Mortgage Rates Today: What Utah Homebuyers Need to Know

When it comes to buying a home or refinancing your current one, staying informed on the mortgage rates today is essential. In a constantly shifting market, knowing the latest rates can help you save thousands over the life of your loan. This guide will break down the most relevant information on refinance rates, HELOC rates, and choosing the best mortgage lenders in Utah.

Current Mortgage Rates and Why They Matter

If you’re shopping for a loan, understanding the current mortgage rates can make a massive difference in your monthly payments. Whether you’re buying your first home or refinancing, even a 0.25% change in rates could significantly impact your affordability.

Many factors influence mortgage interest rates, including Federal Reserve policy, inflation, and housing demand. Fortunately, the average home loan rates in Utah remain competitive compared to national averages, giving local borrowers an edge.

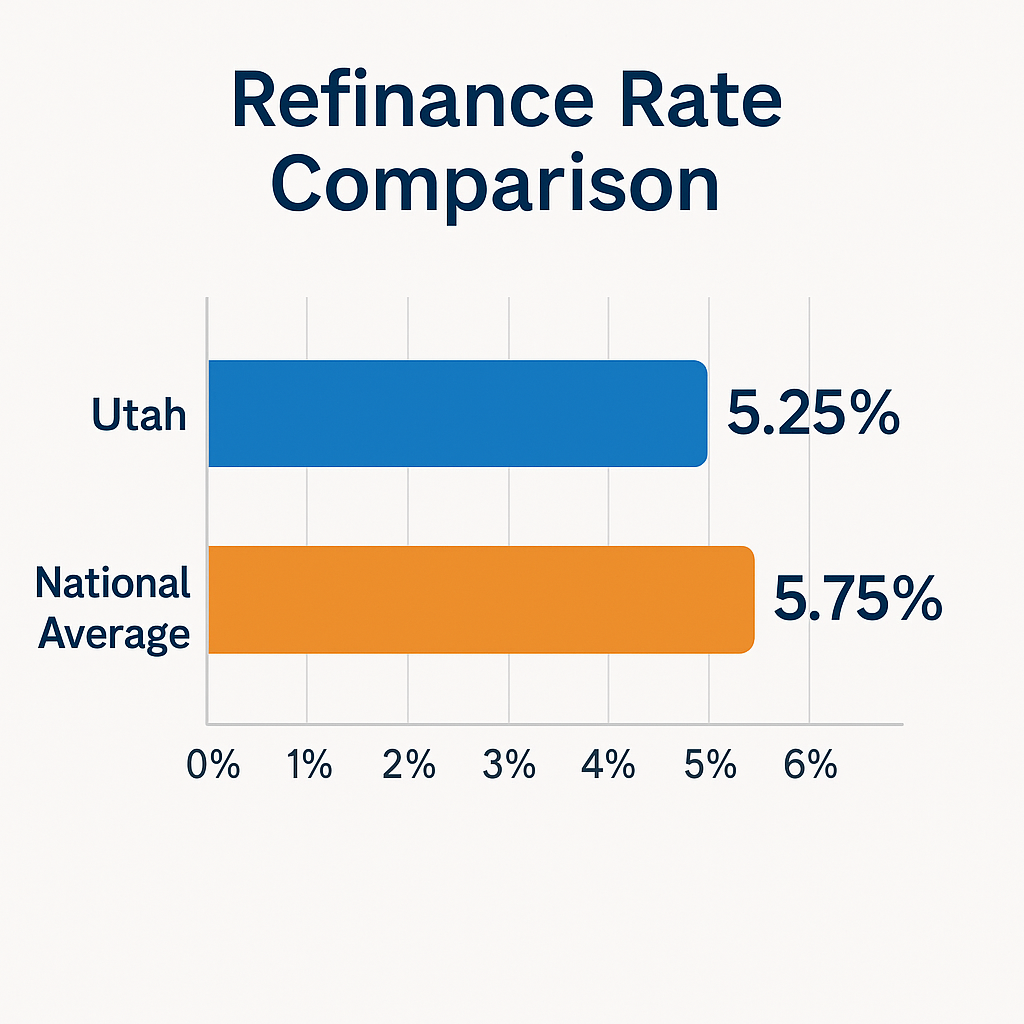

Compare Refinance Rates for the Best Deals

If you’re considering a refinance, you’ll want to closely monitor refinance rates. These rates vary slightly from purchase loan rates and depend on your credit profile, loan term, and equity.

In 2025, many Utah homeowners are locking in savings by exploring refinance mortgage rates with both local banks and national lenders. The goal is to reduce monthly payments, switch to a fixed rate, or tap into equity for renovations.

Exploring HELOC Rates and Home Equity Opportunities

Many homeowners are turning to HELOC rates to leverage the value in their homes. A home equity line of credit allows borrowers to draw funds as needed, often at lower interest than personal loans or credit cards.

If you’re seeking liquidity for major expenses, consider comparing best HELOC rates available through both banks and credit unions. Utah’s home equity loan rates remain favorable in 2025, especially for those with strong credit.

Choosing the Best Mortgage Lenders

With hundreds of options, choosing the best mortgage lenders can feel overwhelming. Look for lenders who offer transparency, fast pre-approvals, and favorable terms on both home loans and refinance mortgage rates.

For Utah borrowers, it’s important to seek out mortgage lenders who understand the local market. The best HELOC lenders may also offer bundled services that combine home equity products with standard loan offerings.

Breaking Down Home Loan Options

Today’s lending environment offers a wide range of home loan interest rates, including both conventional and government-backed options. Borrowers can choose from fixed-rate loans, ARMs, and even low down-payment programs.

Make sure you review not just mortgage rates, but also fees, loan terms, and your long-term goals. Many homebuyers benefit from consulting with loan officers to discuss the best home loan rates based on their financial profile.

Understanding VA Loan Rates in Utah

Veterans and active-duty service members should explore VA loan rates. These loans typically offer lower rates, no private mortgage insurance (PMI), and more flexible credit requirements.

Local lenders in Utah offer highly competitive va home loan rates and may provide rate reductions through streamlined refinance options. If you’re eligible, these products often beat the best conventional mortgage rates on the market.

Finding the Best Mortgage Rates for Your Situation

So how do you secure the best mortgage rates? Start by checking your credit score, reducing debt-to-income ratio, and comparing offers across multiple lenders. Online comparison tools make it easier to spot deals.

If you’re a first-time homebuyer, working with a local mortgage lender can simplify the process. Whether you’re exploring home refinance rates or new home loans, always ask for a full loan estimate.

Tips to Secure the Lowest Home Loan Rates

To increase your chances of securing the lowest mortgage rates or best home equity loan rates, follow these steps:

- Improve your credit score (aim for 720+)

- Save for a down payment of at least 20%

- Compare loan offers from at least 3 lenders

- Opt for shorter loan terms when possible

Final Thoughts: Lock in Your Rate Now

With interest rate uncertainty on the horizon, now is the time to lock in competitive mortgage rates today. Whether you’re buying, refinancing, or accessing home equity, your best move is to get pre-qualified and compare personalized loan offers.

Take advantage of the wide variety of home equity line of credit rates, va mortgage rates, and refinance rates to create a financing plan that fits your goals. The Utah housing market still offers opportunities—seize them with the right mortgage strategy.