-

How to Get Mortgage Pre-Approval in Utah | Top Lenders & Tips

•

Buying a home in Utah can feel overwhelming, especially for first-time buyers. Between finding the best mortgage lenders Salt Lake City and understanding low down payment mortgage options Utah, there is a lot to navigate. This guide will walk you through the steps to get mortgage pre-approval in Utah, highlight…

-

2025 Utah Mortgage Rates Forecast: What Buyers Need to Know Now

•

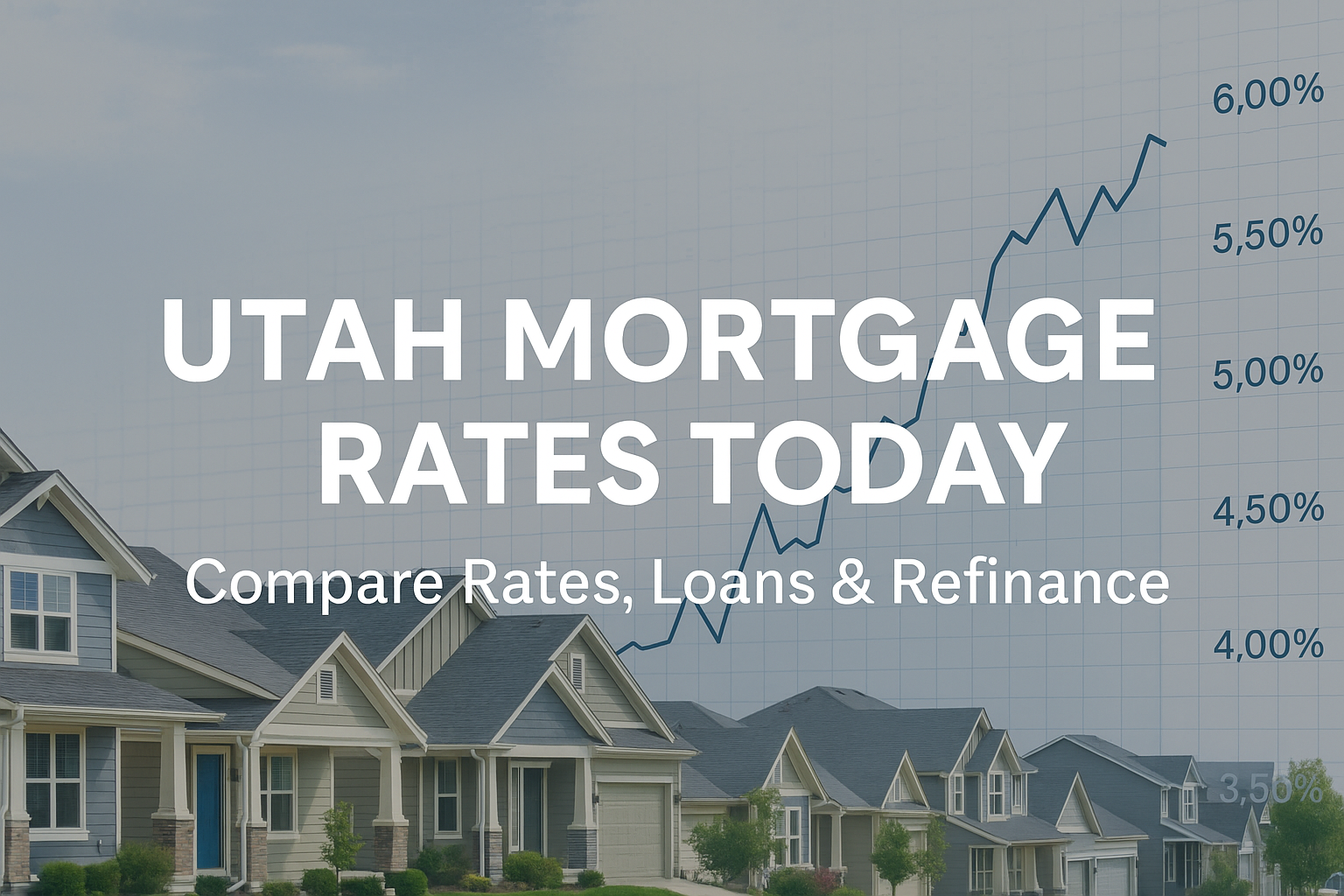

If you’re planning to buy a home or refinance in Utah, understanding mortgage rates is critical to making a smart financial decision. In 2025, the mortgage rates Utah buyers will see could look very different from a few years ago. This guide breaks down everything you need to know about…

-

FHA vs. Conventional: Best First-Time Home Buyer Loans in Utah

•

Buying your first home is both exciting and overwhelming. If you’re like most first-time buyers in Utah, you’re likely trying to make sense of all the first time home buyer programs and mortgage options out there. From FHA and USDA loans to conventional mortgages and down payment assistance programs, the…

-

How to Refinance Your Mortgage in Utah

•

How to Refinance Your Mortgage in Utah Refinancing your mortgage means replacing your existing home loan with a new one, ideally one with better terms. But how does refinancing a mortgage work? In short: you apply for a new loan, get approved, and use it to pay off your old…

-

First-Time College Student Financial Aid: Scholarships, Grants, and Loans

•

Learn how first-time college students can pay for college using financial aid, scholarships, grants, and student loans. A complete 2025 guide for first-gen and low-income students. Starting college is exciting—but the cost can feel like a huge barrier. If you’re a first-time college student, you’re probably wondering how to afford…

-

Best Mortgage Rates & First-Time Home Buyer Programs in Utah | Prequalify Today

•

Utah’s real estate market is competitive, and buying your first home can feel like a maze of financial options. Whether you’re a first-time buyer or simply looking for better terms, understanding the best mortgage rates and taking advantage of first-time home buyer programs is essential to making smart, informed decisions.…