Buying a home in Utah is a dream for many families, but the rising costs of real estate can make saving for a large down payment feel impossible. Fortunately, Utah FHA mortgage rates with low down payment provide a practical solution. Backed by the Federal Housing Administration, FHA loans are designed to help first-time buyers and borrowers with modest incomes or lower credit scores enter the housing market.

FHA Loans in Utah: How They Work

When comparing a Utah FHA vs conventional mortgage, FHA loans stand out because they allow for much smaller down payments. Conventional loans typically require 5–20% down, while FHA loans allow qualified borrowers to buy with as little as 3.5% down.

FHA loans are insured by the Federal Housing Administration and include:

-Flexible credit score requirements (often as low as 580)

–Fixed-rate stability and predictable payments

-The ability to combine with Utah assistance programs for extra savingss 3.5% down.

FHA Interest Rates in Utah (2025–2026 Outlook)

The trend for FHA interest rates Utah 2025 shows continued competitiveness despite rising national mortgage rates. Looking ahead, analysts expect FHA interest rates Utah 2026 to remain a strong choice for borrowers who value consistency and government backing.

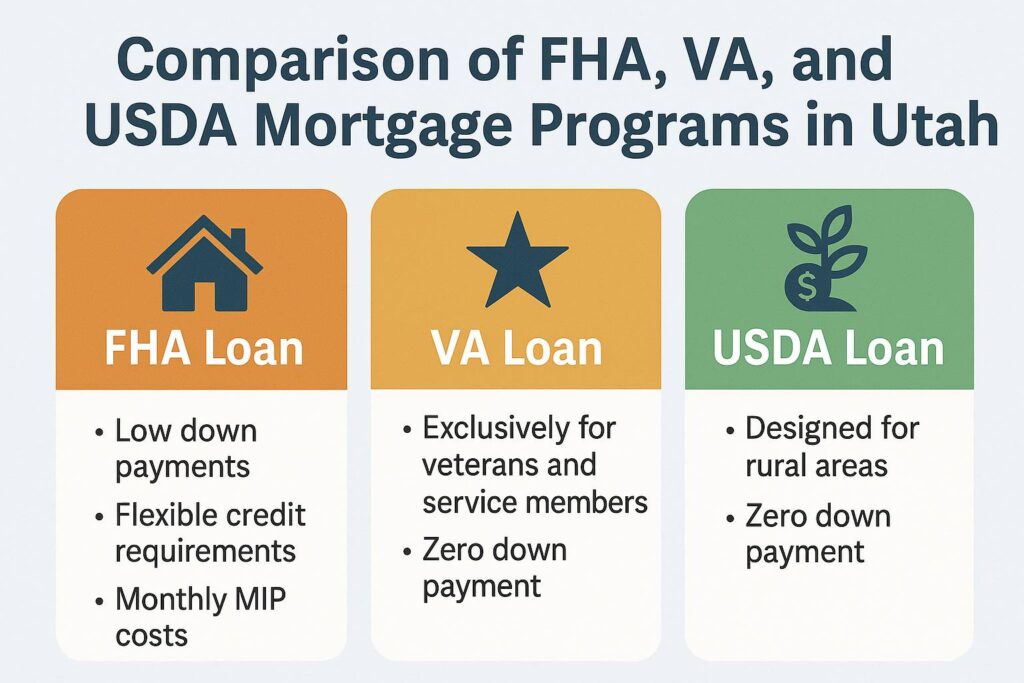

Comparing FHA, VA, and USDA Mortgage Rates in Utah

While FHA loans are popular, they aren’t the only government-backed programs available. Utah homebuyers should also consider:

| Loan Type | Down Payment | Credit Flexibility | Mortgage Insurance | Best For |

|---|---|---|---|---|

| FHA | 3.5% | Moderate | Yes (MIP) | Buyers with limited savings |

| VA | 0% | High | None | Veterans & service members |

| USDA | 0% | High | Yes (annual fee) | Rural area buyers |

| Conventional | 3–20% | Higher | PMI (can cancel) | Strong-credit borrowers |

You can also compare Utah VA loan programs and explore USDA options to find the best fit.

Utah Home Buyer Programs and Assistance

Beyond federal programs, Utah offers local support for first-time buyers.

- Utah Housing Corporation (UHC): Down payment and closing cost help

- 2025–2026 Assistance Programs: State and county-level grants or loans

- Combine these with FHA loans to lower your out-of-pocket costs

👉 Visit the Utah Housing Corporation website to learn more about current offers.

First-Time Buyers: Maximizing Savings

If you’re a first-time buyer in Utah, you can save even more by combining FHA loans with assistance programs.

Utah first-time buyer interest rates are sometimes reduced through state initiatives, plus you may receive closing cost help.

Pro Tips:

- Compare at least three FHA lenders to find your best rate

- Ask about seller concessions (FHA allows up to 6%)

- Use a mortgage calculator to compare FHA vs conventional monthly payments

Why FHA Remains a Top Choice

Although VA and USDA loans are attractive for those who qualify, FHA remains the most widely used program in Utah. The combination of flexible credit requirements, small down payments, and steady interest rates keeps FHA at the center of the government mortgage programs Utah.

FAQs About FHA Mortgages in Utah

1. What credit score do I need for an FHA loan in Utah?

Most lenders require at least 580 for 3.5% down, though you may qualify with a lower score if you can put 10% down.

2. Are FHA interest rates lower than conventional?

Often, yes. FHA loans tend to offer competitive rates, though they include mortgage insurance premiums that add to overall costs.

3. Can first-time buyers combine FHA with Utah assistance programs?

Absolutely. Programs like Utah first time home buyer assistance 2025 can reduce upfront costs when paired with FHA.

4. Are FHA loans only for first-time buyers?

No. While they’re popular with new buyers, repeat buyers can also use FHA financing if they meet eligibility requirements.

Final Thoughts: Your Next Steps

For Utah residents, Utah FHA mortgage rates with low down payment remain one of the most powerful tools to achieve homeownership. By combining FHA financing with Utah home buyer programs 2025 and 2026, families can significantly lower upfront costs and monthly payments.