Buying a Home in Utah with an FHA Loan in 2025?

Whether you’re a first-time buyer or looking for a fresh start, understanding FHA loan requirements in Utah is the first step toward homeownership. From checking your credit and saving for a down payment, to comparing FHA loan limits and choosing the right lender, this guide will help you navigate the FHA mortgage process in Utah with confidence.

Know What FHA Lenders Want

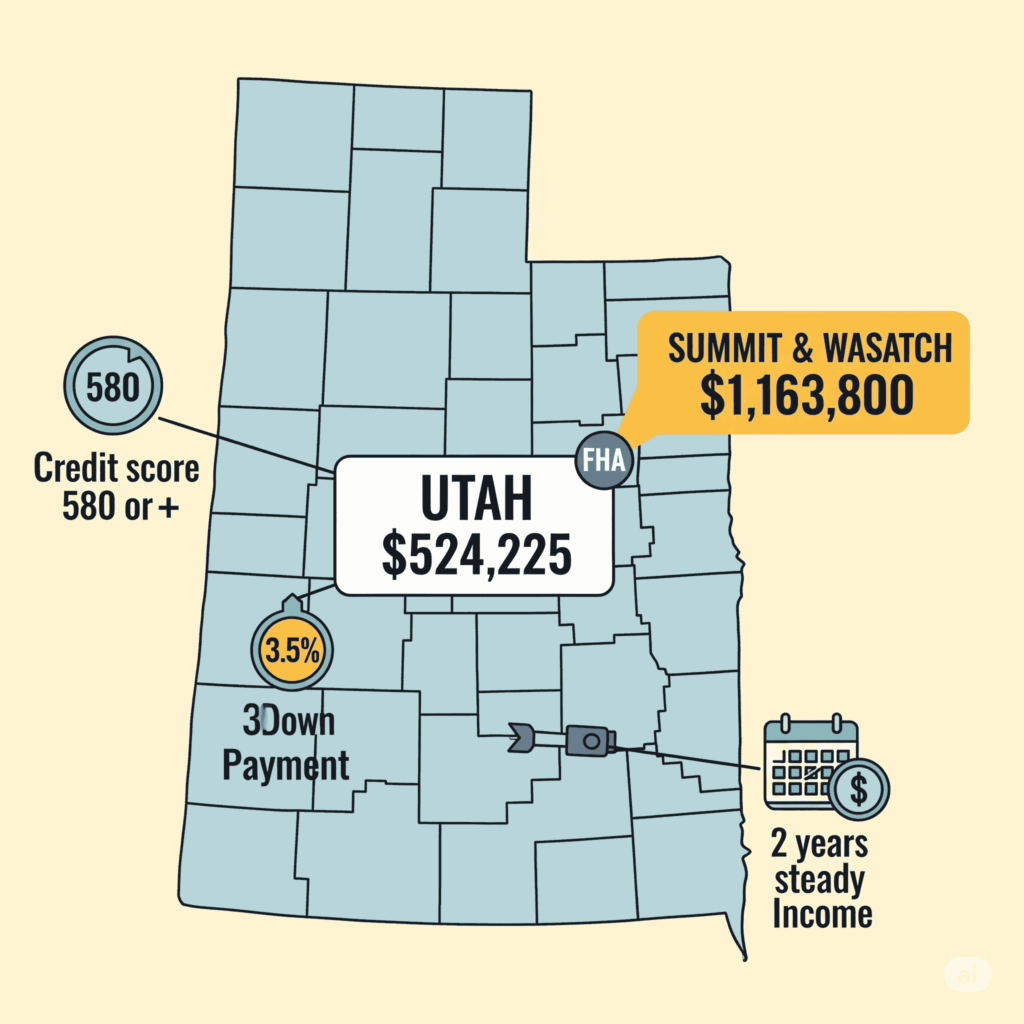

Understanding basic requirements for an FHA loan is essential. These are some of the requirements:

- Credit Scores: 580+ for 3.5% down: 500-579 requires 10% down.

- Income: At least 2 years of steady employment rates.

- Debt-to-Income: Usually 43% or less.

- Residence: This must be your primary residence.

- Mortgage Insurance: This is an upfront premium and annual MIP apply.

FHA Loan Limits You Should Know About

FHA loans are county-specific and have maximum loan amounts that you can borrow. Knowing you FHA loan local limits is essential in avoiding unwanted surprises:

- Most Utah counties have a limit around $524,225 for single-families.

- High-counties like Summit and Wasatch County allow uo to $1,163,800

- Check the current limits on the HUD website or with your lender.

Getting Pre-Approved For FHA Loans

Getting pre-approved is a crucial step that tells sellers you’re a serious buyer. This also helps you understand your borrowing power before you go house hunting.

- Make sure to submit your financial documents online.

- Establish a buget amount and receive a loan amount.

By completing these steps this will accelerate your buying process once you find the right home for you.

Calculating Your Payments for FHA Loans

It is essential to use an FHA mortgage calculator to estimate your monthly payments. This also includes the principal, interest, taxes, insurance, and mortgage insurance premiums. This will help you budget realistically to find your dream home!

City Creek Mortgage Utah FHA Calculator:

- Allows you to customize for 15, 20, or 30-year terms and has detail reports for county-specific loan limits

NerdWallet Utah Mortgage Calculator:

- Allows you to get a breakdown of estimated payments and see what the annual amortization rates are for Utah homes.

Zillow Mortgage Calculator:

- Quickly estimates what the potential prinicpal, interest, taxes, and insurance is depending on your location.

Comparing Lenders & Rates for FHA Loans

It is important to look around and find the best options for FHA mortgage rates and credible lenders with experience in Utah that align with your options. Local lenders also might offer special programs and perks based on certain requirements. Make sure to look for good customer reviews about FHA expertise and choosing Utah-specific lenders may provide faster service or benefits.

Lower Credit Score?

If your credit score is below 580, don’t fret, there are still options for FHA loans. However, here are some things you might be to do to compensate:

- Consider putting down 10% if your credit score is lower.

- Make sure to check your credit report for any errors and pay any debts.

- Avoid any new credit inquiries before applying for an FHA loan.

Game Plan for First-Time Homebuyers

To conclude, make sure to follow these steps to stay organize and help maximize your chances for being approved for a FHA loan:

- Get pre-approved for your loan early.

- Verify the county FHA loan limit for where you are looking to buy.

- Compare different rates from potential lenders.

- Utilize FHA loan calculators to estimate payments.

- Prepare all of the necessary financial documents.

- Work on improving your credit score if needed.

Securing an FHA loan in Utah is an achievable thing for all first-time buyers or those with a less-than-perfect credit score. By understanding what lenders are looking for, checking local limits, getting pre-approved, comparing rates, and calculating potential payments, you’ll be prepared to make confident decision to lead you to becoming a homebuyer!