Mortgage Rates History: Utah’s 2023 vs Today

If you bought a home in Utah during the volatile rate spikes of 2022 or 2023, you already understand how quickly monthly payments can climb. To help you navigate today’s more stable landscape, this guide breaks down the Mortgage Rates History: Utah’s 2023 vs Today so you can clearly see where you stand and whether refinancing may benefit you now.

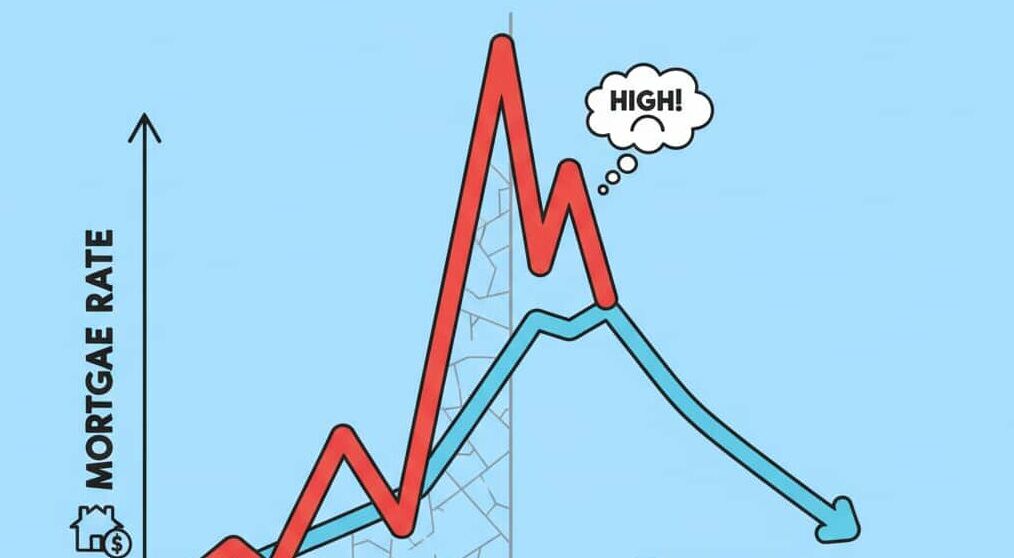

Mortgage Rate History: The Great Rate Reversal

To understand the Mortgage Rates History: Utah’s 2023 vs Today, it helps to look back at how drastically rates changed. When reviewing the 30-year mortgage rates history, the contrast is hard to ignore.

The mortgage rates in 2021 delivered record lows—often below 3%. That era ended quickly as mortgage rates in 2022 marked the sharpest rate correction in decades. The Federal Reserve’s aggressive inflation response created uncertainty and drove expectations that overall interest rates would rise.

This ultimately produced the high mortgage rates of 2023 that impacted many Utah homeowners. For accurate benchmarking, we use the Freddie Mac Primary Mortgage Market Survey.

Click here for the Freddie Mac Primary Mortgage Market Survey:

https://www.freddiemac.com/

While the Federal Reserve does not directly set mortgage rates, changes to the Federal Funds Rate influence lending conditions. When the Fed applies upward pressure, mortgage rates typically follow.

Current 30-Year Fixed Mortgage Rates: Anchor Your Strategy

A major part of understanding Mortgage Rates History: Utah’s 2023 vs Today is comparing the past year’s volatility to the stability we’re seeing now.

Current 30-year fixed mortgage rates have settled significantly compared to 2023. By reviewing today’s average 30-year mortgage rate, we can uncover refinance opportunities that may not have existed earlier in the year.

Key factors to review include:

- Comparisons between today’s 30-year fixed rates and 15-year mortgage rates

- Current conventional loan interest rates and lending conditions

Online calculators offer estimates, but a personalized analysis reveals a far clearer picture of your potential Utah-based savings.

Mortgage Rate Predictions: Planning Ahead

A strong refinance strategy requires looking beyond present numbers. To help you better understand the Mortgage Rates History: Utah’s 2023 vs Today, we track both national and Utah-specific rate forecasts.

This includes:

- Short-term projections for mortgage rates over the next 90 days

- Longer-term expectations, including mortgage rate forecasts into 2025

- Anticipated shifts in Federal Reserve policy

Click here for the Federal Funds Rate:

https://www.newyorkfed.org/

By following changes in the prime mortgage rate, we can help you identify the ideal time to lock in a lower rate.

A Note for Utah Military & Veteran Borrowers

If you purchased your home during the high VA mortgage rates of 2022, you may now qualify for significant savings. The VA IRRRL streamline refinance offers a simpler and often faster path compared to conventional refinancing. Reviewing VA rates from 2022 against today’s numbers may show that your refinance opportunity is now wide open.

Your Actionable Roadmap: Skip the Generic Calculator

Generic refinance calculators don’t reflect Utah-specific considerations such as property taxes, equity growth, or the spread between your 2023 rate and today’s best options. When comparing Mortgage Rates History: Utah’s 2023 vs Today, a personalized review is essential.

Our customized refinance roadmap includes:

- Lifetime Cost Comparison: Complete amortization schedules for both your 2023 loan and a projected refinance

- Break-Even Analysis: The exact month your refinance produces net savings

- Utah-Specific Strategy: Tailored guidance based on equity, goals, and market timing

Your mortgage rate history doesn’t have to dictate your future. With the right strategy—and improving market conditions—you can move toward lower payments and long-term financial stability.