-

Getting a Self-employed Mortgage in Utah: A 2025 Guide

•

For many Utahns, the dream of homeownership is alive and well — but if you’re self-employed, that dream might feel just out of reach. The good news? It’s absolutely possible to qualify for a home loan when you’re your own boss. This guide breaks down what you need to know…

-

HELOC vs Home Equity Loan in Utah?

•

ALT: Happy group of people because of signing a mortgage loan for a house.

-

Mortgage Rates Utah: Everything You Need to Know in 2025

•

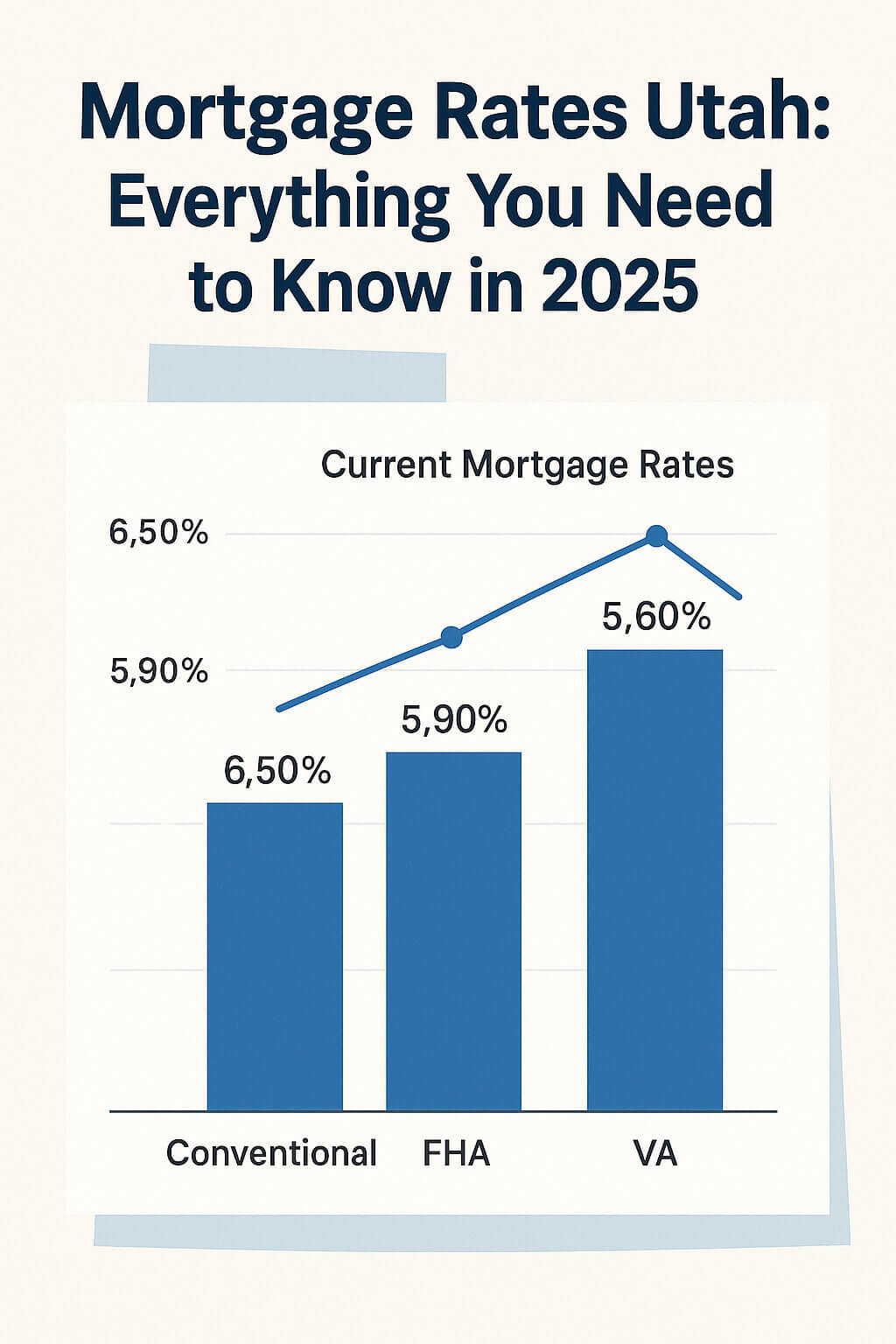

Utah mortgage rates 2025 are shifting due to inflation, interest rate policies, and evolving economic trends in the state. Whether you’re a first-time homebuyer or refinancing an existing loan, understanding the current mortgage landscape in Utah is essential. In this guide, we’ll explore the latest rate updates, compare top lenders,…

-

Apply for a Mortgage Loan Now!

•

Mortgage Loan Processing Time: What to Expect At first, applying for a home loan may seem overwhelming. However, understanding what to expect can help reduce uncertainty and you can apply for a mortgage loan now! Once you apply, the lender immediately begins reviewing your finances, verifying your details, and ordering…

-

Navigating Utah’s Mortgage Landscape: A Comprehensive Guide for Homebuyers

•

Are you dreaming of owning a home in the Beehive State? Utah’s thriving economy and stunning landscapes make it a desirable place to live. However, understanding the mortgage landscape can be daunting for first-time buyers and seasoned homeowners alike. This comprehensive guide will navigate you through the essential aspects of…

-

Utah Mortgage Calculator – Estimate Your Monthly Payments

•

When it comes to buying a home or refinancing in Utah, understanding your mortgage costs upfront is critical. A mortgage calculator can help you estimate monthly payments, compare loan terms, and see how interest rates will affect your total investment. In this guide, we’ll walk through everything you need to…

-

Current Mortgage Rates in Utah: Utah’s Complete 2025 Guide

•

If you’re looking for current mortgage rates in Utah, you’re navigating one of the most challenging interest rate environments in over a decade. With mortgage interest rates today hovering around 6.75% to 7%, understanding today’s market can help you make informed decisions about buying or refinancing your home. Current Mortgage…

-

Best HELOC Lenders and Home Equity Loan Rates in 2025

•

If you’re a homeowner looking to borrow in 2025, it’s important to compare the best HELOC lenders and home equity loan options. Popular choices like Bank of America HELOC, AmeriSave HELOC, and BECU HELOC offer competitive rates and flexible terms. You can also explore fixed-rate loans such as 15 year…

-

Mortgage Rates in Utah: A 2025 Guide for Homebuyers and Homeowners

•

If you’re buying your first home, refinancing a current mortgage, or exploring a homeequity option, understanding mortgage rates in Utah is more important than ever in2025. Utah’s real estate market has been one of the fastest-growing in the U.S. foryears, fueled by a young population, strong job growth, and an…