Discover the best first-time home buyer programs in Utah, including FHA, VA, and USDA loan options. Learn how to get pre-approved, compare rates, and calculate what you can afford.

Utah FHA Loan Requirements

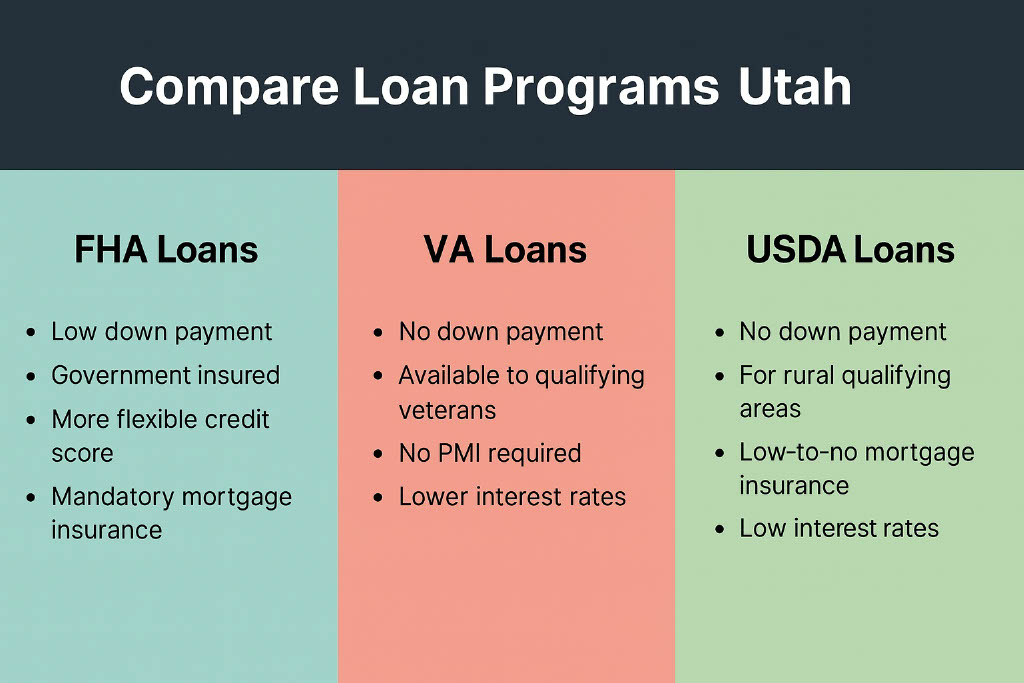

One of the most popular choices for new buyers is an FHA loan. These government-backed loans come with lower down payment requirements and more flexible credit standards. If you’re a first-time buyer with limited savings or lower credit, you’ll want to understand the **Utah FHA loan requirements**.

To qualify, you’ll typically need:

– A **minimum credit score for Utah** FHA loans of 580 (or 500 with a larger down payment)

– A debt-to-income ratio below 43%

– Proof of steady income and employment

Utah VA Loan Rates and Benefits

If you’re a veteran, active-duty military member, or eligible spouse, you might qualify for a VA loan. **Utah VA loan rates** are often lower than conventional loans, and you won’t need to pay private mortgage insurance (PMI).

VA loans also require no down payment in most cases—making it one of the best programs for eligible first-time buyers.

Utah USDA Home Loans for Rural Buyers

Looking outside the city? **Utah USDA home loans** are designed to support buyers in rural areas. They offer 100% financing (no down payment) and reduced mortgage insurance.

To qualify, the home must be in a USDA-eligible area, and your income must fall below local limits.

Compare Mortgage Rates Utah

Don’t just settle for the first lender you find—**compare mortgage rates Utah** to find the best deal. Rates vary daily, so keep an eye on:

– **Mortgage rates today**

– **Mortgage rates in Utah today**

– **HELOC rates Utah** if you’re considering a home equity line

Use a **mortgage calculator Utah** or **refinance calculator Utah** to estimate your monthly payments and compare loan scenarios.

Pre Approval Mortgage vs Prequalified

Before house hunting, get a **pre approval mortgage** to show sellers you’re serious. But what about being **prequalified**?

Here’s the difference:

– **Prequalified** = rough estimate based on unverified data

– **Preapproved** = verified loan offer based on your financial info and credit

How Much House Can I Afford Utah?

Use tools like a **mortgage calculator Utah** to answer: **how much house can I afford Utah**? Most lenders recommend your housing costs stay under 28% of gross income.

Should I Refinance My Mortgage in Utah?

Even first-time buyers should think long-term. If rates drop later, consider:

– **Best refinance rates Utah**

– **Refinance calculator Utah**

– **Should I refinance my mortgage in Utah**

Refinancing can lower your monthly payment or change your loan type from **fixed vs variable mortgage Utah**.

Jumbo Loan Rates Utah

For high-priced homes, consider **jumbo loan rates Utah**. These loans may require a higher **minimum credit score for Utah** and a bigger down payment.

Best Time to Buy a House in Utah

Timing your purchase can save you thousands. The **best time to buy a house in Utah** is typically fall or winter, when there’s less competition and sellers are more motivated.

Final Thoughts

Buying a home in Utah for the first time can be exciting and affordable with the right tools. Whether you’re checking **equity loan rates**, comparing **HELOC rates today**, or browsing the **best mortgage lenders in Utah**, preparation is everything.

Talk to a trusted **mortgage broker Salt Lake City**, get **pre approval mortgage**, and take the first confident step toward your new home.