Homeownership is possible—even on a limited income. You don’t need a perfect credit score or massive savings to buy a home in Utah. Whether you’re applying for your first loan or looking to refinance, this guide will walk you through how to qualify for a mortgage with low income, explore government loan programs, and compare key options like fixed vs adjustable-rate mortgages.

Best Mortgage Rates for First-Time Home Buyers

If you’re buying your first home, you may qualify for some of the best mortgage rates for first time home buyers through FHA, VA, or USDA programs. These government-backed loans often offer:

- Lower down payments

- Reduced credit score requirements

- Flexible income limits

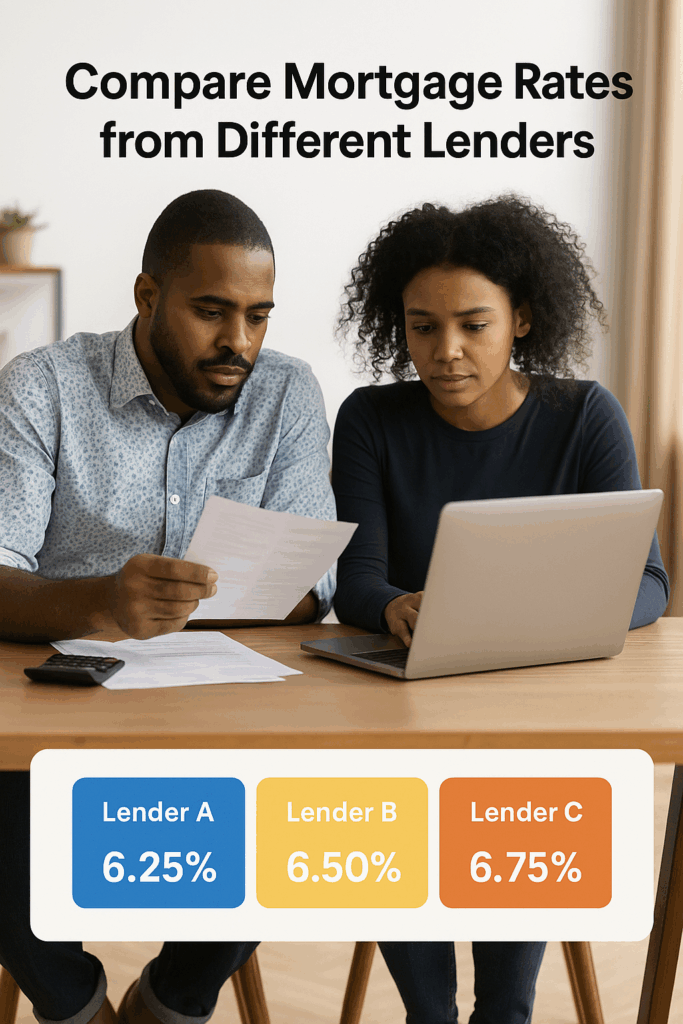

To get the best deal, always compare mortgage rates from different lenders. Shopping around can save you thousands in interest over time.

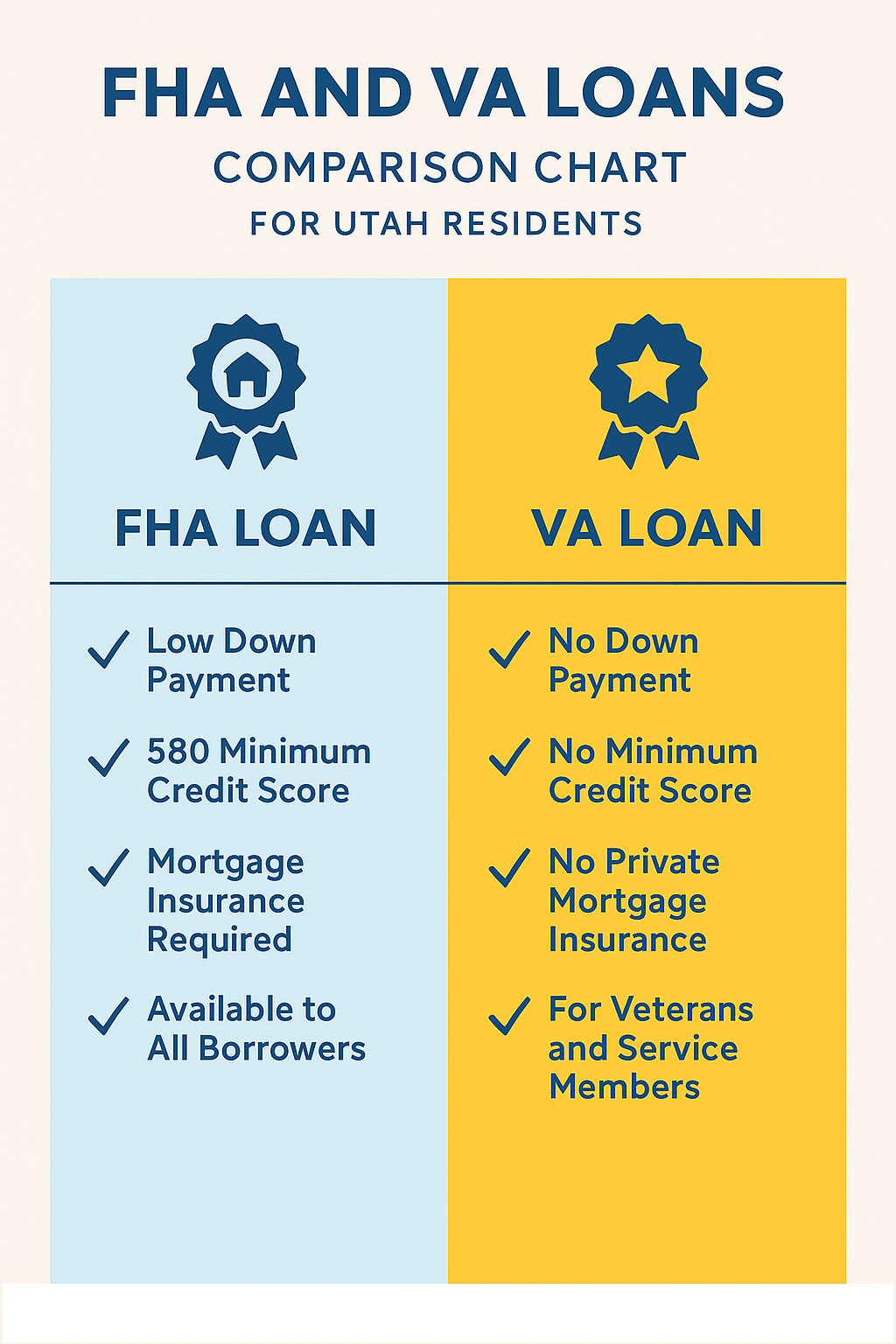

FHA and VA Loan Requirements in Utah

If you’re low on savings or have a lower credit score, FHA loan requirements in Utah may make homeownership accessible:

- 3.5% minimum down payment

- Credit scores starting at 580

- Backed by the Federal Housing Administration

FHA loans are designed specifically for first-time and low-income buyers, making them one of the most popular options in Utah.

Current VA Mortgage Rates in Utah

If you’re a veteran, active-duty military member, or eligible spouse, current VA mortgage rates in Utah could be your lowest-cost path to homeownership. VA loans offer:

- 0% down payment

- No private mortgage insurance

- Competitive interest rates

To get started, learn how to apply for a VA home loan step by step, including obtaining your Certificate of Eligibility (COE) and finding a VA-approved lender.

with a lower income or limited savings.

How to Refinance Your Mortgage With Bad Credit

Yes, it’s possible to refinance with bad credit. Programs like the FHA Streamline Refinance allow current homeowners to lower interest rates without needing a new appraisal or full credit check.

Other strategies include:

- Working with a mortgage broker in Salt Lake City Utah who understands local lending options

- Improving your debt-to-income ratio (DTI)

- Making on-time payments for 6–12 months before applying

Fixed vs Adjustable-Rate Mortgage: Pros and Cons

When choosing a mortgage, it’s important to weigh the fixed vs adjustable rate mortgage pros and cons:

| Mortgage Type | Pros | Cons |

|---|---|---|

| Fixed-Rate | Consistent monthly payments, stability | May have a higher initial rate |

| Adjustable-Rate (ARM) | Lower starting rates, short-term savings | Rate can rise over time, increasing payment risk |

If your income is tight or unpredictable, fixed-rate loans usually offer safer long-term budgeting.

Mortgage Pre-Approval vs Pre-Qualification

Before shopping for a home, get pre-approved—not just pre-qualified. Pre-approval shows sellers and lenders that you’re serious and gives you a more accurate budget range.

| Pre-Qualification | Pre-Approval |

|---|---|

| Soft check, quick estimate | Hard credit pull, verified documentation |

| Not binding | Increases purchase credibility |

Utah Mortgage Lender Reviews

Reading reviews of Utah mortgage lenders helps you find the best match. Look for:

- Specialization in FHA or VA loans

- Experience with first-time buyers

- Responsive customer service

Some local credit unions and community banks offer more flexible terms for low-income applicants than large national lenders.

Work With a Mortgage Broker in Salt Lake City Utah

A local mortgage broker in Salt Lake City Utah can help you:

- Understand your best loan options

- Apply for low-income or special program loans

- Navigate local banks and credit unions

Brokers often have access to exclusive rates and understand Utah’s unique housing landscape better than large national lenders.

HELOC vs Home Equity Loan Comparison

If you already own a home and want to access its equity:

- A HELOC (Home Equity Line of Credit) works like a credit card. You borrow as needed.

- A Home Equity Loan gives you a lump sum with a fixed rate.

Both can help with renovations or debt consolidation—even with moderate credit.

Best Bank for Home Equity Loans in Utah

When comparing Utah banks, look at:

- Interest rates

- Fee transparency

- Customer reviews

- Flexibility on credit requirements

Credit unions often provide more competitive terms to Utah residents.

How Mortgage Interest Rates Are Determined

Mortgage rates are influenced by:

- Federal Reserve interest rate policies

- Economic trends

- Your credit profile and DTI ratio

- Loan type (FHA, VA, fixed, ARM)

Stay informed and try to lock your rate when market trends are favorable.

Best Online Mortgage Calculators for First-Time Buyers

Use these tools to estimate:

- Monthly payments

- Interest costs over the life of your loan

- Affordability based on income

A few great free tools include:

- NerdWallet Mortgage Calculator

- Bankrate’s Affordability Estimator

- Utah Housing Corporation calculators

Final Thoughts

Homeownership is within reach—even on a limited income. With the right preparation, smart comparisons, and loan program choices, you can qualify for a mortgage in Utah and start building equity and stability for your future.

Have questions or need help getting started? Contact a local mortgage advisor today.