Utah mortgage rates 2025 are shifting due to inflation, interest rate policies, and evolving economic trends in the state. Whether you’re a first-time homebuyer or refinancing an existing loan, understanding the current mortgage landscape in Utah is essential. In this guide, we’ll explore the latest rate updates, compare top lenders, and share expert tips to help you secure the best deal possible.

Utah mortgage rates 2025

Understanding Mortgage Rates Utah in 2025

Utah mortgage rates 2025 are shifting as the housing market responds to inflation, policy changes, and local economic trends. Whether you’re a first-time buyer or looking to refinance, understanding how rates are trending in Utah can help you make smarter financial decisions. In this guide, we’ll break down the latest rate updates, tools to compare lenders, and tips to secure the best home loan for your needs.

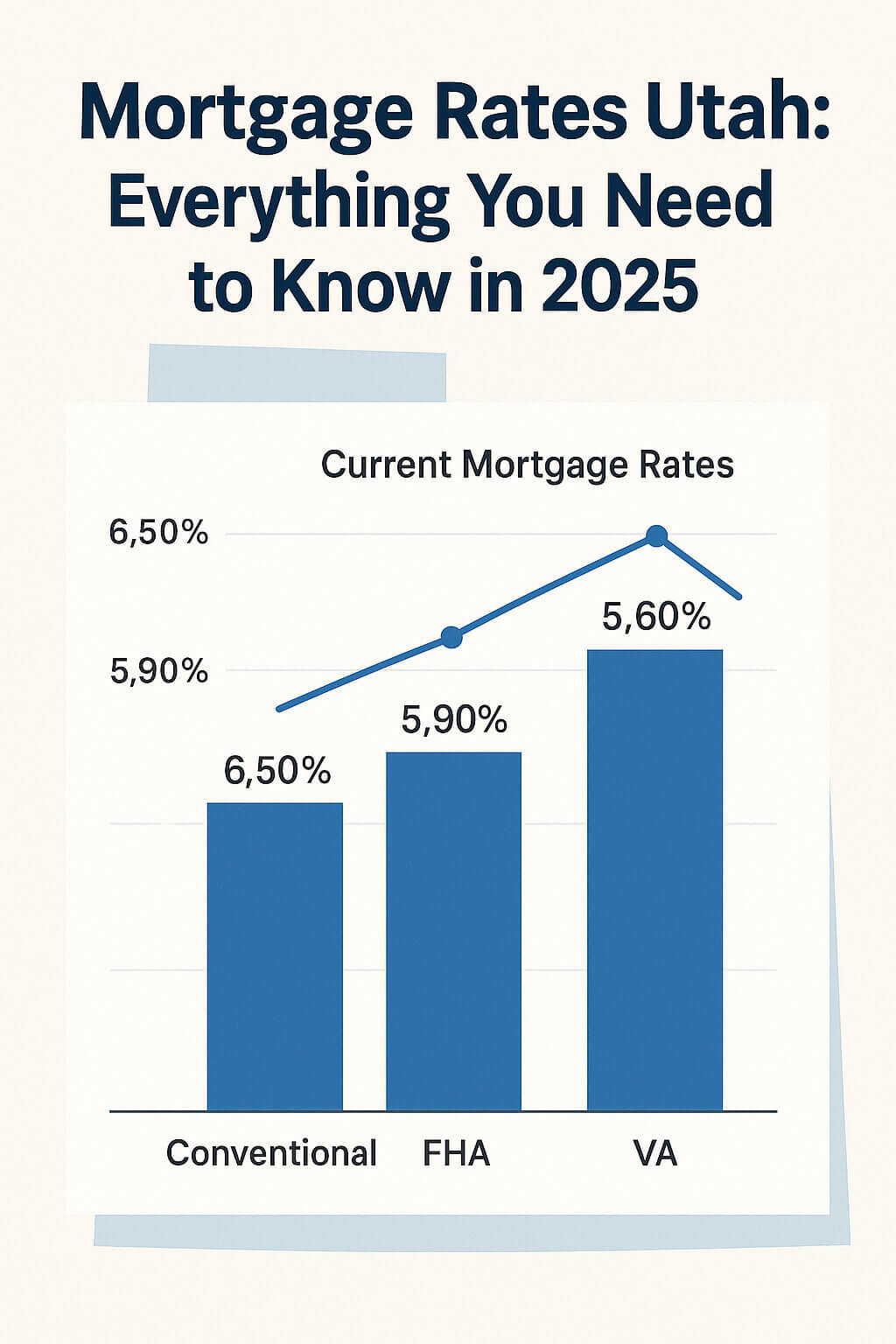

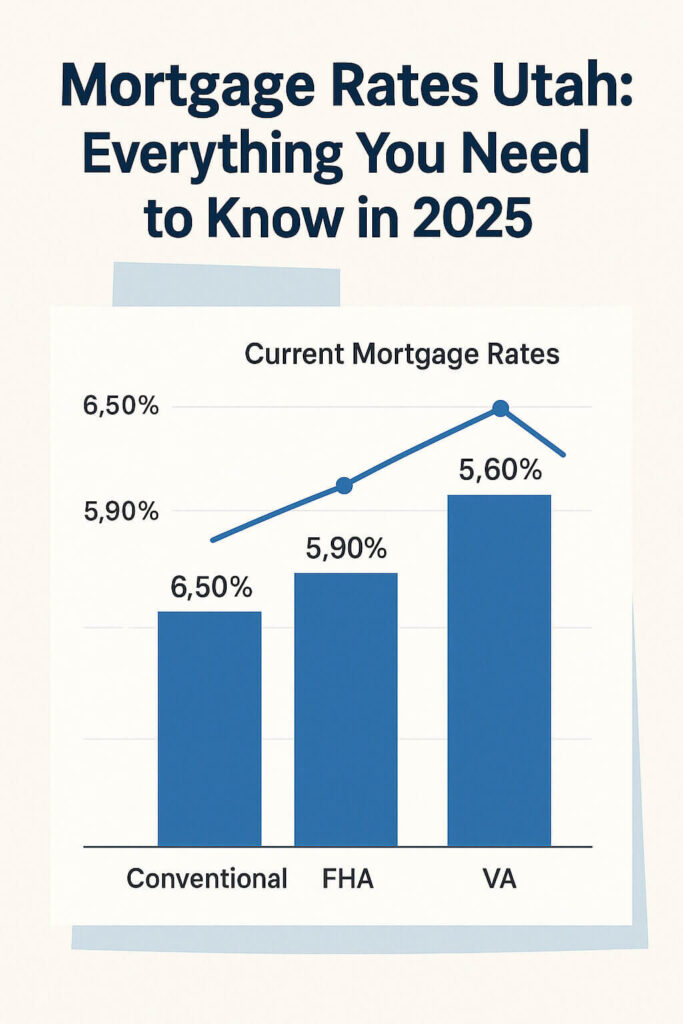

borrowers are seeing depend on factors like loan type, credit score, down payment, and even location.Navigating the landscape of mortgage rates Utah can feel overwhelming, especially as we head into 2025. Whether you’re buying your first home, refinancing, or comparing lender offers, having accurate information is essential. Current mortgage rates Utah

Daily Tracking: Why Mortgage Rates Today Matter

Mortgage interest rates change quickly. Federal Reserve updates, market conditions, and inflation reports all influence rate fluctuations. By monitoring Utah mortgage rates 2025, homebuyers and investors can time their decisions more effectively and potentially save thousands in interest over the life of the loan.

Find the Has to OfferBest Mortgage Rates Utah

To lock in the lenders provide, you need to:best mortgage rates Utah

– Compare multiple lenders

– Use a reliable mortgage estimator Utah

– Review loan options like FHA, VA, and conventional loans

Salt Lake City home loan rates may vary based on lender policies or local promotions.If you’re located in Salt Lake, consider checking mortgage rates Salt Lake City for region-specific offers.

Factors Impacting Utah Mortgage Rates 2025

Several variables affect the mortgage rates you’re offered in Utah:

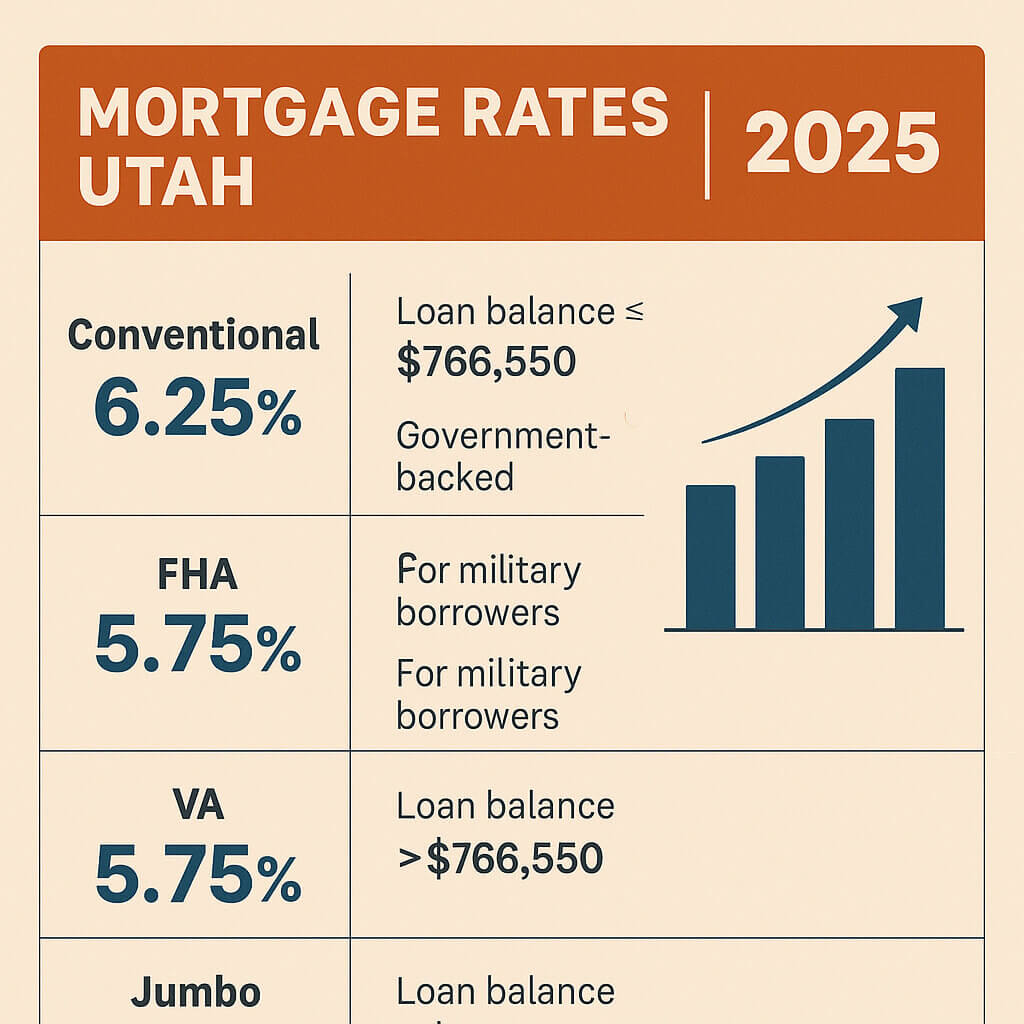

- Loan type (FHA, VA, conventional)

- Credit score

- Down payment amount

- Property location

Because of these factors, Utah mortgage rates 2025 vary across borrowers and lenders. It’s important to evaluate offers tailored to your financial profile.

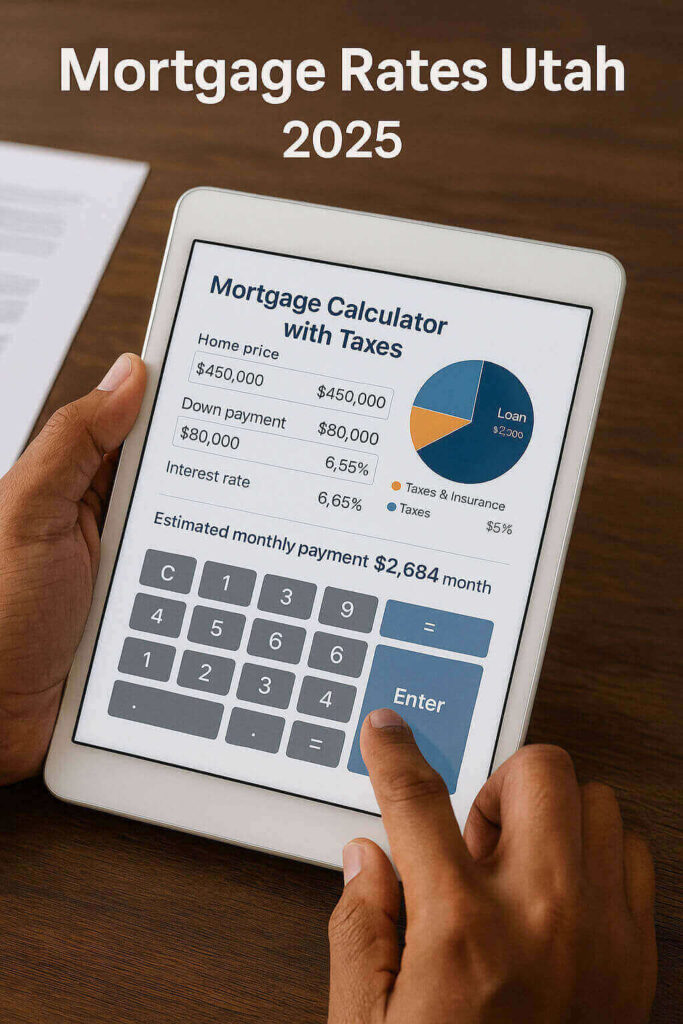

Using the Right Tools: Estimators & Calculators

mortgage calculator mortgage rates or a Smart homebuyers use a mortgage estimator with taxes to calculate their full monthly cost, including property tax and insurance. Tools like a home loan mortgage rates calculator offer deeper insights. The best platforms also provide a Utah mortgage calculator with real-time rate comparisons.

Compare Utah Mortgage Lenders

compare Utah mortgage rates side-by-side using objective tools before locking in a rate.There are several Utah mortgage lenders offering competitive packages. When shopping, don’t just look at advertised rates—check APRs, fees, and closing costs. It’s also smart to

Loan Types: FHA, VA & More

Different loans come with different rates. For example:

Utah home loan rates will depend on your financial profile and loan structure.- Utah FHA loan rates are popular for first-time buyers due to their low down payment options.

– Utah VA loan rates offer incredible value to veterans and active military members, often with no down payment.

– Standard

Comparing Utah Mortgage Rates 2025 Offers

Don’t rely on a single lender’s offer. To find the best Utah mortgage rates 2025, compare:

- Interest rate vs APR

- Loan term (15 vs 30 years)

- Lender fees and closing costs

Use a mortgage rate comparison tool or a Utah-specific loan estimator to make informed comparisons.

First Time Home Buyer Utah: Tailored Programs

If you’re a first time home buyer Utah offers several grant and assistance programs that help reduce upfront costs and secure better terms. Many lenders also offer special Utah housing loan rates for qualifying buyers.

How to Secure the Lowest Mortgage Rates in Utah

Securing the lowest mortgage rates in Utah comes down to preparation:

– Improve your credit score

– Choose a shorter loan term

– Provide a larger down payment

– Shop during low-rate cycles

Using these tactics can help you lower your Utah interest rates home loan and save thousands over the life of your mortgage.

Mortgage Estimator Refinance | Calculate Your Savings with Today’s Rates

Use our Utah mortgage calculator to estimate your payments instantly.

Tools and resources for homebuyers

Learn more from the Consumer Financial Protection Bureau about comparing mortgage offers.