Mortgage Qualification Tools For First Time Buyers

Buying a home is one of the biggest financial decisions most people will make, and understanding how much house you can afford is the critical first step. That’s where a mortgage qualification calculator comes in. These tools help you determine your buying power by factoring in income, expenses, interest rates, and loan terms. When paired with other financial tools like a mortgage payoff calculator or a HELOC calculator payment, they can give you a clear picture of your financial future.

https://www.calculator.net/house-affordability-calculator.html

First Time Home Buyer Loans with Zero Down

For many, the biggest hurdle to homeownership is saving for a down payment. A first time home buyer loan with zero down offers a path forward. Combined with a zero interest home improvement loan, new homeowners can upgrade their property without breaking the bank. These calculators show whether you can qualify for these loans and how they might impact your monthly budget. For example, pairing a mortgage insurance calculator with your pre approval calculator ensures you know the exact costs before making an offer.

HELOC Calculator Free

Home equity lines of credit (HELOCs) are a popular way for homeowners to access funds for renovations or other expenses. Using a HELOC calculator free, or a HELOC calculator payment tool, allows you to estimate your monthly payments. This makes it easier to compare whether a 20 year home equity loan payment calculator provides more savings in the long run. A smart homeowner will also check the refinance house calculator to see if consolidating debts into a new mortgage makes sense.

https://www.unfcu.org/help/heloc-calculator

Refinance Calculator Cash Out

If you’ve built equity in your home, you may be considering a cash-out refinance. A refinance calculator cash out can show you how much money you can access while still keeping your monthly payments affordable. Sometimes, homeowners also compare a refinance calculator car loan to see if rolling a car payment into the mortgage saves money. It’s also helpful to look at a mortgage cash out refinance calculator alongside the refinance rates calculator to find the best deal. These calculators give you the flexibility to make smarter financial decisions.

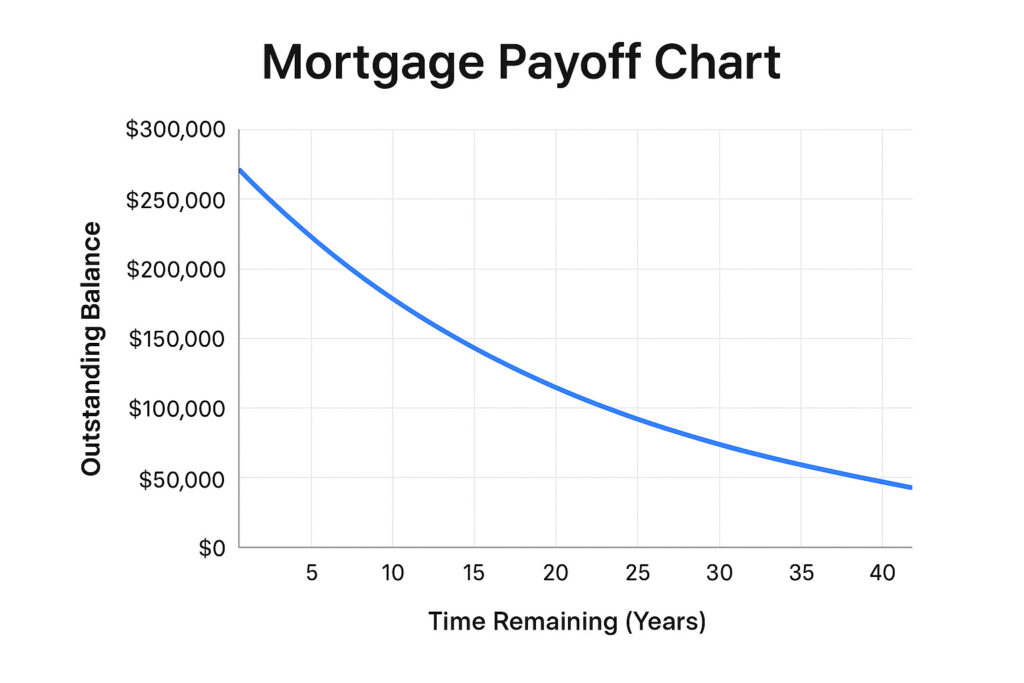

Mortgage Payoff Calculator with Extra Payments

Many homeowners dream of paying off their mortgage early. A mortgage payoff calculator with extra payments shows how even small additional payments can shave years off your loan. Pair this with a 15 year mortgage calculator to compare the long-term savings of refinancing into a shorter loan. For military families, a VA loan payment calculator or a VA home loan mortgage calculator can reveal benefits unique to VA-backed loans.

Another tool worth considering is a mortgage life insurance calculator. It ensures your family is protected if something happens to you before the loan is paid off. Combined with the monthly mortgage payment calculator, these tools give you a complete financial overview.

Mortgage Rate Today Calculator

Interest rates change constantly, and a mortgage rate today calculator helps you understand how those changes impact your payment. When you pair it with a google mortgage calculator or an online mortgage calculator, you can instantly compare scenarios. These mortgage qualification tools are particularly useful when looking at real estate interest rates to time your purchase. Even a half-point difference in rate can change your affordability.

Reverse Mortgage Calculators

For seniors exploring ways to access home equity, a reverse mortgage calculator AARP or a reverse mortgage calculator Reddit provides clarity. They allow you to see how much cash you can receive based on age, home value, and loan type. These calculators are often paired with a homeowner loan calculator or house buying calculator for family members planning transitions between generations.

Why Use Multiple Calculators Together?

No single calculator tells the whole story. While the mortgage qualification calculator is the starting point, combining it with tools like the refinance house calculator, the mortgage life insurance calculator, or the mortgage payoff calculator ensures a well-rounded financial plan. These tools can highlight opportunities, such as paying off your loan early, refinancing at the right time, or protecting your family from unexpected risks.

Conclusion

Whether you’re a first-time buyer using a pre approval calculator, a military family checking a VA home loan mortgage calculator, or a retiree using a reverse mortgage calculator AARP, there’s a tool designed for your unique needs. Mortgage qualification tools are the foundation, but using multiple calculators together gives you confidence, clarity, and control over your homeownership journey.

By understanding how these calculators work, you can make smarter financial decisions today and build long-term security for tomorrow.