Home Loans for First Time Buyers: What Are Your Options?

First-time homebuyers often wonder what types of home loans for first time buyers are available. Options include FHA loans, VA loans, and USDA loans, each offering benefits like low or no down payment and flexible credit requirements. If you’re looking for a mortgage for first-time home buyers with lenient credit requirements, FHA loans for first time buyers are a popular choice. In fact, many first time home buyer programs in Utah work in tandem with FHA guidelines to make homeownership more accessible.

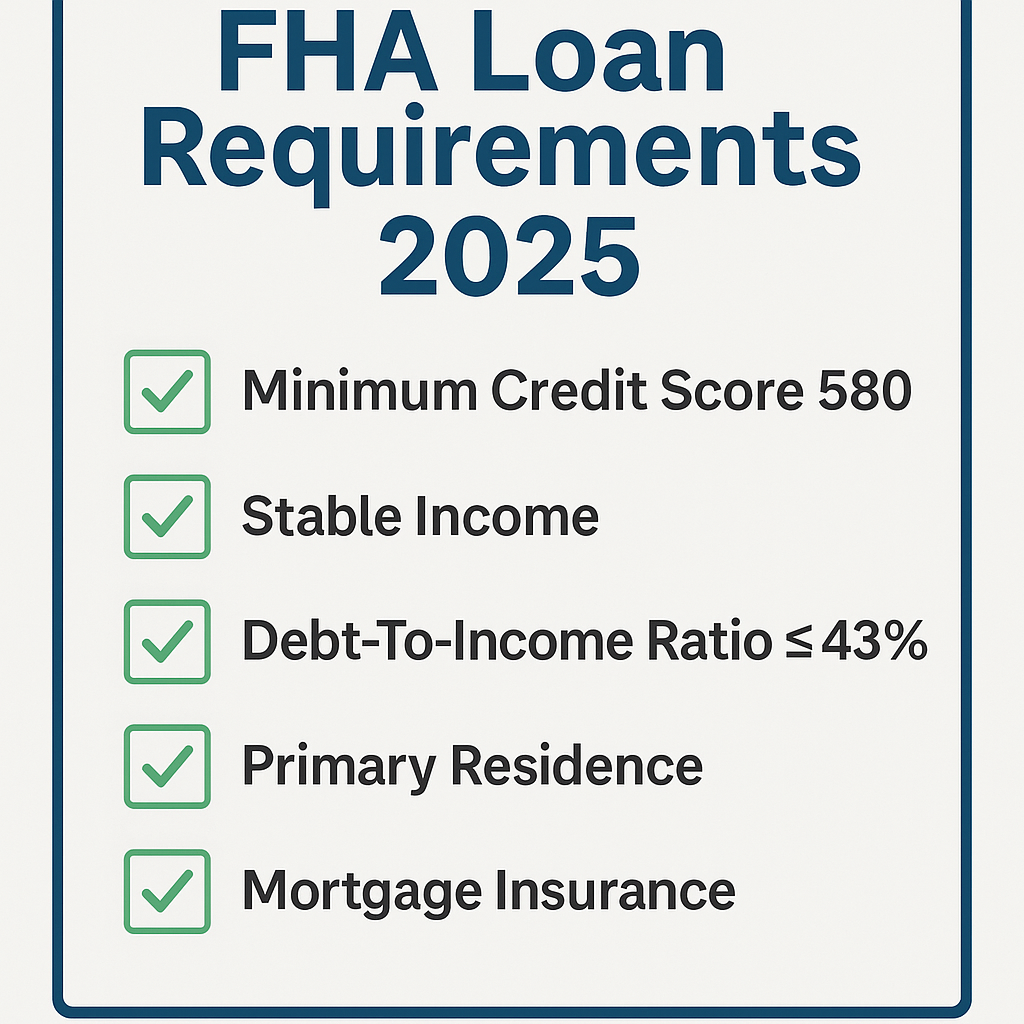

Understanding FHA Loan Requirements in 2025

The FHA loan requirements 2025 include a minimum credit score of 580 for a 3.5% down payment and a stable income history. These loans are government-backed, which makes them less risky for lenders and more accessible for buyers. To get an accurate picture of costs, you can request an FHA mortgage quote from lenders or use online tools. Many first time buyer mortgage quote tools also provide a breakdown of estimated monthly payments and interest rates.

Best Mortgage Lenders for First Time Buyers with No Down Payment

Some lenders specialize in home loans with no down payment. These include best mortgage lenders for first time buyers no-down payment options, which may combine down payment assistance programs with competitive rates. When shopping around, consider the best mortgage lenders for new buyers and compare terms, customer reviews, and loan options. You can also find a local lender near me to work with someone familiar with Utah’s housing market.

Mortgage Rates in Utah Today

If you’re wondering about home rates Utah or home rates today FHA, keep in mind that these can fluctuate based on your credit score, loan type, and market conditions. To make sure you’re getting the best deal, research how to get the lowest mortgage rate and compare offers from multiple providers. Utah homebuyers often benefit from region-specific deals and seasonal rate drops.

Step-by-Step Mortgage Loan Process

Understanding the mortgage loan process step by step can eliminate stress and help you prepare the right documents. Here’s a simplified overview: 1. Get pre-approved – This gives you a clearer budget and strengthens your offer. 2. Submit documentation – Lenders will ask for income, credit history, and ID verification. 3. Appraisal and inspection – These ensure the home is worth the loan amount. 4. Final underwriting – The lender reviews all information before approval. 5. Closing – You sign the final paperwork and officially become a homeowner. Knowing the documents needed to apply for mortgage can help you get through these steps quickly.

Pre-Approval vs Pre-Qualification: What’s the Difference?

Many people confuse pre approval vs pre qualification mortgage. Pre-qualification is an estimate based on unverified information, while pre-approval involves a full credit check and verified documents. Most sellers prefer buyers who are pre-approved because it shows a serious commitment. Learning how to get pre approved for a first home can give you a competitive edge when making an offer.

Assistance Programs and Closing Costs

Utah offers several down payment assistance programs that can significantly reduce upfront costs. These programs are especially useful for first-time buyers who may not have large savings but meet certain income requirements. In addition to down payments, there are closing costs for home loans— typically 2% to 5% of the home’s purchase price. Some assistance programs also help cover these costs, making homeownership more affordable.

How Long Does Mortgage Approval Take?

If you’re wondering how long does mortgage approval take, the average timeline is 30 to 45 days. However, delays can occur if you’re missing documents or the lender needs more information. Getting pre-approved and being organized with paperwork can speed up the process.

Common Mistakes First Time Home Buyers Make

One of the most common mistakes first time home buyers make is not budgeting for all expenses beyond the down payment. These include moving costs, property taxes, HOA fees, and maintenance. Another frequent error is applying for new credit or making large purchases during the approval process, which can jeopardize your loan. Partnering with the best banks for home mortgage ensures you get guidance through each step.

Refinancing Later: When It Makes Sense

Once you’ve been in your home for a few years, you may consider refinancing. Today’s refinance rates 30-year fixed remain competitive, especially for those who originally purchased when rates were higher. Refinancing can help you lower your monthly payment, pay off your loan faster, or cash out equity—but be sure to compare costs and consult a professional.