So, you’ve decided it’s time to stop renting and start building equity. Maybe you’re dreaming of your own space—or just tired of paying your landlord’s mortgage. Either way, if you’re wondering how to qualify for a mortgage loan with a not-so-perfect credit score, limited savings, or a non-traditional job, this guide is for you.

We’ll break it all down using real-world terms, tools like a mortgage qualification calculator, and explain what lenders actually look for.

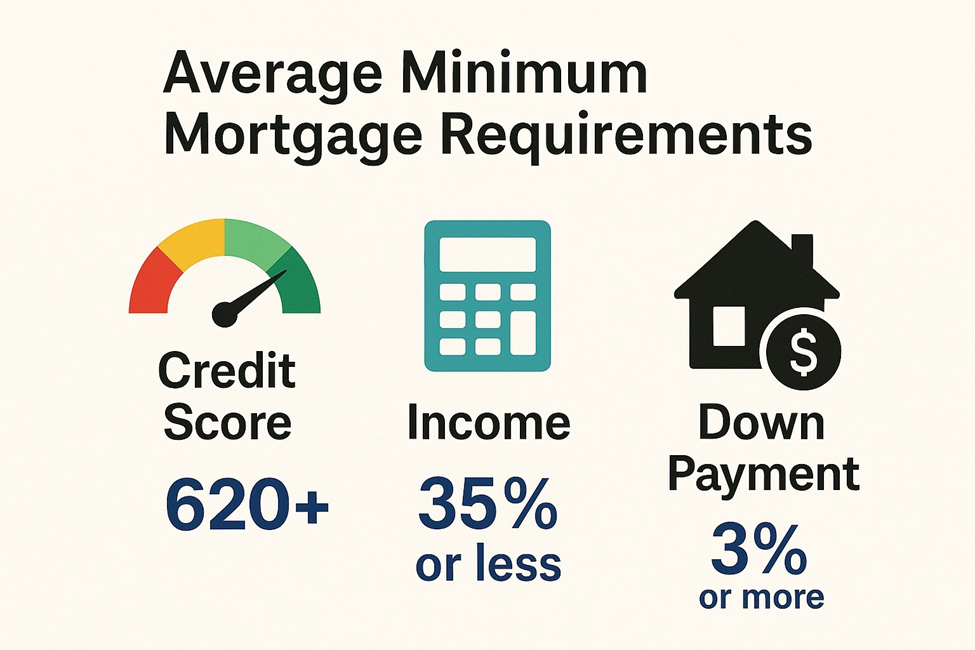

What Credit Score Is Needed to Buy a Home?

Let’s start with the basics: what credit score is needed to buy a home?

In 2025, most conventional lenders want a score of 620 or higher. But don’t panic if yours is lower. FHA loan requirements allow scores as low as 500, depending on your down payment. And if you qualify for VA home loan benefits, you may get approved with a score in the mid-500s or even without one entirely.

Looking to take advantage of programs like first time home buyer loans or USDA home loan qualifications? These tend to be more flexible, especially if you’re considered low- to moderate-income.

Use a Mortgage Qualification Calculator to Know Where You Stand

Before you go to an open house or call a realtor, use a mortgage qualification calculator. This handy tool helps estimate how much house you can afford based on your income, credit score, interest rates, and debts.

If you’re considering buying an investment property or vacation home, try a second home mortgage qualification calculator for more tailored numbers.

How Much Mortgage Can I Qualify For?

This is a million-dollar question (well, hopefully not literally). How do lenders figure it out?

One major factor is your DTI ratio for mortgage approval. That’s your Debt-to-Income ratio. It’s calculated by dividing your total monthly debt by your gross monthly income. Most lenders like to see this under 43%, though some will go higher with strong compensating factors.

Lower your DTI by paying down credit cards or holding off on financing that new car. It can open doors to better rates and higher approval amounts.

Get Prequalified (Then Preapproved)

Here’s where things get official. A mortgage prequalification gives you a rough idea of your eligibility—think of it as a soft yes. A pre approval calculator mortgage offers a more detailed estimate, and if you follow through, a lender can provide full preapproval, which makes your offer stronger when buying.

Also try a mortgage prequalification calculator if your lender offers one—it makes the process faster and more precise.

Down Payment Assistance & 0 Down Mortgage Programs

Worried about the down payment? You’re not alone.

Plenty of buyers qualify for down payment assistance programs near me, including grants, forgivable loans, and matched savings programs. Combine this with 0 down mortgage programs like USDA or VA loans, and homeownership may be closer than you think.

These options are especially helpful if you’re searching for low income mortgage lenders that focus on helping buyers with limited savings.

Best Mortgage Lenders for First-Time Buyers Near Me

Now that you’re preapproved, it’s time to pick a lender. Don’t just go with the first offer—shop around.

Search for the best mortgage lenders for first time buyers near me and compare rates, closing costs, and customer reviews. Some lenders specialize in first-time buyers, offering flexible underwriting, educational support, or waived fees.

How to Get a Mortgage With No Credit

Yes, it’s possible. If you have no credit score—meaning you’ve never had a credit card, loan, or bill in your name—you’re considered “credit invisible.” But that doesn’t mean you’re unqualified.

Lenders who offer how to get a mortgage with no credit solutions often use alternative credit data like rental history, utility bills, or even streaming service payments. Some first time home buyer loans through local credit unions also work with applicants building credit from scratch.

Credit Score to Buy a House First Time vs. 2025 Standards

Is your score good enough? If you’re a new buyer, lenders often look for a credit score to buy a house first time of at least 580 with 3.5% down (FHA), or 620 for a conventional mortgage.

Aiming higher? Great—many buyers shoot for a credit score to buy a house 2025 in the 700+ range to lock in the best rates.

Final Thoughts

You don’t need a perfect financial profile to get a mortgage. You need a strategy. By understanding how to qualify for a mortgage loan, exploring your options, and using the right tools (like a mortgage qualification calculator), you’ll set yourself up for success.

You’ve got this—and if you ever feel overwhelmed, remember: every homeowner started somewhere.