Why Utah Mortgage Rates Today Matter More Than Ever.

In today’s competitive housing market, understanding Utah mortgage interest rates for first-time home buyers is essential for making informed decisions and securing favorable loan terms.. Whether you’re a seasoned homeowner or a first-time buyer, staying current with Utah mortgage interest rates today empowers you to lock in favorable financing terms.

Mortgage rates fluctuate based on a range of economic factors, including inflation trends, Federal Reserve policy, and lender risk assessments. While national averages provide a benchmark, Utah mortgage interest rates can vary significantly across lenders. Comparing current mortgage rates, 30-year fixed and mortgage rates today, FHA at the local level helps ensure that you secure a rate tailored to your needs.

Utah Mortgage Interest Rates Trends and 2025 Forecasts

As mortgage professionals, we are often asked: What are the projections for Utah home loan rates forecast for 2025? Based on market analysis, we anticipate relative rate stability in 2025, following the fluctuations seen throughout 2024. Prospective buyers and homeowners should closely monitor Utah mortgage interest rate trends this week via trusted sources like Freddie Mac’s PMMS and Utah-based lenders such as City Creek Mortgage. Utilizing tools like a Utah mortgage refinance calculator allows you to forecast payment scenarios and assess refinancing potential as market conditions evolve.

The Best Mortgage Lenders in Utah 2025: FHA, VA, and Jumbo Loans.

Navigating mortgage products can be complex, but understanding the nuances of each option is key. When researching the best mortgage lenders in Utah 2025, consider how your financial goals align with the following programs:

- Utah FHA loan limits for 2025 have increased, allowing greater access for buyers using FHA-backed financing.

- VA mortgage rates in Utah today remain a strong option for qualifying veterans, often featuring lower interest rates and no down payment.

- Jumbo mortgage Utah requirements continue to evolve, with lenders requiring higher credit scores and thorough income documentation.

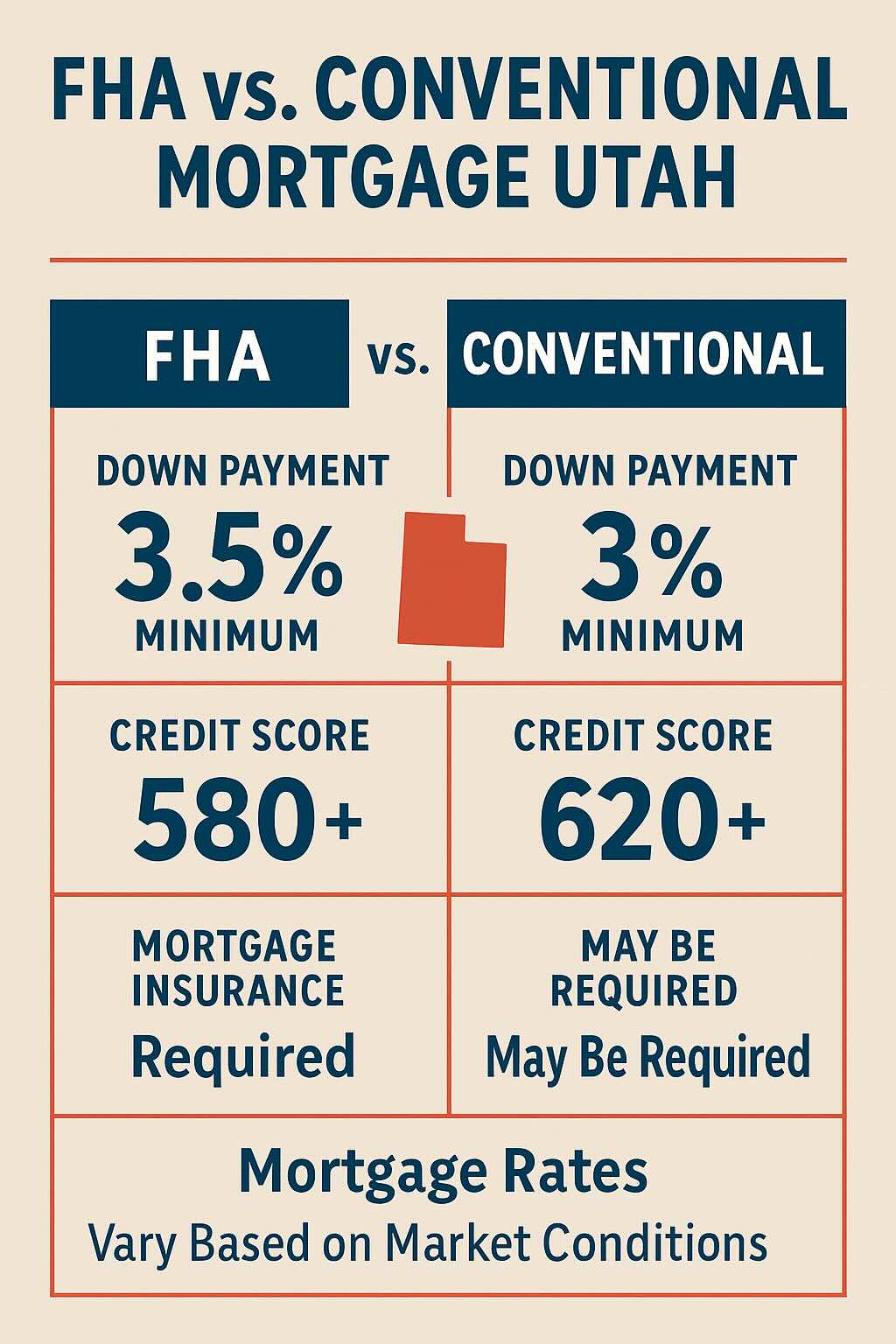

Those weighing FHA vs conventional mortgage Utah options should factor in long-term cost savings and qualification thresholds. For those with limited funds, programs offering Utah FHA down payment assistance provide critical support toward homeownership.

Getting Approved and Refinancing at Today’s Utah Mortgage Interest Rates

Knowing how to get approved for a mortgage in Utah includes maintaining a healthy credit profile, managing debt-to-income ratios, and collecting financial documentation early.

Homeowners evaluating mortgage rates refinance options should assess both cash out refinance Utah rates and traditional term refinancing. Not sure if it’s the right time? A Utah mortgage refinance calculator and platforms like FHA.com help clarify when to refinance mortgage Utah based on both market rates and your financial objectives.

Utah Mortgage Tools: Use These Calculators Before You Buy Before starting the home search, utilize tools that help shape your financial expectations.

A mortgage payment calculator Utah estimates your monthly obligation, while a home affordability calculator Utah factors in income, debt, and projected interest rates.

These resources are especially valuable if you’re exploring home equity loan interest rates or considering a move into Utah’s housing market for the first time.

FAQ – Utah Mortgage Interest Rates

Q: What are the current Utah mortgage rates for first-time buyers?

A: Rates vary based on credit score, loan type, and market conditions. First-time buyers may qualify for competitive FHA and VA rates.

Q: Are Utah mortgage rates expected to drop in 2025?

A: Based on current forecasts, experts anticipate a stable or slightly declining trend in interest rates through mid-2025.