitive interest rates. If you are considering other options, first-time

homebuyer loans often provide special incentives to make homeownership more accessible.

To learn more about FHA loan requirements, visit the official HUD website. If you’re

thinking about tapping into your home equity, compare home equity loan vs. mortgage

options carefully.

How Much House Can You Afford?

Before you get pre-approved, use a how much house can I afford calculator to find your

comfortable price range. This tool works together with a house payment estimate to show

how monthly mortgage payment calculator figures align with your income and expenses.

Knowing this in advance will streamline the mortgage pre-approval process and help you

understand your mortgage loan eligibility.

Mortgage-planning couple. Created by ChatGPT using OpenAI’s DALL·E image model

(June 29 2025).

Prepare for the Mortgage Application Process

The mortgage application process requires documentation of your income, assets, and

credit history. Be prepared to cover mortgage closing costs, which typically range from 2–

5% of the home price.

If you’re wondering how to apply for a mortgage, our step-by-step guide will walk you

through each requirement, including tips to improve your credit and boost your mortgage

loan eligibility.

Already own your home. Compare refinance rates today to see if you can lower your

payment or shorten your term. Use our Refinance Calculator to explore your options.

For seniors considering accessing home equity, reverse mortgage lenders may provide

specialized products to convert equity into cash.

Additional Resources

● FHA Loan vs. Conventional Loan Comparison

● Mortgage Interest Deduction Guide

● VA Home Loan Benefits Overview

How to Apply for a Mortgage and Understand Your Eligibility

If you are wondering how to apply for a mortgage, start by gathering your financial

documents, including recent pay stubs, tax returns, and bank statements. This information

will help your lender verify your income and assets. It’s also important to review your credit

report in advance, since your credit score plays a major role in determining your mortgage

loan eligibility.

Most borrowers will begin with a mortgage pre-approval process, which provides a clear

idea of how much you can borrow and the interest rate you are likely to receive. After pre-

approval, you can confidently make offers on properties within your budget. Throughout the

mortgage application process, your lender will guide you step by step to be sure you

understand every requirement and potential mortgage closing costs.

Considering Reverse Mortgage Lenders

For homeowners aged 62 and older, reverse mortgage lenders can help convert part of your

home equity into cash without selling your property. A reverse mortgage can be a useful

tool for supplementing retirement income or covering unexpected expenses. However, it’s

essential to compare offers carefully and consult with a financial advisor to be sure this

option aligns with your long-term goals. Always research reputable reverse mortgage

lenders and read all disclosures before signing any agreements to avoid surprises with

current mortgage rates & options.

Choosing the right mortgage doesn’t have to be complicated. With the right tools and

guidance, you can confidently compare today’s mortgage rates, estimate your house

payment estimate, and find the loan that fits your needs. Ready to get started? Contact

our team to begin your mortgage journey today.