Understanding Utah Home Loan Rates for First Time Buyers

Buying your first home in Utah is a major milestone. It requires navigating Utah home loan rates, learning buyer programs, and comparing loan options. Start with a home loan pre approval and complete a full application. These steps help you secure financing and make confident decisions.

Utah Home Loan Rates: Pre Approval and FHA Loan Application

A home loan pre approval is one of the smartest first steps for Utah buyers. It shows sellers that you’re serious. It also sets clear expectations for your budget. Once ready, submit a home loan application to get the process moving.

For many first-time buyers, the FHA mortgage is a preferred choice. The FHA loan application process is simple and flexible. The FHA first time home buyer program is built for new buyers. You can even apply online to save time and effort.

File name: Home-loan-interest-rates-today-Utah.jpg

Alt Text: young couple in Utah meeting with a mortgage lender to review home loan interest rates today

Cheapest Home Loan Rates and Lenders

Finding the cheapest home loan rates requires research and comparison. Check trusted sources daily for updates on Utah home loan rates to ensure you lock in the best deal.

Not all lenders are equal. Compare offers and look for lenders who specialize in first-time buyers. Many advertise competitive FHA mortgage rates. Seek out the best FHA lenders or search for “FHA lenders near me” to explore local options.

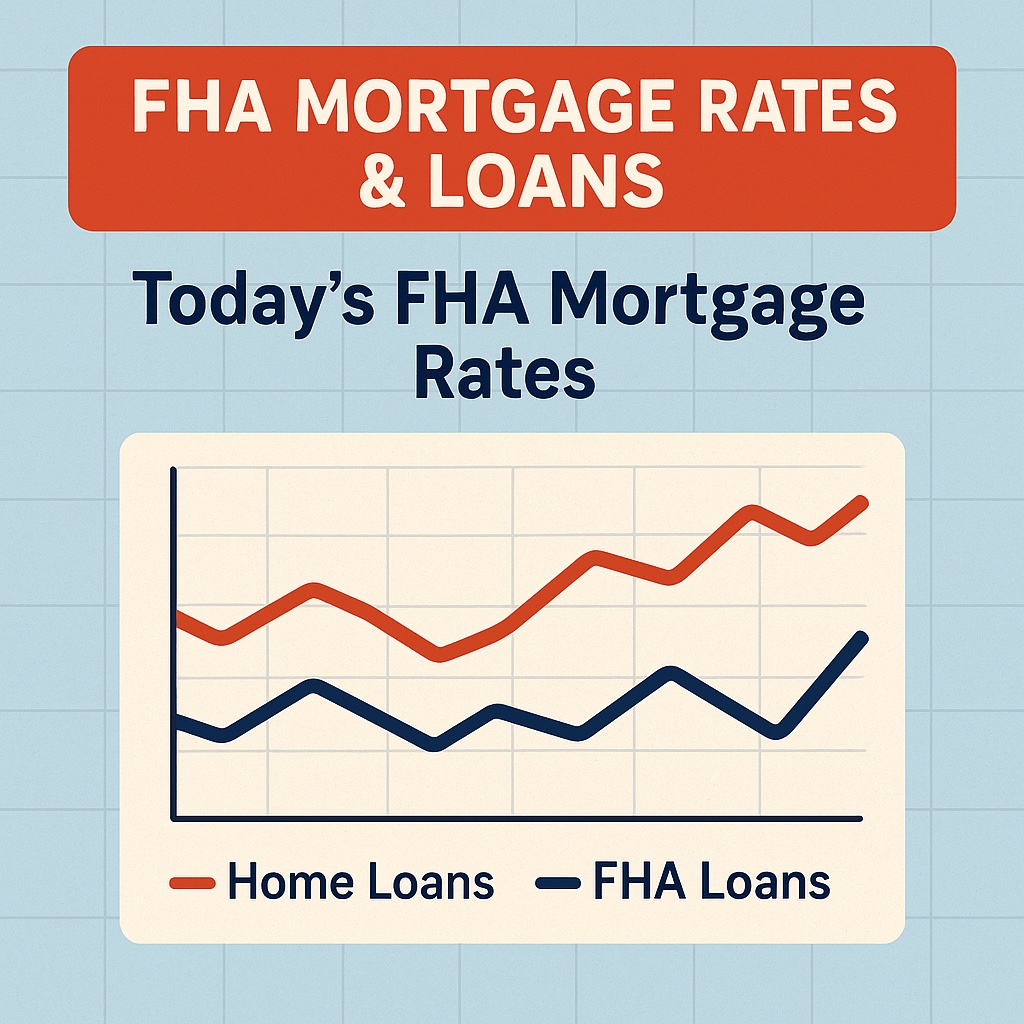

File name: Fha-mortgage-rates-today-utah.jpg

Alt Text: infographic chart showing FHA mortgage rates today in Utah and home loancomparisons

1st Time Home Buyer Programs and FHA Support

Beyond rates, programs like first time home buyer programs and state initiatives provide extra support. Pairing these with an FHA home loan application can reduce upfront costs. Some lenders also promote first home owner loan programs or highlight the best first time home buyer loans to make ownership more affordable.

Educational resources and counseling in these programs help prepare you for long-term financial stability. For buyers with challenges, specialized first time home buyer programs for low credit can open the door to homeownership.

File name: First-time-home-buyer-programs-Utah.jpg

Alt text: First time home buyers in Utah discussing FHA programs and down payment assistance with a mortgage advisor

FHA First Time Home Buyer Options

An FHA first time home buyer program is especially helpful if you have limited savings or credit. By comparing FHA mortgage rates and seeking out the best FHA lenders, you can find a loan that balances affordability with flexibility. For convenience, consider applying with FHA lenders near you to get personal support while still benefiting from national FHA standards.

Why Interest Rates Matter Today

Rates fluctuate daily. Monitoring Utah home loan rates is essential because even a small difference can affect your monthly payment and total loan cost. Stay proactive by checking regularly and lock in when the terms align with your financial goals.