Understanding mortgage interest rates trends is crucial for anyone navigating the home buying or refinancing process. Whether you’re a first-time buyer or a seasoned investor, your interest rate can determine the affordability of your loan and significantly impact your long-term financial outlook. This guide will explore the different types of rates, how they’ve changed, and how major lenders compare in today’s market. We’ll also show you how to find the cheapest mortgage interest rates and make sense of what’s happening in the economy right now.

Interest rates have a direct impact on monthly mortgage payments, and with property values continuing to shift, securing a favorable rate is more important than ever. According to a recent update on Oregon Live, the average mortgage interest rates now have fallen to their lowest levels since early May 2025. For buyers and those looking to refinance, this represents an excellent opportunity to lock in a favorable deal. Keeping track of todays mortgage interest rates through reliable sources can mean the difference between saving thousands or overpaying across the life of your loan.

What Are Mortgage Interest Rates and Why Do They Matter?

A mortgage interest rate is the cost of borrowing money from a lender to purchase a home. This percentage rate is influenced by a variety of economic factors including inflation, the Federal Reserve’s monetary policy, and investor demand for mortgage-backed securities. For homebuyers, this means rates can fluctuate daily. Access to accurate and timely data is key, which is why many borrowers turn to Freddie Mac’s rate updates to monitor the latest mortgage interest rates.

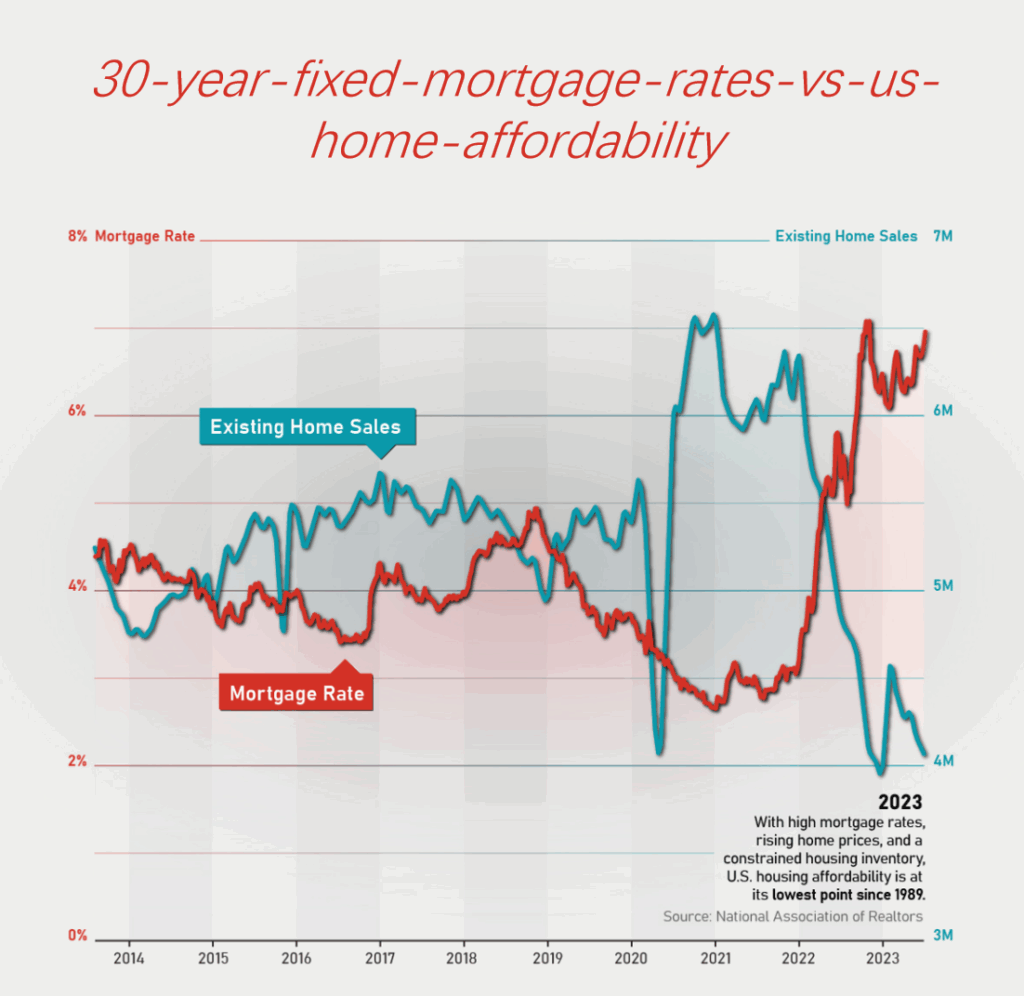

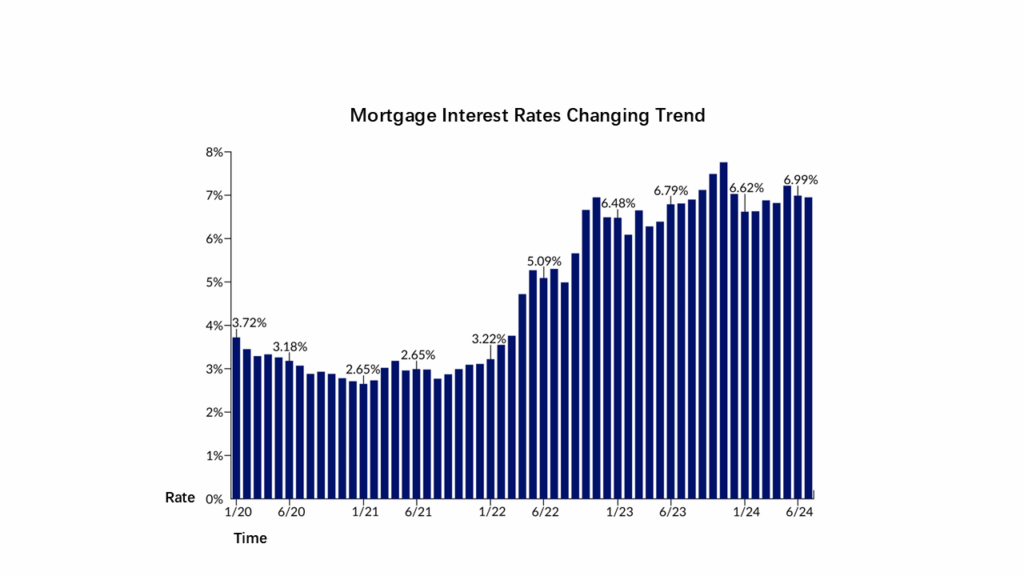

The mortgage interest rates trends over time tell a compelling story. In 2023, rates surged to some of the highest levels in over a decade. Many were priced out of the market. The landscape has shifted in 2025, with mortgage interest rates right now showing a more stable and even declining pattern. Comparing to mortgage interest rates 2023, buyers today have more leverage and access to better terms.

Image: 30-year Fixed Mortgage Rates vs. US Home Affordability

Types of Mortgage Interest Rates: Fixed, Interest-Only, and More

Different buyers have different needs, and lenders offer a variety of rate structures to accommodate them. For instance, interest only mortgage rates offer lower payments initially — ideal for borrowers expecting higher income later. If you’re accessing equity, you may face higher 2nd mortgage interest rates or second mortgage interest rates, due to the increased risk for lenders.

Image: How Mortgage Interest Rates Affect Home Price Growth

Those investing in properties or buying through a business may need to look into commercial mortgage interest rates. Veterans can take advantage of low VA mortgage interest rates, while new homeowners may qualify for new mortgage interest rates through subsidized or government-backed programs.

Compare Rates from the Top Mortgage Lenders

Choosing a lender is just as crucial as choosing a loan type. Rocket mortgage interest rates are frequently competitive, especially for digital borrowers. Wells Fargo mortgage interest rates often include relationship discounts for long-term banking customers. Borrowers looking for federal loan products might consider Freedom mortgage interest rates, known for specializing in VA and FHA loans.

If you prefer traditional institutions, both Chase mortgage interest rates and Bank of America mortgage interest rates offer flexible programs and promotional options. In addition, your local bank mortgage interest rates could offer surprisingly favorable terms, particularly for refinancing.

To find the mortgage lenders with lowest interest rates, use comparison tools and consult customer reviews. Many online-only or fintech platforms now compete with traditional banks as mortgage companies with lowest interest rates.

Refinancing and Tracking House Mortgage Interest Rates

When mortgage refinance interest rates drop, refinancing becomes a valuable tool for reducing monthly payments or shortening loan terms. If you’re considering this move, first evaluate your current house mortgage interest rates and check the current mortgage loan interest rates available at lenders like Bank of America.

The best time to refinance is often when you can drop your rate by at least 0.5%, though savings will vary depending on your balance and remaining term. With the mortgage interest rates trends showing signs of decline, now may be the right time to explore options.