If you’re planning to buy a home in Utah, getting pre-approved for a mortgage in Utah is the key to securing your dream home. This guide covers FHA loan qualifications, ensuring you’re ready for Utah’s competitive market.

Why Mortgage Pre-Approval Matters in Utah?

Utah’s housing market (especially in Salt Lake City and Provo) is highly competitive. A pre-approval letter proves you’re a serious buyer and helps you:

- Stand out in bidding wars

- Lock in mortgage rates by credit score before they rise.

- Calculate affordability with tools like a 300k mortgage payment calculator or mortgage affordability calculator income.

Step 1: Understand Pre-Qualification vs. Pre-Approval

Mortgage Pre-Qualification

- Soft credit check (no impact on score).

- Example: “estimate prequalification mortgage”.

Mortgage Pre-Approval

- Hard credit pull + verified documents.

- Example: “being pre approved for a home loan”.

💡 *Tip: Need a precise estimate? Use a 30-year fixed mortgage calculator or recast calculator mortgage.*

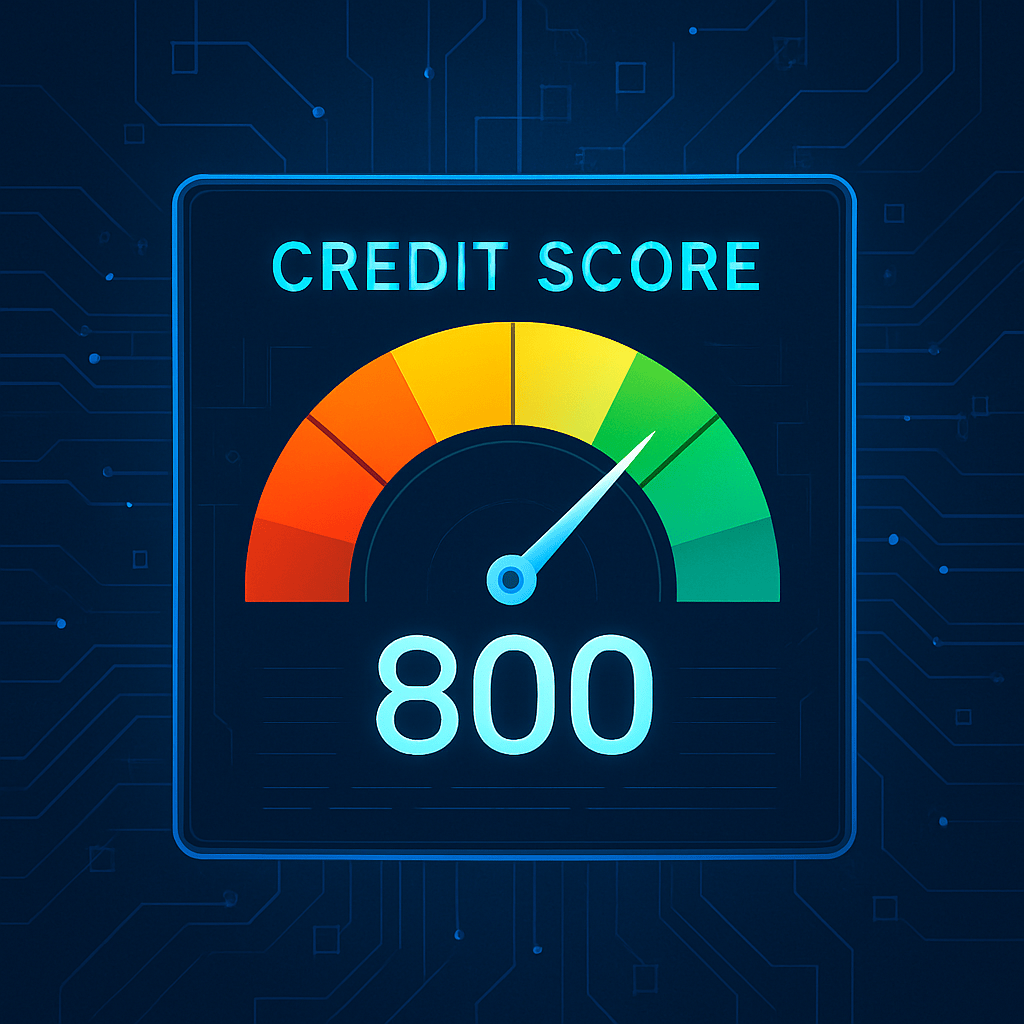

Step 2: Check Your Credit Score

Your mortgage rates in Utah depend heavily on your credit score:

<620 → Explore credit union refinance mortgage options.

740+ → Best rates (e.g., “top rated mortgage lenders 2021”).

620-699 → May need FHA loans (“what qualifies for fha home”).

Step 3: Compare Utah Mortgage Lenders

| Lender Type | Best for | Keywords Examples |

| Banks | Traditional borrowers | “bank of america get pre approved” |

| Credit Union | Lower rates | “uw credit union pre approval” |

| Online Lenders | Speed | “preapproval rocket mortgage” |

| Local Lenders | Personalized service | “best mortgage company to use” |

🔎 *Self-employed? See “best mortgage lenders for small business owners”.

Step 4: Submit Your Application

Documents Needed:

- Pay stubs, tax returns, proof of income (“mortgage affordability calculator income”).

- ID, bank statements, and asset proof.

Timing:

- Apply 3-6 months early (“when should i apply for mortgage pre approval”).

- Pre-approval lasts 60-90 days

Step 5: Explore Loan Types & Refinancing

FHA Loans

- “Can I get a second FHA home loan?” → Yes, with restrictions.

Investment Properties

- “Qualifying for investment property mortgage” requires higher down payments.

Refinancing

- “Refinance mortgage lenders” can lower rates or tap equity.

Final Checklist for Utah Homebuyers

- Use a mortgage payment calculator Utah to budget.

- Avoid new debt before closing.

- Compare mortgage charges for home loan fees.