For many veterans, active-duty service members, and eligible surviving spouses, the dream of homeownership is more attainable than ever, all thanks to the VA home loan program. Backed by the U.S. Department of Veterans Affairs, a VA home loan is a powerful mortgage option that offers significant benefits, including no down payment, competitive interest rates, and limited closing costs.

If you’re exploring the idea of buying a home in Utah, a VA home loan could make the journey much smoother and more affordable. Whether you’re just starting to look or already have your dream home in mind, considering your financing options is a smart first step. From getting pre-approved to working with trusted local lenders, this guide breaks down everything you’ll need to know in order to make buying your home as easy as can be!

How to Get Pre-Approved for a VA Home Loan

The first step in your journey is learning exactly how to get pre-approved for a VA

home loan. This is where a lender checks your income, credit, and eligibility to give you an

idea of how much you can borrow.

To get pre-approved for a VA home loan, you’ll typically need:

- Certificate of Eligibility (COE): This verifies your VA loan entitlement and eligibility.

- Proof of income: Recent pay stubs, W-2s (or tax returns if self-employed), and possibly verification of other income sources like disability or retirement.

- Employment history: Usually a two-year work history is requested.

- Credit report: Lenders will review your credit history and score to assess risk.

- Details on assets and debts: Bank statements, investment accounts, and information on monthly obligations like car payments or student loans.

- Government-issued ID: Such as a driver’s license or military ID for identity verification.

While these documents are only required for pre-approval, having them ready early can give you an edge. Utah’s housing market moves quickly, so being prepared to act when the right home comes along can make all the difference.

VA Home Loan Application Process: What You’ll Need

Once you’re pre-approved, the next step is completing your VA home loan application. The process is straightforward when you’re working with an experienced VA-approved lender and have your documents in order.

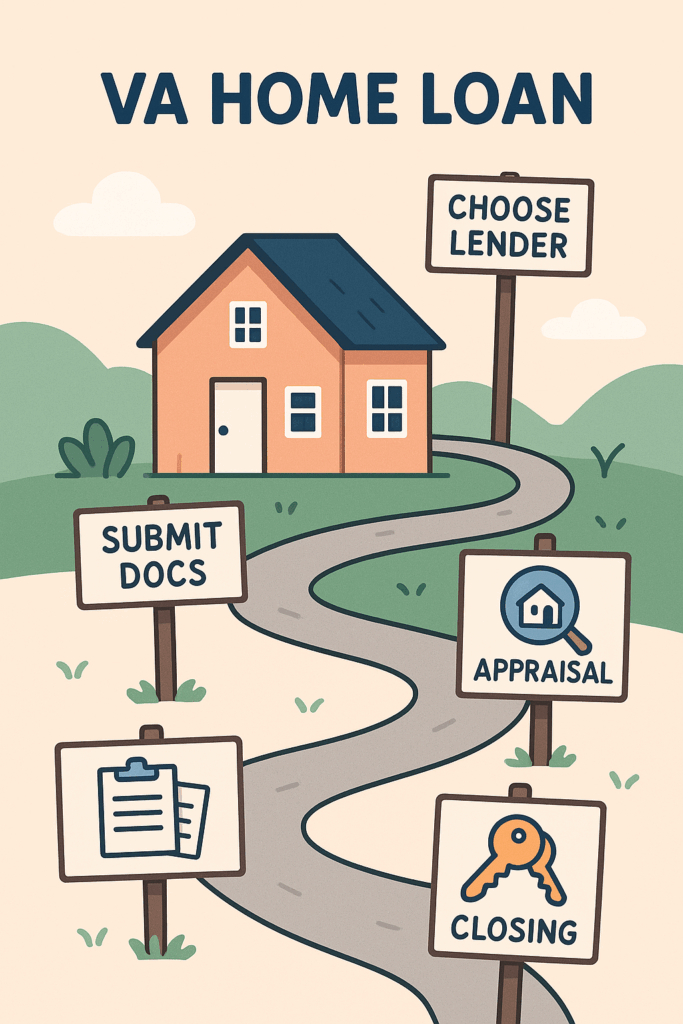

Here’s what the application process typically involves:

- Choose a VA-approved lender in Utah

- Pick a trusted, experienced lender who handles VA loans regularly.

- Complete the full loan application

- Fill out the Uniform Residential Loan Application (Form 1003) with your lender’s help.

- Collect and submit the commonly required documents:

- DD-214 or Statement of Service

- Certificate of Eligibility (COE)

- Pay stubs, W-2s, tax returns

- Bank statements

- Photo ID

- VA appraisal ordered by lender

- Confirms the home’s value and that it meets VA property standards.

- Note: This is not a full home inspection—consider getting one separately.

- Underwriting review

- The lender reviews your finances and the appraisal.

- They may request additional documents during this step.

- Clear to close

- Once everything is approved, your lender will schedule the closing.

Many local Utah VA loan programs also offer extra support, such as assistance with closing costs or streamlined processing, to help make the path to homeownership even smoother.

VA Loan Requirements, Tips, and Tools

Unlike most private loans, VA loans don’t require perfect credit, making homeownership more accessible for veterans and service members. With more flexible credit guidelines than conventional mortgages, VA loans are designed to work in your favor. While the Department of Veterans Affairs doesn’t set a strict minimum credit score, most Utah lenders look for a score of around 620. If you happen to have a lower score, DON’T WORRY! A strong income, low debt, and a steady employment history can still help you qualify. Additionally, lenders also consider your residual income and VA eligibility when determining how much home you can afford.

Before you commit to a home, it’s smart to explore your financing options using online tools. Using a VA Home Loan Calculator can help you estimate your monthly mortgage payments based on loan amount, interest rate, and term. Check out the link below for this tool:

These calculators can give you a clearer idea of what fits your budget and help you compare potential homes. Just remember, online estimates are a great start, but always check with your lender for the most accurate numbers based on current VA loan rates in Utah.

Securing your Personal Rates and Payments

One of the biggest perks of a VA home loan is getting a lower interest rate. If you’ve been searching for “VA mortgage rates today” or “VA loan rates in Utah,” you’ll notice they’re often better than regular mortgage rates. That means you could save thousands over time.

Here are a few simple tips to help you get the best deal:

- Lock in your rate early so it doesn’t go up later

- Ask your lender if a fixed or adjustable rate is better for you

- Check VA loan rates in Utah often—they can change daily

- Try using a VA loan calculator to estimate your monthly payment

If you’re buying your first home, the benefits only increase with a VA loan:

- No down payment

- No private mortgage insurance (PMI)

- Lower interest rates

- Fewer upfront costs

Interested in stacking benefits? Check out another one of our articles that dives deeper into additional programs backed by local Utah governments and regional lenders;

Not ready to apply just yet? You can still get prequalified for a VA loan with no commitment. It’s a quick way to see what you might qualify for before you start shopping for a home.

Final Thoughts and Next Steps

Buying a home is a big step, but with a VA home loan, it doesn’t have to be overwhelming. Whether you’re a first-time buyer or just new to the VA loan process in Utah, the right tools and support can make all the difference. From getting pre-approved to locking in a great rate, you have access to benefits designed to make homeownership easier and more affordable. Take your time, ask questions, and lean on trusted lenders to guide you. You’ve earned this, and your path to a new home might be closer than you think.

Ready to get started? Check out the link below to be paired with a trusted VA loan lender in Utah and begin your pre-approval process today.

https://www.bestmoney.com/mortgage-loans/compare-va-loans

- Utah Homebuyer’s Guide: Mortgage Pre-Approval and First-Time Loan Options

- The Great Rate Divide: Comparing 30-Year Fixed Mortgage Rates from 2023 to Today

- Mortgage Rates Today-Need to Know

- Utah Mortgage Refinance Rates in 2025: How to Compare, Save, and Decide If Now Is The Right Time

- Best Mortgage Rates Utah | Home Loans, VA Lenders & First-Time Buyer Programs